A growing number of large U.S. companies are concerned about falling profit margins which could spell trouble for stock market valuations, analysts and investors say.

During the past three months, 25 companies in the S&P 500 index SPX, +0.01% have discussed ‘margin pressure’ in conference calls with analysts, up from 16 in the three months prior, according to FactSet. The latest example was a Tuesday-evening analyst call with FedEx Corp. FDX, +2.77% even though management refuted a report in the Wall Street Journal that it was offering significant discounts in an effort to win over shippers from rival United Parcel Service Inc. UPS, +3.01%

FedEx Chief Marketing Officer Brie Carere admitted that the rising popularity of shoppers buying small and inexpensive items online is putting pressure on how much money the company can make per item shipped.

E-commerce has done much to empower the consumer to keep a lid on prices, but new tariffs on exports to the U.S. is another cause for concern. “You are starting to see companies cite tariffs more and more for not being able to maintain pricing power,” Craig Birk, chief investment officer at Personal Capital told MarketWatch. “There’s no doubt that they’re having an impact now.”

James Meyer, chief investment officer at Tower Bridge Advisors pointed to home builder Lennar Corp. LEN, -0.90% as one such firm that has recently bemoaned the effects of tariffs on its bottom line, in a Wednesday research note.

In a post-earnings conference call on Tuesday, Lennar estimated tariffs on China had raised the cost of a new home’s construction by $500. Shares of the home builder were down more than 7% this week, even after its second-quarter profits beat analysts’ expectations.

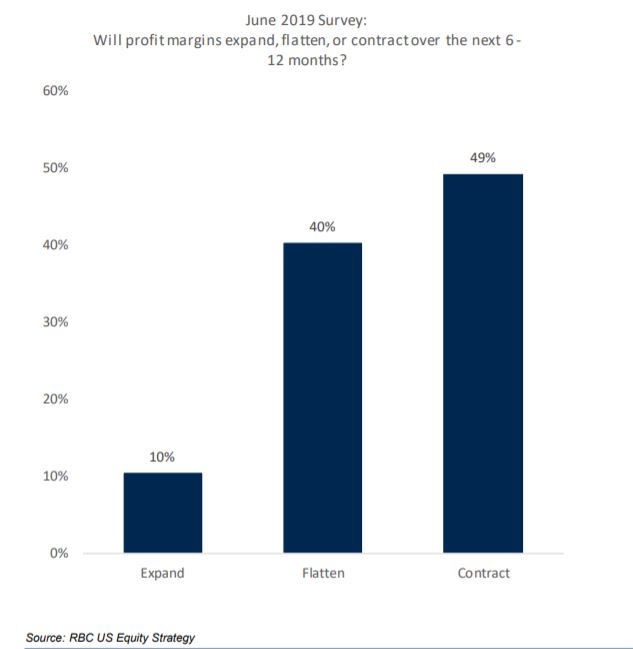

More broadly, according to a recent survey of investors by RBC Capital Markets, 49% said they expect S&P 500 index SPX, +0.01% company margins to contract over the next 12 months, while 40% said they would flatten. Just 10% believe they will increase.

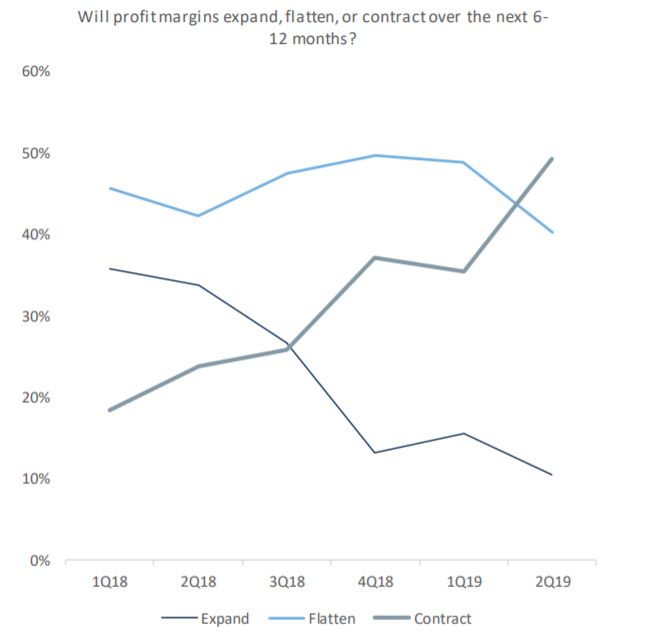

RBC Capital Markets

RBC Capital Markets

RBC Capital Markets

RBC Capital Markets

Meyer wrote that investors are too focused on the boost from lower interest rates for equities, and ignoring the long-term implications of import tariffs. Concern about the impact of tariffs helped prompt the Federal Reserve’s decision to signal a potential shift into a more accommodative policy stance later this year.

“The reason stock prices are up isn’t about expanded sales and earnings. It’s all about lower interest rates and higher P/Es,” wrote Meyer. The S&P 500 index SPX, +0.01% hit a new all-time high last week, while the Dow Jones Industrial Average DJIA, +0.07% sits roughly 1% below its high-water mark, set last October.

In other words, investors are putting the cart before the horse by bidding up stocks in the hope of lower interest rates, as those lower rates will only come to fruition if the U.S.-China trade spat and slowing economic growth seriously dent the economy and corporate profit growth.

Indeed, analysts have been busy revising down their earnings estimates for the third quarter, even as S&P 500 companies are forecast to see an earnings decline of 2.6% in the second quarter of 2019, compared a year ago, according to FactSet.

If that pace of decline holds, the index would suffer an earnings recession, defined as two consecutive quarters of earnings declines, after earnings shrunk 0.3% in the first quarter. And it doesn’t look like the third quarter will be any better, with analysts projecting another 0.3% decline in earnings-per-share.

“If interest rates are falling, stocks will still be attractive” even amid an earnings contraction, Personal Capital’s Birk said. “But if we look at price-to-sales or the size of the stock market relative to GDP, it paints a darker picture. Earnings may be more precarious than people realize because margins are at an all-time high.”

But according to Birk, these record profit margins are the result of the stock market being dominated by “a few oligopolies” like Google parent Alphabet Inc. GOOG, -0.82% and Facebook Inc. FB, -0.66% , which have very strong pricing power, along with very low interest rates, which has kept the cost of corporate debt low.

But if the Trump Administration follows through on threats to implement 25% tariffs on a further $300 billion in Chinese imports so far untaxed, margin pressures could engulf a much wider range of companies.

If the trade war widens further, and earnings continue to contract, it would behoove investors to ask what the Federal Reserve fears in terms of slower economic growth that may cause the central bank to lower interest rates, rather than just focusing on the benefits to equity valuations of lower rates alone.