An intensifying Middle East conflict is threatening to throw the world’s energy market into disarray after weekend drone attacks destroyed parts of Saudi Aramco’s Abqaiq plant — one of the world’s largest processors of oil— and a separate nearby oil field.

On Saturday, the drone attacks, directed at Saudi Arabian oil facilities that account for nearly 10 million barrels of crude-oil production, resulted in massive plumes of black smoke emanating from the oil field, and a shutdown that could lead to about 50% of its production being at least temporarily thrown off line.

Prominent crude-oil strategist Phil Flynn at Price Futures Group told MarketWatch on Sunday that the drone strike was a “big deal” that could result in a major spike in crude-oil prices, because of the potential disruption to global supplies.

Read: Saudi oil sites shut production after hit by Yemen’s Houthi drones

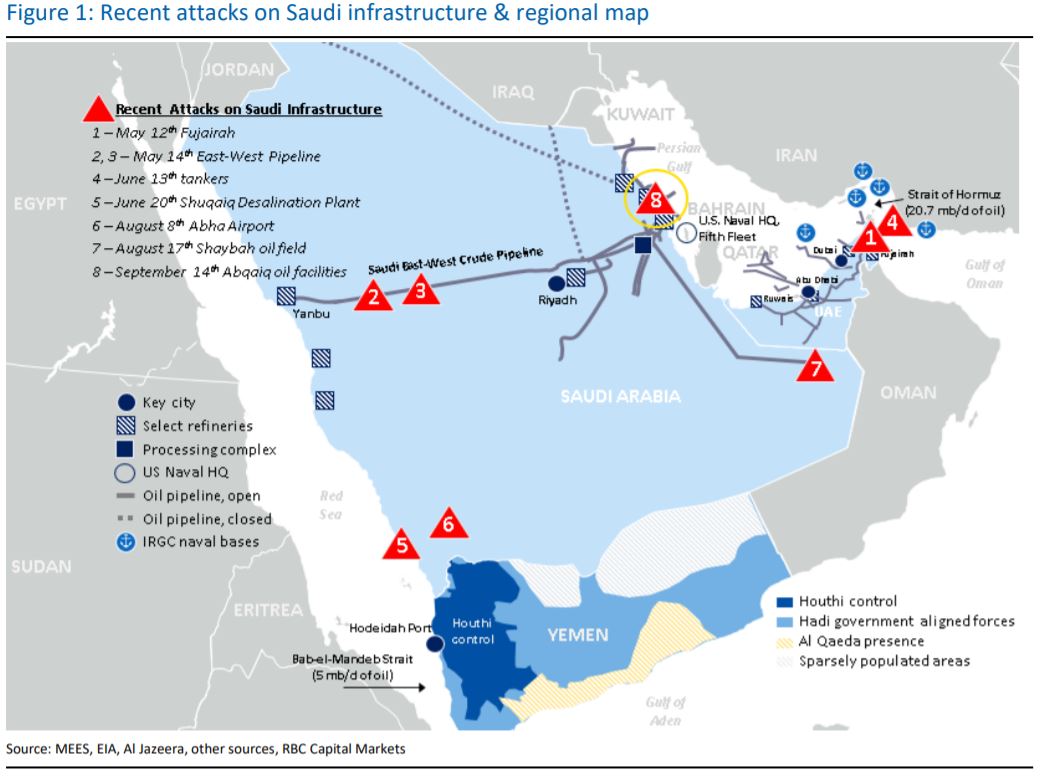

This isn’t the first such strike in the region but this most recent attack highlights the vulnerability of Arabian Peninsula’s oil production and the far-reaching implications of political clashes in the Middle East on the rest of the world.

Here’s what investors need to know about the weekend drone strikes and the implications for global markets:

What happened?

Ten automated, aerial, combat drones launched an attack on Saudi Aramco’s Abqaiq plant in Buqyaq and the Khurais oil field on Saturday at 3:31 a.m. and 3:42 a.m. local time, according to Gulf News.

Saudi Aramco describes Abqaiq as “the largest crude oil stabilization plant in the world,” and the Khurais, considered Saudi Arabia’s second-largest oil field (see map below):

via Gulf News

via Gulf News The attacks are believed to be part of a continuing conflict between Yemen’s Houthi rebels and Saudi Arabia, which harks back to a 2014 takeover of Yemn’s largest city San’a by the Houthis, according to the Associated Press. Saudi-led coalitions have launched military campaigns to stem the Houthi’s expansion.

Over the years, Saudi-led airstrikes have killed Yemeni civilians, while the Houthis have used drones and missiles to attack Saudi Arabia and have also targeted vessels in the Red Sea, the AP has reported.

Saturday’s drone attack is being described as the biggest on Saudi Arabia’s oil infrastructure since Iraq’s Saddam Hussein in 1990s fired missiles into The Kingdom during the first Gulf War.

On Saturday, Secretary of State Mike Pompeo blamed Iran for the Saudi attacks. However, he also said there was no evidence that the weekend’s drone strike came from Yemen.

