Futures pointed to a higher start for U.S. stocks Wednesday, with investors appearing to show confidence in efforts by Chinese authorities to contain the outbreak of a potentially deadly flulike virus.

What are major indexes doing?

Futures on the Dow Jones Industrial Average YMH20, +0.28% rose 88 points, or 0.3%, to 29,267, while S&P 500 futures ESH20, +0.41% gained 12.75 points, or 0.4%, to 3,332.25. Nasdaq-100 futures NQH20, +0.71% were up 60.5 points, or 0.7%, at 9,230.25.

On Tuesday, the Dow DJIA, -0.52% shed 152.06 points, or 0.5%, to 29,196.04, ending its five-day streak of gains. The S&P 500 index SPX, -0.27% fell 8.83 points, or 0.3%, to 3,320.79 and the Nasdaq Composite Index COMP, -0.19% closed down 18.14 points, or 0.2%, at 9,370.81, after briefly turning positive mid-session to set a record intraday high of 9,397.58.

What’s driving the market?

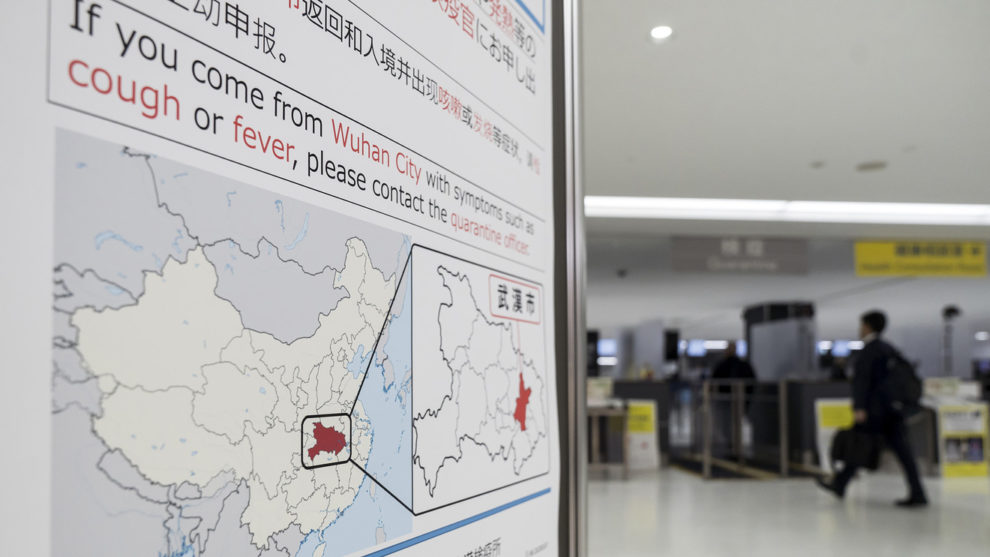

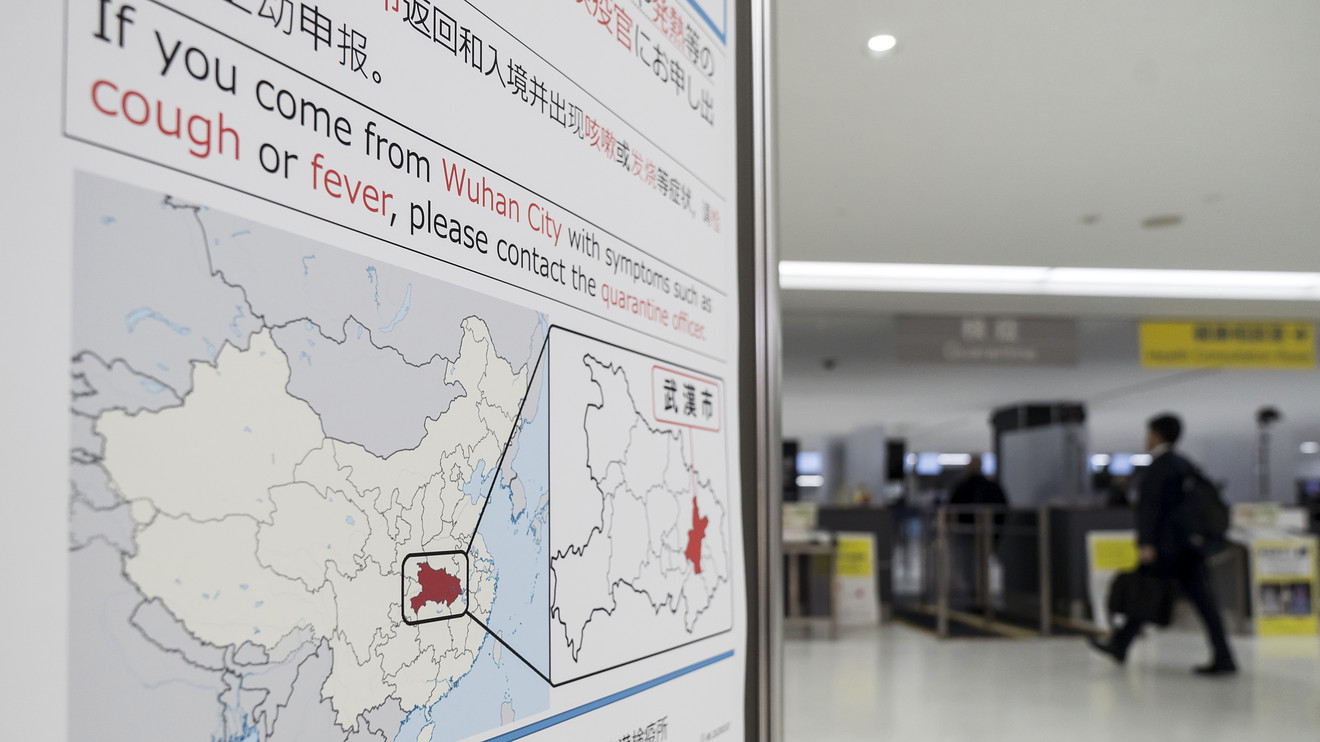

Major indexes finished lower on Tuesday, pulling back from records seen last week, after a U.S. citizen who had recently returned from a trip to central China was diagnosed with the new virus that’s raised worries over a potential pandemic. But analysts said recent updates from Chinese authorities had provided investors with some comfort the outbreak will be contained.

“It seems that risk sentiment is considering much of the widespread news and talk of a potential SARS 2003 outbreak as predominantly fearmongering, and that the situation will eventually return to normal, as it has historically,” said Bethel Loh, macro strategist at ThinkMarkets, in a note.

“This has driven investors to use yesterday’s broad selloff as an opportunity to get their positioning right well before earnings season gets under way,” Loh said.

