An old problem could come back to haunt the European Central Bank as it prepares to lift interest rates out of negative territory.

The issue is “fragmentation.” Simply put, it’s the fear that when the ECB tightens or loosens monetary policy, the effects aren’t felt the same way across all 19 nations that make up the eurozone — a potentially destabilizing phenomenon.

It’s a problem that other central banks don’t typically have to worry about. It plagues ECB policy makers because of what economists at Bruegel, the influential, Brussels-based economic think tank, describe as the eurozone’s “peculiar and possibly incomplete institutional framework, with 19 sovereign governments that each have their own fiscal policy but share one currency and one monetary authority.”

Fragmentation, were it to materialize, could be devastating for the euro area, the Bruegel economists warned, “because financial fragmentation could threaten financial stability and ultimately jeopardize price stability and the euro itself.”

Indeed, former ECB President Mario Draghi’s July 2012 vow to do “whatever it takes” to preserve the euro at the height of the region’s debt crisis came as fragmentation was stoking fears the shared currency would be blown apart as yields for Italian and other debt-stressed eurozone countries soared toward unsustainable levels relative to German and other core government bonds.

Why is fragmentation on the radar? Developments in the eurozone government bond market are raising some red flags.

Bonds are selling off, as would be expected, as the ECB prepares to end its program of asset purchases and lays the groundwork to deliver the first in an expected series of interest rate hikes next month as it wrestles with inflation that has soared well above its 2% medium-term target. The concern, however, is that Italian government bonds, for example, are selling off much more sharply than their German counterparts.

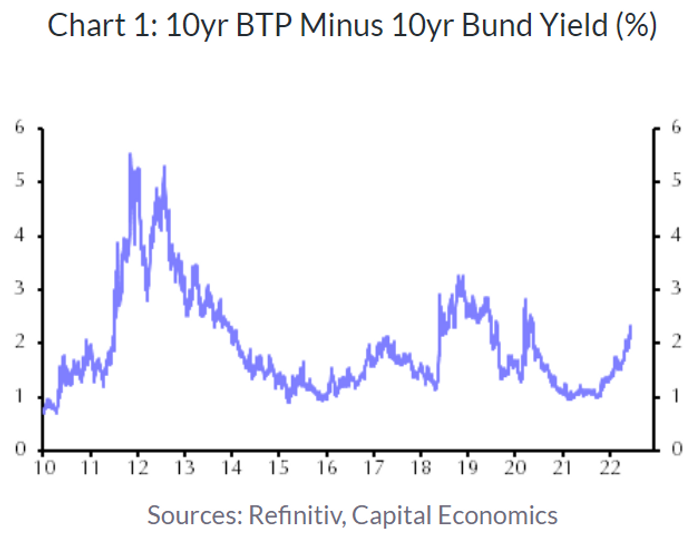

The spread between yields on 10-year Italian government bonds TMBMKIT-10Y, 3.605%, known as BTPs, and 10-year German government bonds TMBMKDE-10Y, 1.432%, or bunds, has widened sharply. In other words, investors are demanding a significantly higher yield to hold Italian debt over German paper.

Those spreads, however, aren’t yet anywhere near the levels reached during the worst days of the eurozone debt crisis about 10 years ago. And judging by remarks from ECB President Christine Lagarde on Thursday, policy makers aren’t sweating it just yet.

But economists are nervous. The spread continued to widen Thursday after Lagarde offered no details on a so-called spread-fighting tool, instead touting the ECB’s record of quickly improvising tools to deal with crises when needed. The ECB has also emphasized that reinvestments of bonds it purchased under the pandemic emergency purchase program “can be adjusted flexibly across time, asset classes and jurisdictions at any time.”

The ECB on Thursday said it would end its bond-buying program on July 1 and would raise rates by a quarter of a percentage point in July, and signaled it would likely raise rates by a half point in September.

Read: ECB says it will join the rate-hike party, but analysts say there’s little demand to crush

The lack of detail “confirms our view that the ECB will move reactively (as opposed to proactively) to mitigate sovereign spread widening if this threatens the transmission mechanism of monetary policy,” said Marco Valli, the Milan-based chief European economist at UniCredit Bank, in a note.

“For now, the ECB seems to be fairly unconcerned, which increases the risk that markets will test the central bank,” Valli wrote.

Andrew Kenningham, chief Europe economist at Capital Economics, said Lagarde ‘s remarks offered “only limited comfort.”

“The Bank’s track record in preventing fragmentation is mixed. And there are good reasons to think the Governing Council would struggle to agree on how and when to take action unless bond markets were under severe stress,” he said, in a note (see chart below). “So it is no surprise that bond spreads widened further today.”

What could the ECB do if things get ugly?

The eurozone debt crisis calmed in 2012 as Draghi proceeded to lead the ECB in fashioning an emergency bond-buying program that went well beyond anything the central bank had used previously and which could be used in an emergency. The program, known as outright monetary transactions, or OMT, was never used, but its existence, and the work toward fashioning it, helped calm the storm as yields on the debt of the eurozone’s most vulnerable governments returned to sustainable levels.

The Bruegel economists, in a paper, said the best tool would be country-specific and would be applied “only when debt sustainability of the countries in question is validated by a political process, and that it needs to be applied in conjunction with interest rate decisions so the whole framework is consistent.”

The OMT comes closest to those characteristics. The problem, however, is that it’s designed for times when there’s a high probability of a solvency crisis, they said, while a tool is now needed for non-crisis times.

What’s needed, they said, is “new option with the right economic ingredients and a process ensuring that it is politically legitimate and within the bounds set by the European Union Treaties, but that, contrarily to OMT, could be applied in real time to neutralize the additional risk that monetary tightening could pose for some countries.”