U.S. benchmark stock indexes climbed to new records Thursday after Congress confirmed President-elect Joe Biden’s election win, offering the prospect of more financial aid for consumers and businesses coping with the coronavirus pandemic.

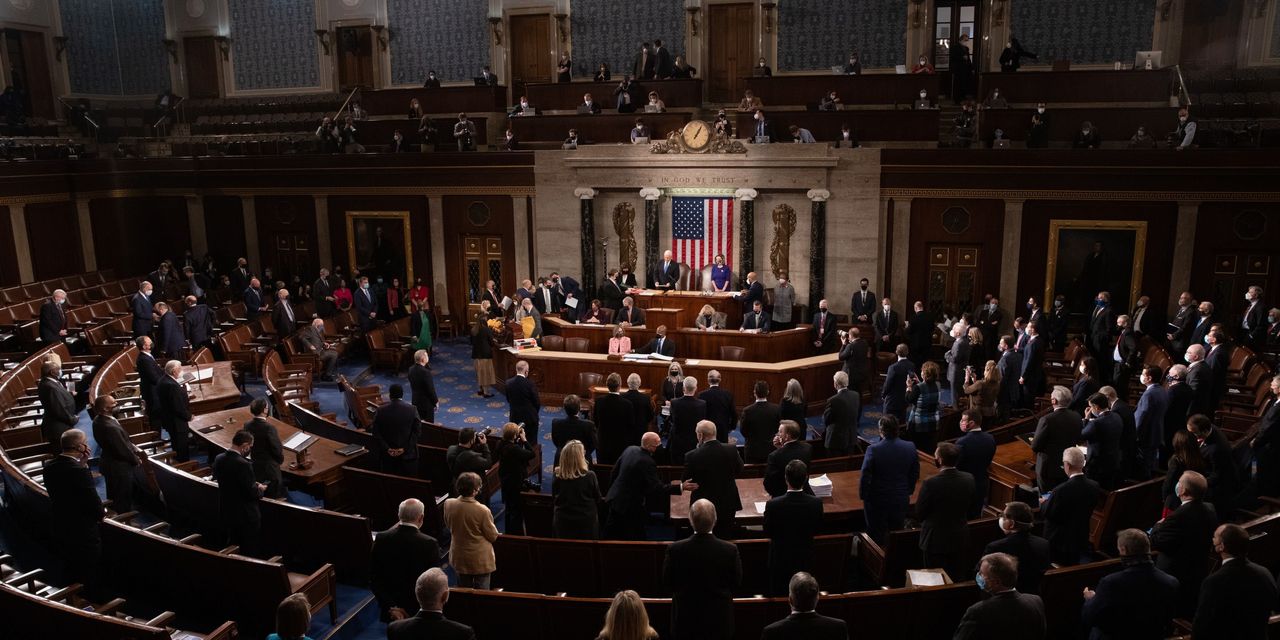

Markets looked past the violent protests by President Donald Trump’s supporters in Washington on Wednesday and the president promised an orderly transition of power on Jan. 20.

How are stock benchmarks performing?

- The Dow Jones Industrial Average DJIA, +0.88% was up 213 points, or 0.7%, at 31,043, in record-close territory.

- The S&P 500 index SPX, +1.50% was trading 49 points , or 1.3%, to reach 3,798, putting the broad-market index in record territory.

- The Nasdaq Composite Index COMP, +2.32% climbed 274 points, or 2.2%, to reach a milestone at 13,015.

On Wednesday, the Dow and small-capitalization Russell 2000 ended at record highs but off their best levels of the day as equity markets pared gains somewhat amid the chaos in Washington.

- The Dow closed up 437.80 points, or 1.4%, to end at a record 30,829.40

- The small-cap Russell 2000 RUT, +1.56% gained 4% to end at a record 2,057.92.

- The S&P 500 gained 21.28 points, 0.6%, to close at 3,748.14.

- The Nasdaq Composite Index COMP, +2.32% finished lower by 78.17 points, or 0.6%, at 12,740.79.

What’s driving the market?

The positive tone to trading on Thursday suggested investors were focused on the prospect of a more aggressive fiscal agenda under a new Biden administration, said Esty Dwek, head of global market strategy at Natixis Investment Managers.

The political wins by Democrats Jon Ossoff and Raphael Warnock in the Senate runoff elections on Tuesday raise the prospect of additional coronavirus fiscal relief measures and other legislation that could boost the U.S. economy after Biden is sworn in on Jan. 20.

U.S. stocks scored an additional boost after the Institute for Supply Management’s nonmanufacturing or services sector survey of activity rose to 57.2% in December from 55.9% in the prior month.