Read: China’s new coronavirus cases rise sharply to 400, as death toll rises to 9

Also see: Why the mysterious coronavirus from China has spread so quickly

Chinese officials said hospitals are stepping up preventive measures and moving to discourage movement into and out of Wuhan, the central Chinese city where the virus originated, The Wall Street Journal reported.

President Donald Trump on Wednesday said he had been briefed by the Centers for Disease Control and Prevention and that the U.S. had nothing to fear from the virus outbreak. “It’s one person coming in from China. We have it under control. It’s going to be just fine,” he told CNBC in Davos, Switzerland.

DJIA, -0.52% The Dow has risen for five of the past six weeks, with a year-to-date return of 2.3%. The S&P 500 has gained for two consecutive weeks, with a year-to-date return of 2.8% and the Nasdaq has risen for six straight weeks, with a year-to-date return of 4.4%.

See: Founder of world’s largest hedge fund says ‘cash is trash’ as the Dow soars to records

Which companies are in focus?

Netflix Inc. NFLX, -0.46% late Tuesday reported a boost to revenue and global net subscriber growth at the end of 2019, but offered a weak outlook for the start of 2020. Shares were up 2.4% in premarket trade.

Opinion: Netflix investors need to get used to the new normal

Dow-component Johnson & Johnson JNJ, +0.07% early Wednesday reported a fourth-quarter profit that beat expectations, though revenue came up a bit shy. Shares were off 0.9% in premarket action.

Oil-field-services provider Baker Hughes Co. BKR, -3.73% reported profit and revenue that came in short of consensus estimates.

United Airlines Holdings UAL, -4.36% late Tuesday reported results that beat Wall Street’s adjusted profit expectations in the fourth quarter.