Growth stocks have outperformed value equities recently as investors begin to question if the Federal Reserve has passed peak hawkishness already with its plans to raise rates to combat high inflation.

Recent bets on fed-funds futures have pointed toward a potential pivot back to rate cuts at some point next year, while 10-year yields on U.S. government debt have fallen below 3%. Corporate bond spreads have widened as recession worries bubble up. But the decline in Treasury yields appears to be giving a lift to technology and other growth stocks over value-oriented equities.

“While it’s too early to declare the value outperformance ‘over,’ we do think the outperformance of tech recently is notable, because if it continues that will be a strong signal that the market is now looking past future rates hikes towards eventual rate cuts in 2023,” said Tom Essaye, founder of Sevens Report Research, in a note Wednesday. “If tech can mount sustained outperformance, that will tell us the market thinks the Fed has passed ‘peak hawkishness.’”

Long-term Treasury yields have been falling recently because investors are worried that the U.S. economy is slowing and “a recession is a distinct possibility,” said Tom Graff, head of investments at Facet Wealth, by phone.

The yield on the 10-year Treasury note jumped as high as about 3.482% in June, before falling Tuesday to 2.808%—the lowest since May 27 based on 3 p.m. Eastern Time levels, according to Dow Jones Market Data. That compares with a yield of about 1.5% at the end of 2021, when investors were anticipating that the Fed was gearing up to hike its benchmark rate to curb hot inflation.

The Fed raised its benchmark rate in March for the first time since 2018, lifting it a quarter percentage point from near zero while laying out plans for further increases as inflation was running at the hottest pace in 40 years. Since then, the central bank has become more hawkish, announcing larger rate hikes as the cost of living has remained stubbornly high.

That has made investors anxious that the Fed risks causing a recession by potentially being too aggressive to bring runaway inflation under control.

Read: Fed’s Waller backs another jumbo 75 bp interest-rate hike in July

But now slowing growth has some investors questioning how long the Fed will continue on an aggressive path of monetary tightening, even though it began hiking rates just this year.

Recession worries

The yield curve spread between 10-year and 2-year Treasury rates briefly inverted on July 5 for the first time since mid-June, another sign that the U.S. may be facing a recession, although this time against a backdrop of declining rates, according to Graff. The yield curve was inverted on Wednesday afternoon, with two-year yields TMUBMUSD02Y, 2.975% slightly higher than 10-year rates TMUBMUSD10Y, 2.908%, FactSet data show.

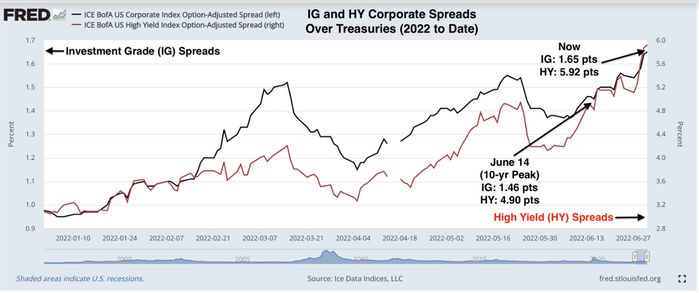

In Graff’s view, the corporate bond market also has been flashing recession concerns.

“Investment-grade corporate spreads are about as wide as they’ve been any time” outside of a recession in the last 25 years, said Graff. That doesn’t mean there’s “100% odds” of an economic contraction, he said, “but it’s definitely clearly showing credit markets think there’s a risk.”

Spreads over Treasurys for high-yield debt, or junk bonds, have similarly increased, according to Graff.

“U.S. corporate bond spreads continue to move higher even though 10-year Treasury yields peaked 3 weeks ago,” said Nicholas Colas, co-founder of DataTrek Research, in a note emailed July 6. “Spreads tend to rise when markets are increasingly uncertain about future corporate cash flows, and that has been the case most of this year.”

Investors worry about cash flows drying up in an economic slowdown as that may hinder companies from reinvesting in their businesses, or make it more difficult for cash-strapped borrowers to meet their financial obligations.

The U.S. stock market has sunk this year after a repricing of valuations that looked stretched as rates rose. Growth stocks, including shares of technology-related companies, have taken a steep drop in 2022. The tech-heavy Nasdaq Composite plunged 29.5% during the first half of this year, while the S&P 500 dropped 20.6%.

Growth stocks are particularly sensitive to rising rates as their anticipated cash flow streams are far out into the future. But with rates recently falling amid recession concerns, they’ve recently been gaining ground after being trounced by value-style bets over a stretch that began late last year.

Since June 10, the Russell 1000 Growth Index RLG, +0.49% has eked out a gain of 0.5% through Wednesday, while the Russell 1000 Value Index RLV, -0.04% dropped about 3.7% over the same period, FactSet data show.

Upcoming company earnings reports for the second quarter should give investors a “clearer picture” of what companies expect in terms of demand for their goods and services in the second half of 2022, as well as which direction stocks will be headed, according to Graff.

“Some amount of earnings slowdown is priced in,” he said of the equities market. “In our view, if earnings are mildly lower in the second half but companies see them rebounding in ‘23, that’s probably a pretty good outcome for stocks.”

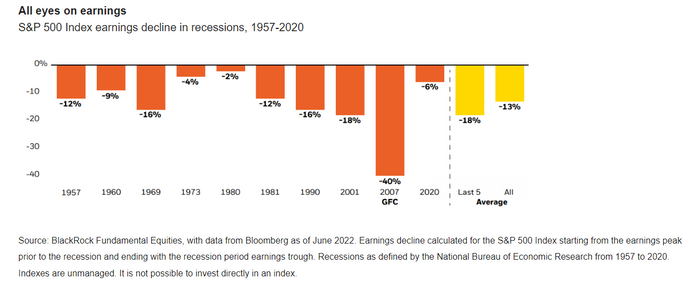

In prior recessions, the average earnings drop for the S&P 500 was 13%, with the global financial crisis, or GFC, skewing the results, according to Tony DeSpirito, BlackRock’s chief investment officer for U.S. fundamental equities. A chart in his third-quarter outlook report illustrates this finding.

“We are not calling for a recession, but we are cognizant that the risks of a recession are rising,” DeSpirito said in the note. “The Fed is tightening monetary policy, bringing an end to ‘easy money’ policies,” he said, while 30-year mortgage rates have about doubled since last year to nearly 6% today, inflation is starting to “erode household savings” and “inventories of goods are elevated as both pandemic-induced supply shortages and voracious demand ease.”

All three major U.S. stock benchmarks ended Wednesday higher after the release of minutes of the Fed’s last policy meeting. The S&P 500 SPX, +0.36% gained 0.4%, while the Nasdaq Composite COMP, +0.35% rose 0.3% and the Dow Jones Industrial Average DJIA, +0.23% edged up 0.2%, according to Dow Jones Market Data.