The unexpected rebound in the ISM services index to 57.2 in December, from 55.9, is hard to square with the range of other evidence showing that the latest wave of coronavirus cases and restrictions on businesses are starting to weigh more heavily on the economy, particularly services.

Indeed, the U.S. economy will likely experience a significant slowdown early in 2021, Philadelphia Federal Reserve President Patrick Harker said on Thursday.

But the report on services comes after manufacturing activity grew in December at the fastest pace since the coronavirus pandemic erupted last spring.

“Like the manufacturing survey released earlier this week, the headline services reading received an artificial boost from a jump in the supplier deliveries component, which reflects virus-related disruption rather than stronger demand,” wrote Andrew Hunter, senior U.S. economist at Capital Economics.

In other economic data, a weekly report on initial state jobless claims dipped by 3,000 to 787,000 for the week ended Jan. 2, while the U.S. trade deficit widened in November.

The ongoing slow recovery of the economy in the face of coronavirus pandemic is being pointed to as one reason for the market’s apparent dismissal of Wednesday’s civil unrest in Washington.

“There should be no mystery as to why the markets didn’t care about what happened in the [Capitol] yesterday, however disturbing, disgraceful, and embarrassing it was. It’s because it has no bearing on the direction of the economy, earnings and interest rates. It’s that simple,” wrote Peter Boockvar, chief investment officer at Bleakley Advisory Group.

Read: Why the stock market rallied even as a violent mob stormed the Capitol

Which stocks are in focus?

- Shares of Tesla Inc. TSLA, +5.80% were up 5.9% on Thursday after RBC Capital Markets analyst Joseph Spak ended his bearish call on the electric-vehicle maker, upgrading it to sector perform from underperform.

- DXC Technology Co.’s stock DXC, +6.39% were up 5% Thursday after Reuters reported that Atos SE ATO, -5.77% has made a bid for the information technology company.

- Conagra Brands Inc. shares CAG, -3.62% fell 2.8% in Thursday trading after the food company reported fiscal second-quarter earnings and sales that beat expectations.

- Constellation Brands Inc. shares STZ, +3.06% rose 3.4% Thursday, after the company beat estimates for its fiscal third quarter. The company posted net income of $1.281 billion, or $6.55 a share, in the quarter to Nov. 30, up from $360.4 million, or $1.85 a share, in the year-earlier period.

- Bed Bath & Beyond Inc. shares BBY, +2.25% slid by about 10% Thursday, after the retailer posted weaker-than-expected sales and profit for its fiscal third quarter as the pandemic continued to weigh.

- Walgreens Boots Alliance Inc. stock WBA, +6.58% rose 6.6% in Thursday trading after the pharmacy retailer reported fiscal first quarter adjusted earnings per share and sales that beat the Street.

- Shares of Victoria’s Secret parent L Brands Inc. LB, +7.83% rose 6% Thursday, after the company said holiday sales exceeded its expectations and offered consensus-beating guidance for fourth-quarter per-share earnings.

- Shares of Plug Power PLUG, +29.60% rose nearly 30% after reaching a deal for SK Group to make a $1.5 billion strategic investment and form a joint venture company in South Korea.

- Las Vegas Sands LVS, -0.38% said Thursday that Chairman and Chief Executive Sheldon Adelson, a major Republican donor, is taking a medical leave of absence after resuming his cancer treatment. Shares were off 0.6%.

- Wayfair Inc. W, +1.14% said Thursday that it has raised wages for all U.S. employees to at least $15 per hour, effective Jan. 3, 2021. Shares climbed 2.2%.

How are other markets faring?

- The 10-year Treasury note TMUBMUSD10Y, 1.081% was up 4 basis points at 1.08%, as traders bet on stronger inflation pressures. Bond yields rise as prices fall.

- Oil futures traded higher Thursday. Crude for February delivery CLG21, +0.34% was up 0.2% to $50.75 a barrel, a day after closing above $50 a barrel for the first time in 11 months.

- Gold futures GC00, +0.21% rose 0.1% after settling 2.3% lower Wednesday as bond yields gained.

- The pan-European Stoxx 600 Europe index SXXP, +0.51% finished 0.5% higher, while London’s FTSE 100 UKX, +0.22% gained 0.2%.

- In Asia, Hong Kong’s Hang Seng Index rose 0.2%, while the Shanghai Composite SHCOMP, +0.71% gained 0.6% and Japan’s Nikkei 225 NIK, +1.60% rose 1.6%.

- The ICE U.S. Dollar Index DXY, +0.37%, a measure of the U.S. currency against a basket of six major rivals, was up 0.4%.

Add Comment