U.S. stocks finished mostly higher Monday, with the S&P 500 rising for eighth session in a row, as investors geared up for a new earnings season.

How did the benchmarks fare?

S&P 500 index SPX, +0.10% bounced back to rise 3.03 points, or 0.1%, to 2,895.77, tying its longest winning streak from October 2017. The tech-oriented Nasdaq Composite Index COMP, +0.19% gained 15.19 points, or 0.2%, to 7,953.88.

The Dow Jones Industrial Average DJIA, -0.32% however, dropped 83.97 points, or 0.3%, to 26,341.02, dragged down by Boeing Co., which was the blue-chip index’s biggest loser.

What drove the market?

The market struggled most of the session on concerns about weakness in coming first-quarter results. A number of companies, including Dow-component Walgreens Boots Alliance Inc. WBA, +0.68% have dialed back earnings outlooks for 2019.

Read: How the worst earnings season in years could trip up the stock market

Investors are also awaiting concrete progress on U.S.-China trade negotiations which will be symbolically concluded with a meeting between President Donald Trump and his Chinese counterpart Xi Jinping.

U.S. factory orders fell 0.5% in February, steeper than the 0.4% decline forecast by economists in a MarketWatch poll. The data show that growth in the manufacturing continues to expand but manufacturers are becoming more cautious.

On Friday, the March employment report showed that the U.S. economy added 196,000 new jobs, above consensus expectations of 177,000 in a MarketWatch poll of economists. The number alleviated some worries that U.S. economic growth was losing momentum in tandem with increasing signs of slowdown elsewhere in the world.

In Europe, market participants were watching the latest development surrounding Britain’s attempt to extricate itself from the European Union. Brussels was set to decide on an extension to the so-called Brexit deadline, possibly setting a date at the end of the year or even in 2020.

What were strategists saying?

Craig Callahan, president of Icon funds, told MarketWatch that Monday’s price action amounted to consolidation. “There are many skeptics of this bull market, and so when the market goes up a bit as it did last week, they take the opportunity to get out,” he said.

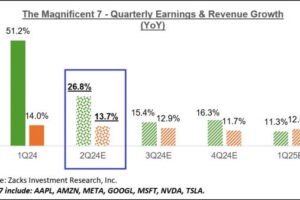

“S&P 500 earnings are expected to post a 4% year-over-year decline for the quarter. This would be the first quarterly year over year decline in earnings since second quarter 2016,” said Bill Stone, chief investment officer at Avalon Advisors LLC, in a note.

In fact, Stone expects earnings in three sectors—technology, materials and energy—to drop by double digits.

“The good news is that we don’t expect a real earnings recession with the earnings picture brightening as the year progresses,” he said.

Which stocks were in focus?

Shares of Boeing BA, -4.44% slumped 4.4% after the aeronautics and defense contractor announced that it was scaling back production of its 737 MAX aircrafts, which have been grounded after a pair of fatal plane crashes within six months of each other.

Shares of General Electric Co. GE, -5.19% fell 5.2% after analyst Stephen Tusa at JPMorgan returned to a bearish stance on the company, lowering his price target to $5 from $6, or 50% below Friday’s closing price.

Warren Buffett said that the next chief executive of embattled bank Wells Fargo & Co. WFC, +0.21% shouldn’t come from Wall Street. Buffett is one of the biggest shareholders in Wells Fargo via Berkshire Hathaway BRK.A, -0.10% BRK.B, -0.04% Shares of the bank bounced back to edge up 0.2%.

Shares of Zillow Group Inc. ZG, +0.79% rose 0.8% after analysts at Cowen upgraded the stock to outperform.

Pinterest PINS, +0.00% set a price range for its coming initial public offering at between $15 and $17 dollar. The online-imaging company is slated to go public next week on the New York Stock Exchange.

Read: Pinterest’s IPO filing — 5 things investors should know

How were other markets trading?

Stocks in Asia traded mixed, with Japan’s Nikkei 225 NIK, -0.22% losing 0.2%, while Hong Kong’s Hang Seng Index HSI, -0.13% added 0.5% and China’s Shanghai Composite Index SHCOMP, -0.29% edged 0.1% lower.

European markets were mostly weaker with the Stoxx Europe 600 SXXP, -0.19% index edged lower.

In commodities markets, crude-oil prices CLK9, -0.09% climbed while gold GCM9, +0.06% settled higher. The U.S. dollar DXY, -0.03% retreated against a basket of its peers.

—Mark DeCambre contributed to this article

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.

Add Comment