Stocks were higher Monday afternoon, after Moderna Inc. said its vaccine candidate proved highly effective in preventing COVID-19 infections, bolstering the least-loved sectors and industries as investors rotated away from shares of companies that thrived in the stay-at-home environment created by the pandemic.

What are major benchmarks doing?

The Dow Jones Industrial Average DJIA, +1.22% advanced 349 points, or 1.2%, to 29,831, after briefly surpassing its intraday record of 29,933.83 set last week, and is on track for its first record close since February. The S&P 500 SPX, +0.82% gained 27 points, or 0.8%, to 3,612. The Nasdaq Composite COMP, +0.50% rose 56 points, or 0.5%, to 11,885, turning higher after starting the session near break-even levels.

Read: Dow on verge of 30,000 and first record close in 10 months

The small-cap Russell 2000 RUT, +1.54% rose 1.9%.

Stocks closed with strong gains Friday, pushing the S&P 500 to its first record close since Sept. 2 and the Russell 2000 RUT, +1.54% to its first record since 2018. A rotation away from large-cap tech juggernauts that have been the main beneficiaries of the work-from-anywhere phenomenon saw the Nasdaq Composite lag behind as investors rotated into stocks and sectors left behind by the pandemic.

In One Chart: Small-cap stocks ‘remain pretty seriously underloved’ despite vaccine-fueled gains

What’s driving the market?

The “great rotation” away from growth-oriented technology stocks into downtrodden shares of companies that make goods and provide services, tethering them to the U.S. economic recovery, deepened on Monday.

“Value is rocking and rolling and it’s up because of the vaccine news,” said Kent Engelke, chief economic strategist at Capitol Securities Management. “That’s showing, at least in my view, the underlying strength that might come back into the economy.”

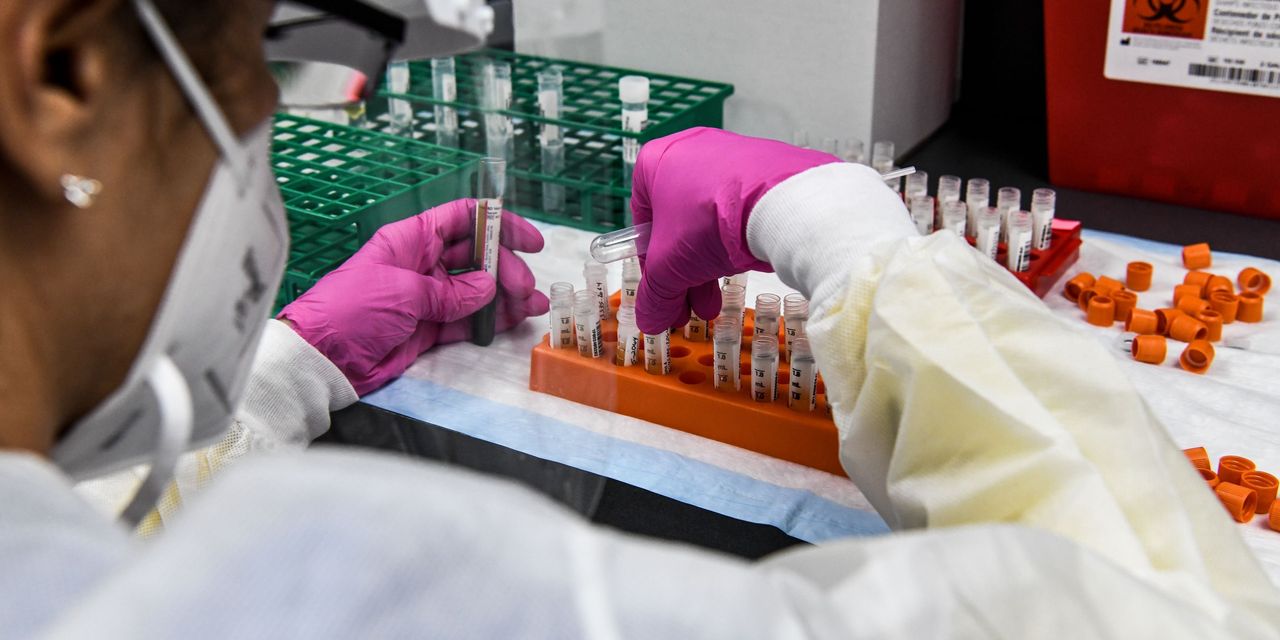

Moderna MRNA, +10.70% said its COVID-19 experimental vaccine cut COVID-19 infections by 94.5%. The company said it plans to submit an Emergency Use Authorization with the U.S. Food and Drug Administration in the coming weeks. Moderna shares jumped around 8%.

