U.S. stock indexes traded higher Monday, with the Nasdaq Composite shaking off earlier losses and Dow industrials rallying by more than 600 points, as investors digested the latest news on the spread of the coronavirus and prepared for new inflation data on Friday.

What’s happening

- The Dow Jones Industrial Average DJIA, +1.99% surged 669 points, or 1.9%, to 35,246, powered by strong point gains in UnitedHealth Group Inc. UNH, +2.27%, Goldman Sachs Group Inc. GS, +2.11%, Home Depot Inc. HD, +1.89% and Boeing Co. BA, +3.42%

- The S&P 500 SPX, +1.28% was trading 53 points, or 1.2%, higher at 4,591.

- The Nasdaq Composite Index COMP, +0.70% was up by 86 points, or 0.6%, at 15,173 after touching an early intraday nadir at 14,931.61.

Last week, the Dow fell 0.9%, the S&P 500 declined 1.2%, and the Nasdaq Composite dropped 2.6%.

What’s driving markets

Markets are on unsteady footing and strategists are expecting volatility to be in force, as uncertainty about the virus and concerns about the Federal Reserve remain a key focus for investors.

“Until health experts better understand the potential impact of the Omicron COVID variant, investors should remain vigilant, focusing on appropriate portfolio diversification to weather market volatility,” wrote Seema Shah, chief strategist at Principal Global Investors.

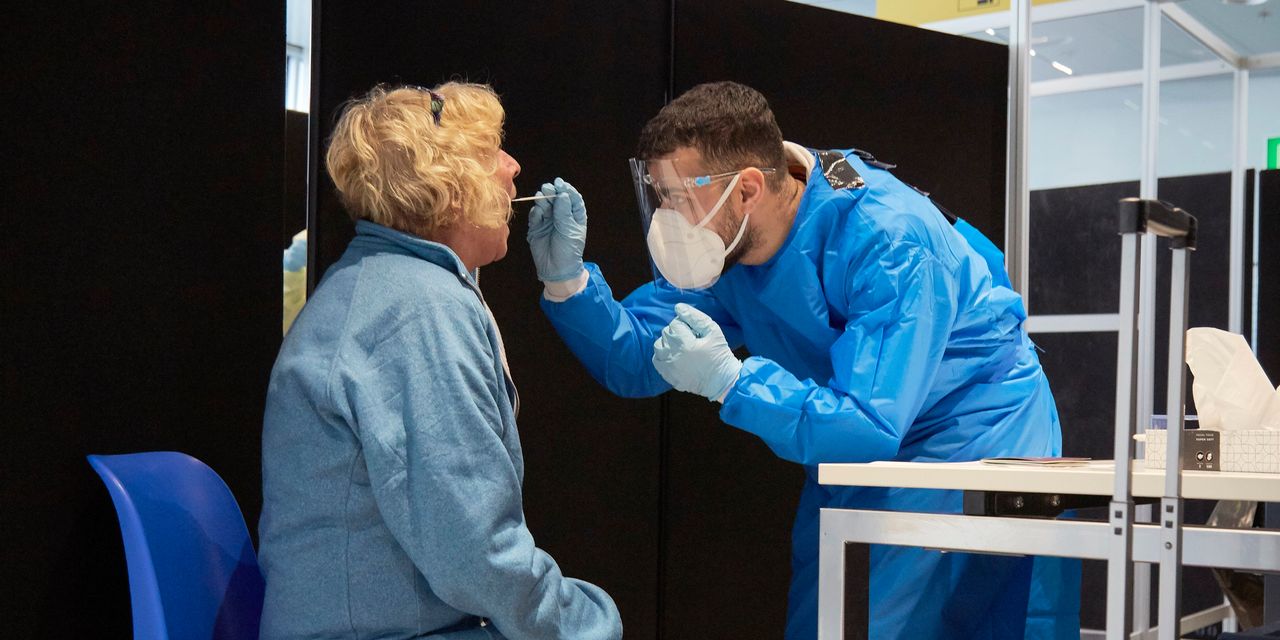

Over the weekend, omicron fears saw some cause for abatement as Dr. Anthony Fauci told CNN’s “State of the Union” that the early reports of the spread of the omicron variant of coronavirus suggest it might be less dangerous than the delta wave. Reports from South Africa show that while the virus is rapidly spreading, hospitalizations aren’t.

Nonetheless, in a pre-emptive strike to control the virus, all New York City employers will have to mandate vaccinations for their workers, starting later this month, under new rules announced Monday by Mayor Bill de Blasio.

Meanwhile, traders continued to react to the implications of jobs for November, which showed slowing growth but a steep decline in unemployment, as they prepare for Friday’s release of consumer price data.

“Against this backdrop of uncertainty and angst, portfolio diversification, particularly considering exposure to both high yield and quality assets, remains the primary tool for investors,” Shah wrote.

Important news out of China also was being parsed for its potential impact on investor sentiment, as the People’s Bank of China cut the country’s reserve requirements for banks, while China Evergrande 3333, -19.56% admitted it might not be able to repay creditors.

This year “has been marked by a confluence of events that have no historical parallel: a unique growth surge, a supply-driven spike in inflation and new central bank frameworks that are stress-tested in real time,” Jean Boivin of BlackRock Investment Institute and others wrote in a note Monday.

“We are still overweight equities even as the omicron virus strain and the Fed’s catching up to inflation reality have hurt risk sentiment,” they wrote.

Which companies are in focus?

- Special-purpose acquisition company Digital World Acquisition Corp. DWAC, -2.05%, which plans to merge with Trump Media & Technology Group, said it received preliminary, fact-finding inquiries from regulatory authorities and is cooperating. Shares were down 3.1%.

- Shares of Lucid Group Inc. LCID were down 8% after the California-based electric-vehicle maker disclosed that it was subpoenaed by the Securities and Exchange Commission related to an investigation.

- Jack in the Box Inc. JACK said Monday it will pay $12.51 a share for Del Taco Restaurants Inc. TACO in a deal valued at about $575 million. Shares of Jack were down 4.5%, while Del Taco shares surged 66%.

- BuzzFeed Inc. BZFD BZFDW, +6.10% shares traded 4.4% lower in the stock’s trading debut on the Nasdaq Monday after the digital media company closed its business combination with 890 5th Avenue Partners Inc., a special-purpose acquisition company.

- Becton Dickinson & Co. BDX said Monday that the spinoff of its diabetes care business will be named “embecta.” Its stock was up 1.7%.

- Shares of Moderna Inc. MRNA, -14.36%, were down more than 14% as investors wrestled with news of the omicron variant.

How are other assets trading?

- The yield on the 10-year Treasury note BX:TMUBMUSD10Y rose Monday to 1.395%, up from 1.342%. Prices for Treasurys fall as yields rise.

- The ICE U.S. Dollar Index DXY, a measure of the currency against a half-dozen other monetary units, was up 0.2%

- In oil futures, West Texas Intermediate crude CL00 for January delivery CLF22 rose 3% early Monday at $68.24 a barrel, after notching a sixth straight week of declines last week.

- Gold futures GC00 for February delivery GCG22 rose by less than 0.1% to $1,785.50 an ounce.

- The Stoxx Europe 600 Index SXXP closed up 1.3% higher on Monday. London’s FTSE 100 Index UKX closed up 1.5%, marking its largest one-day gain since July 21.

- In Asia, the Shanghai Composite Index SHCOMP closed 0.5% lower, while the Hang Seng Index HSI ended 1.8% lower in Hong Kong. Japan’s Nikkei 225 Index NIK fell 0.4%.

— Steve Goldstein contributed to this article