President Donald Trump, left, and former Vice President Joe Biden

Agence France-Presse/Getty Images

The highflying technology sector in the U.S. stock market is largely shrugging off increased bipartisan scrutiny by Congress, but a win by Democratic challenger Joe Biden over President Donald Trump in the November presidential election could undercut the market leaders, while the prospect for a boost in infrastructure spending could lift “old-economy” cyclical stocks, according to one analyst.

Related: These green stocks would thrive under a Biden administration, according to fund managers

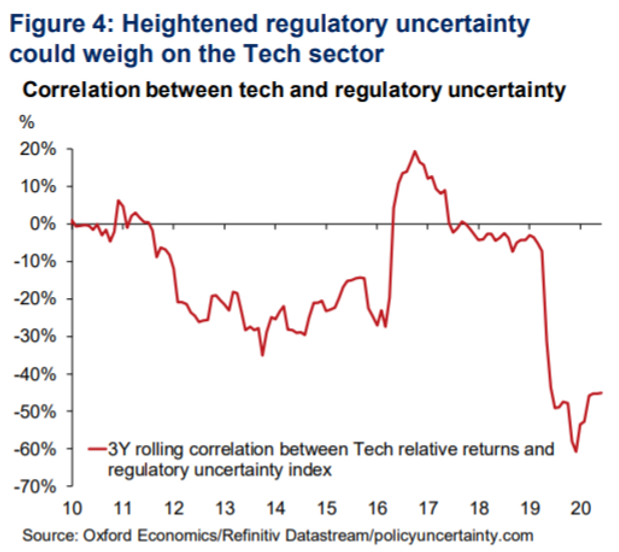

When it comes to regulation of the tech industry, Biden “is seen as more moderate…than some of his challengers for the Democratic nomination would have been, but he has previously stressed the need for greater focus on antitrust enforcement, and heightened regulatory uncertainty could weigh on the sector’s elevated valuation multiples ,” wrote Daniel Grosvenor, director of equity strategy at Oxford Economics, in a Thursday note to clients (see chart below).

Chief executives of four of the world’s most powerful tech companies — Apple Inc. AAPL, +0.98%, Facebook Inc. FB, +0.31%, Amazon.com Inc. AMZN, +1.34% and Google parent Alphabet Inc. GOOG, +0.74% GOOGL, +0.78% — were grilled by lawmakers from both parties Wednesday in a marathon hearing before the House Judiciary Committee’s antitrust subcommittee.

First Take: Big Tech painted as the railroad barons of the digital age in antitrust hearing

Meanwhile the Real Clear Politics average of polls shows Biden with an 8.3 percentage point advantage over the incumbent. Trump on Twitter Thursday raised the possibility of delaying the Nov. 3 election, repeating an allegation that increased mail-in voting could result in fraud. There’s no evidence that mail-in voting has resulted in widespread fraud and the president doesn’t have the authority to move the election date.

The S&P 500 index tech sector is up more than 17% in the year to date, while the consumer discretionary sector, which includes Amazon, is up more than 15%. The communications services sector, which includes Facebook, Netflix Inc. NFLX, +0.12% and Alphabet, is the only other of the S&P 500’s 11 sectors that is positive for the year, up nearly 5%.

The broader stock market has bounced sharply after tumbling into a bear market in late February and March as the COVID-19 pandemic forced the shutdown of businesses in the U.S. and around the world. But tech stocks have solidly outperformed as investors favored companies poised to benefit from or remain insulated from the disruption to business and consumer spending.

The S&P 500 SPX, -0.38% on Wednesday finished 3.8% below its all-time closing high set on Feb. 19, while the Dow Jones Industrial Average DJIA, -0.81% remained around 10% below its record close from Feb. 19. The tech-heavy Nasdaq Composite COMP, +0.48% meanwhile has hit a series of records in recent weeks.

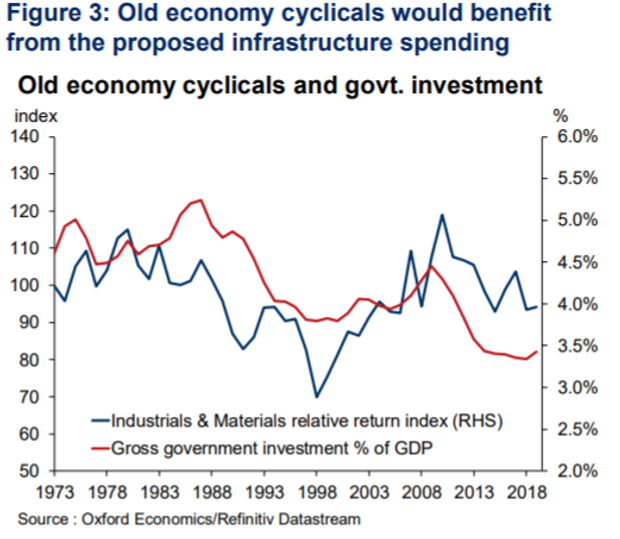

Meanwhile, what Grosvenor termed “old-economy cyclicals” could benefit from a Biden win on Nov. 3, which would be more likely to produce more spending on infrastructure spending, the analyst said.

“Although both political parties are in favor of greater infrastructure spending, the level of government investment would likely be higher under Biden, particularly if the Democrats control both the House and the Senate,” he said.

Biden, he noted, has proposed $2 trillion of infrastructure spending over four years with a focus on clean energy and the goal of eliminating carbon emissions from power plants by 2035.

“Old economy sectors such as industrials and materials have typically fared well as U.S. government investment increases,” Grosvenor said, referring to the chart above, “and we believe that these sectors are well placed regardless of the U.S. election outcome given their attractive valuations and an upswing in China’s credit cycle.”

The S&P 500 industrials sector is down more than 11% year to date, while the materials sector is down 1.8%.

But do investors agree? Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, noted in a research report earlier this week that secular growth sectors — communication services, consumer discretionary (which contains internet retail) and tech – have been moving in sync with Biden’s rising chances of winning the White House, as reflected in betting markets,

Meanwhile, the commodity and cyclical sectors that fared best after Trump won in 2016—energy, financials, and industrials – have been inversely correlated with Biden’s chances, she said.

RBC’s latest survey of its U.S. equity analysts, however, found they expected a Biden win would be “slightly bearish” for the tech sector and “bearish” for consumer discretionary, due in part to issues including higher corporate taxes and an anti-stock buyback stance.

But they also see a Biden win as bearish for industrials, citing factors including calls for a $15 minimum wage and “pro-union bias could create cost/margin pressures.