Last week’s rally was inspired after Pfizer and BioNTech SE on Nov. 9 announced that their vaccine candidate was more than 90% effective in preventing COVID-19 infections in a late-stage trial.

“A vaccine was a dream in March, it’s a near reality today. That may not help during the current surge, but it does promise relief by mid-2021,” said James Meyer, chief investment officer at Tower Bridge Advisors.

The U.S. has been averaging 150,000 new cases a day, a soaring 81% increase from the average two weeks ago, according to a New York Times tracker, and a trajectory that Peter Hotez, dean of the National School of Tropical Medicine and professor of pediatrics and molecular virology and microbiology at Baylor College of Medicine called a pending “humanitarian catastrophe,” on CNN.

Even Sweden, known for its lax social-distancing requirements when compared with its Nordic neighbors, switched course and now ordered a ban on public events of more than eight people.

Tech shares and other stay-at-home beneficiaries slumped again Monday after lagging last week, but hard-hit industries and sectors, including airlines, energy, financials and retail, benefited.

Deal-related news was also in focus, PNC Financial Services Group Inc. PNC, +1.86% agreed to buy the U.S. arm of Spain’s BBVA in an $11.6 billion transaction, the companies said Monday, in one of the largest bank tie-ups since the financial crisis. PNC shares rose 2.1%, while BBVA shares surged over 11%.

Meanwhile, investors looked past what looks to be a hard winter due to COVID-19 and a stalled transition of power, as President Donald Trump continued to refuse to accept the results of the Nov. 3 presidential election.

Trump early Monday tweeted that he “won the election,” prompting Twitter Inc. TWTR, -1.89% to apply a warning to the message that “official sources called the election differently,” a day after Trump appeared to acknowledge that Biden had won the election, while repeating his claim, without evidence, that the election had been rigged. Federal agencies have described the voting process as the most secure in election history. Trump subsequently tweeted that he had not conceded.

Read: Dates to watch as Trump continues legal fight to overturn the presidential election result

“The S&P 500 is having its best November in decades, and the Dow is on pace to close at a record today,” said Lindsey Bell, chief investment strategist for Ally Invest, in emailed commentary.

But Bell also said that it’s still unclear if vaccine hopes will bolster consumer spending during the holidays “a crucial period” that “could provide clues into what the next leg of the economic recovery will look like.”

In economic data, the New York Federal Reserve Bank’s Empire State index came in at a reading of 6.3 from 10.5 in October.

Which companies are in focus?

- Retailers got a boost Monday from vaccine hopes, helping to push shares toward strong monthly gains, including those of Nordstrom Inc JWN, +13.14%, Macy’s Inc., J.C. Penney Co. Inc. JCPNQ, +24.37%, Gap Inc. GPS, +7.83% and others.

- Apple Inc. AAPL, +0.71% shares were up 0.8%, even as it faced two strategic privacy complaints in Europe by Max Schrems, a digital activist who has successfully taken on Facebook’s user data practices.

- Tyson Foods Inc. TSN, +4.16% stock rose 3.6% after the meat processor reported fiscal fourth-quarter earnings that beat expectations and declared a dividend for fiscal 2021.

- Hilton Worldwide Holdings Inc. HLT, +1.58% said Monday it plans to offer $1 billion worth of senior notes to redeem previously issued debt. The stock rallied 1.1%.

- High-end mall developer Taubman Centers Inc. agreed to accept a price cut in its takeover by Simon Property Group Inc. SPG, in a move that will allow the companies to avoid a drawn-out legal battle that was set to kick off on Monday. Simon will pay $43 a share for Taubman under the new deal, they said Sunday. That is down from the original price of $52.50. Simon shares rose 6%, while Taubman shares climbed 8.3%.

- Casper Sleep Inc. CSPR, -14.46% shares fell 15.4% after the mattress-in-a-box seller saw a wider-than-expected third-quarter loss due to an unexpected decline in revenue. Casper cited supply chain challenges as a result of the COVID-19 pandemic.

How are other assets trading?

The yield on the 10-year Treasury note TMUBMUSD10Y, 0.901% rose 1 basis point to 0.90%. Bond prices move in the opposite direction of yields.

The ICE U.S. Dollar Index DXY, -0.15%, a gauge of the greenback’s strength against its major rivals, was down 0.1%.

The pan-European Stoxx 600 index SXXP, +1.18% closed up 1.2%, while the U.K.’s FTSE-100 index UKX, +1.66% Z00, -0.41% climbed 1.7%.

Crude-oil futures rose, with the U.S. benchmark CL.1, +3.11% up 3.2% to trade at $41.43 a barrel. Meanwhile, trading in gold GCZ20, -0.02% rose $1.60. or 0.8%, to close at $1,887.80 an ounce.

—William Watts contributed reporting