A hot labor market could see the U.S. economy avoid a slowdown or recession, forcing the Federal Reserve to crank interest rates higher than market participants anticipate. That isn’t good news for stock-market investors, warned a top Wall Street economist.

The risk is a “no landing” scenario, which would mean more downside for U.S. stock and credit markets because it will force the Federal Reserve to raise its benchmark interest rate higher than market participants or central bankers currently expect, said Torsten Slok, chief economist and partner at Apollo Global Management, in a phone interview on Tuesday.

The Federal Reserve’s efforts to slow the economy and bring down inflation are often likened to landing a jumbo jet, with economists and Fed officials frequently talking of the effort to achieve a “soft landing” as opposed to a “hard landing.” A “no landing” scenario implies that an economic slowdown can be avoided or at least delayed, though with the risk of a later reckoning as the Fed continues tightening monetary policy.

In particular, it means trouble for technology and highly leveraged companies, whose shares have roared back to lead the market to strong gains so far in 2023.

“Interest rates need to go higher and that’s bad for tech, bad for growth [stocks] and bad for the Nasdaq,” Slok said.

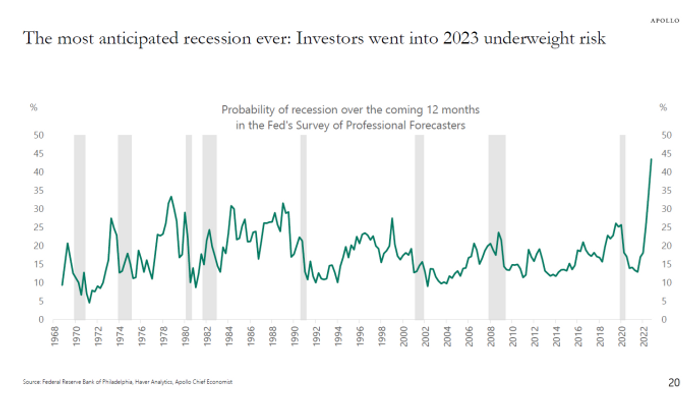

Stocks, however, have rallied sharply to begin 2023 because the lack of any significant sign of a slowdown has wrongfooted investors who were underweight equities after last year’s rout, he said.

Looking ahead, the risk is that persistent inflation, running at a 6.5% year-over-year rate in December, takes much longer than expected to get back to the Fed’s 2% target. The main reason for that risk is a labor market that’s running hot by almost every measure, Slok said.

Last Friday’s January employment report saw the economy add a much stronger-than-expected 517,000 jobs, while the unemployment rate fell to 3.4%, its lowest level since 1969. The labor-force participation rate is historically low and weekly jobless claims remain subdued.

While there’s slower activity in interest-rate-sensitive sectors of the economy that rely on financing, such as autos and durable goods, the services sector, which makes up 80% of the U.S. economy, is still going strong, Slok said.

And if the services sector needs to fill hundreds of thousands of jobs, wage gains will threaten to make inflation sticky.

There’s more to the stickiness than the labor market, though. A downturn in the housing market shows signs of easing, Slok said, as mortgage rates have risen sharply but are off recent highs. Agents report that traffic from prospective home buyers has started to pick up ahead of spring selling season, he noted. That means that the impact of a weaker housing market on inflation seen in recent months could fade.

The reopening of China’s economy as it lifts COVID curbs could push commodity prices back to the upside, also contributing to price pressures after several months of slowing inflation readings, he said.

Slok said he wouldn’t be surprised to see the fed-funds rate peak around 5.5%, above the Fed’s projection of just above 5%. The fed-funds futures market has moved closer to the Fed’s projection but still sees scope for rate cuts by year’s end.

Stocks rallied Tuesday after some wild swings in afternoon trading following remarks by Fed Chair Jerome Powell. Bulls seized on Powell’s repeated observation that the “disinflationary” process has begun, although he emphasized that it would take a long time for inflation to fall back to the target, particularly given the strength in the labor market.

Stocks were lower on Wednesday as investors digested remarks by a number of Fed speakers and continued to weigh corporat earnings.

The retreat in Treasury yields so far in the new year has left room for tech and growth shares to lead a strong rebound, with the Nasdaq COMP, -1.38% up more than 15% since Dec. 31, while the S&P 500 SPX, -0.92% has rallied 8.5%. The Dow Jones Industrial Average DJIA, -0.44%, which outperformed major-index peers in last year’s selloff, is up around 3% so far this year.

Read: U.S. could be heading into period of ‘transitory disinflation,’ traders and strategists say

Meanwhile, the S&P 500 remains in the bear market it tumbled into in 2022, falling as the Federal Reserve aggressively raised interest rates from near zero to above 4% in its effort to get a grip on surging inflation. That sent Treasury yields soaring and saw stocks, particularly rate-sensitive tech and growth shares, tumble.

Rising yields weigh in particular on shares of so-called growth stocks, whose valuations are based on earnings far into the future. Higher Treasury yields mean those cash flows are discounted more sharply, making them less attractive.

If the Fed has to raise rates more aggressively than markets expect in 2023, that brings back the dynamic that prevailed last year, Slok argued. That means another rough year for both stocks and bonds. In a rare double whammy, both fell sharply last year, undermining the traditional 60% stocks/40% bonds portfolio that typically provides a cushion during downturns.

Need to Know: No wonder Powell didn’t commit to extra hikes. Here are five reasons the January jobs report may be too good to be true.