“We call on all nations to publicly and unequivocally condemn Iran’s attacks. The United States will work with our partners and allies to ensure that energy markets remain well supplied and Iran is held accountable for its aggression,” the secretary said on Twitter.

Iran’s President Hassan Rouhani has denied any involvement in the Saudi strikes.

AFP/Getty Images

AFP/Getty Images The drone attack also comes amid tensions between Tehran and Washington after the U.S. pulled out of a global nuclear pact and imposed fresh sanctions against Iran to force it to curb its ambitions to create a nuclear-weapons program.

What does it mean for oil prices?

Helima Croft, global head of commodity strategy at RBC Capital Markets, said the weekend escalation could prove a “game changer” for the dynamic in the Middle East.

“We contend that this morning’s drone attacks on Saudi Arabia’s all important Abqaiq processing facility (which has processing capacity of more than 7 [million barrels a day]) and the 1.5 mb/d Khurais oil field represents a game changer in the escalating Iranian regional standoff,” Croft wrote in a Saturday research report titled: ‘Saudi Arabia/Iran Crisis Guide Update: This is Your Wake Up Call…’

On Friday, West Texas Intermediate crude for October delivery CLV19, -0.05% fell 24 cents, or 0.4%, to settle at $54.85 a barrel on the New York Mercantile Exchange. November Brent crude BRNX19, +0.05% shed 16 cents, or 0.3%, to $60.22 a barrel on the ICE Futures, with prices marking a weekly fall of 2.1%.

S&P Global Platts estimated that Brent oil, the international benchmark, could see a $5 or $10 price surge from its current levels.

“While some commentators may call for triple digit oil prices we would suggest that the sudden change in geopolitical risk warrants not only an elimination of the $5-10/Bbl discount on bearish sentiment, but adds a potential $5-10/Bbl premium to account for now-undeniably high Middle Eastern dangers to supply and the sudden elimination of spare capacity,” the Platts researchers wrote.

“As such prices are likely to break out of the current $55-65/Bbl options range, to test the high $70s as currently supported by fundamentals,” the researchers said.

Croft said Saturday’s major incident raises the risk of further disruptions to Middle East output that likely elevates the risk of oil prices vaulting higher (see map below via RBC Capital Markets showing recent incidents):

via RBC Capital Markets

via RBC Capital Markets The Wall Street Journal reported that five million barrels a day of output, or some 5% of world supply, would be taken offline due to the strikes. Saudi officials have said that it expects to return to normal levels by Monday but experts say that it would take weeks for the facilities to reach full-capacity.

“This could take a longer time than the authorities initially are claiming. Despite lower exports this year, Saudi Arabia has also depleted its crude oil stocks to the lowest levels in 10 years, so the country alone does not have the same robustness to Middle East interruptions as it used to have,” wrote Bjørnar Tonhaugen, head of oil market analysis at Rystad Energy, in a Sunday research note.

“The air attack by Iranian backed militia on vital oil processing terminals in the heart of Saudi Arabia’s oil region has turned the market on its head over the weekend,” said Magnus Nysveen, head of analysis at Rystad.

Price Futures Group’s Flynn suggested that the world-wide global oil reserves may need to be tapped to stem a big surge in prices.

“Global strategic reserve will have to be used to avoid a major price spike. Not only will oil focus on when the processing plant will return but also to whether it can be secured,” he said.

Tonhaugen said he doubts that the U.S. will be able to effectively mitigate a price surge in the near term. “Also, the U.S. cannot quickly replace this volume, as it takes time to relocate oil tankers, and U.S. still has limited export capacity by Very Large Crude Carriers, (known as VLCCs),” he said.

Flynn agrees: “This is a historic event and may have ramifications for years to come. Another key is security. How can Saudi Arabia secure their oil fields in the future? We may now find how quickly shale can ramp up. I am afraid it won’t be fast enough.”

How will the broader market react?

Already Saudi Arabia’s Tadawul stock-market exchange is under pressure and that could have some spillover into U.S. trading early Monday. Bloomberg News reported that the Tadawul All Share Index was down 3.1% after the attack. On Monday, exchange-traded fund iShares MSCI Saudi Arabia ETF KSA, +0.41%, a popular way to gain exposure to Saudi Arabia’s oil market, is likely to be active. The Saudi ETF has gained 2.8% so far in 2019, and a sharp downturn could erase its year-to-date gains.

Stock-index futures in the U.S. weren’t yet being traded but Middle East tensions come as markets are on the brink of all-time highs and as the Federal Reserve on Wednesday is set to weigh signs of global economic slowdown and stubbornly low inflation as it prepares to set monetary policy.

The Dow Jones Industrial Average DJIA, +0.14% is 0.5% from its record at 27,359.16 hit on July 15, while the S&P 500 SPX, -0.07% stood about the same distance from its all-time peak at 3,025.86 set on July 26. The Nasdaq Composite Index COMP, -0.22% was 1.8% from its all-time closing high at 8,330.21 also hit on July 26.

The U.S. central bank has traditionally described moves in the volatile oil markets as inputs that central bankers tend to view as temporary.