U.S. stocks looked set to fall on Monday as souring U.S.-China trade relations continued to weigh on sentiment throughout global markets.

How are major benchmarks faring?

Dow Jones Industrial Average futures YMM19, -0.04% fell 163 points, or 0.6%, to 25,614, those for the S&P 500 ESM19, -0.03% declined 21.75 points, or 0.6%, at 2,840.50, while Nasdaq-100 futures NQM19, +0.01% retreated 104.75 at 7,407.50, a fall of 1.4%.

On Friday, the Dow DJIA, -0.38% slid 98.68 points, or 0.4%, to 25,764 and the S&P 500 index SPX, -0.58% lost 16.79 points, or 0.6%, to 2,859.53. The Nasdaq Composite Index COMP, -1.04% declined 81.76 points, or 1%, to 7,816.28.

The Dow shed 0.7% for the week, bringing its weekly losing streak to four, the longest since May 2016. The S&P 500 fell 0.8% on the week while the Nasdaq dropped 1.3%.

What’s driving the market?

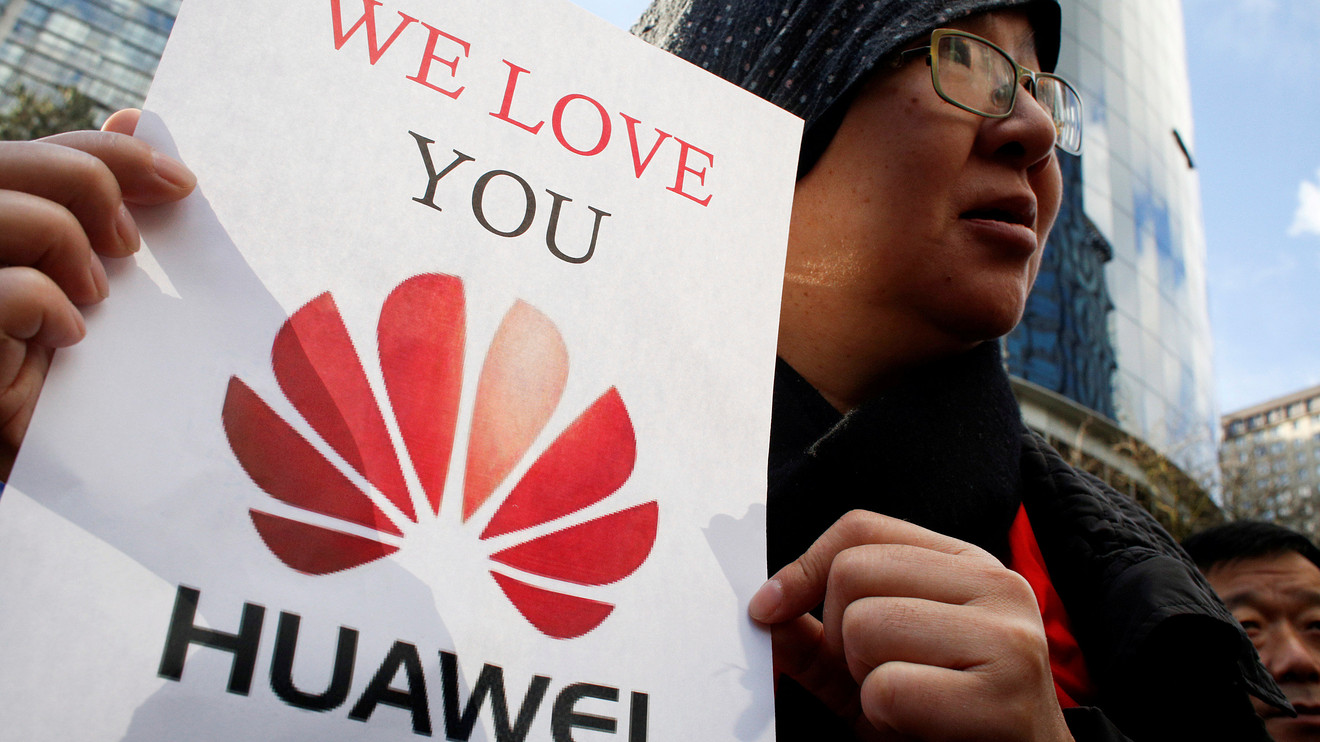

Sino-American trade tensions continued to face apparent escalation, with shares of chip makers taking it on the chin as U.S. technology companies have begun to comply with the White House’s ban on China’s Huawei Technologies Inc.

Bloomberg News reported Sunday that Xilinx XLNX, -1.29% XLNX, -1.29% and other U.S. chip makers, including Intel Corp INTC, -1.41% Qualcomm Corp. QCOM, -1.58% and Broadcom Inc. AVGO, -2.49% have frozen the supply of critical software and hardware components to Huawei. The Wall Street Journal reported separately that Alphabet Inc.’s GOOG, -1.41% Google will cease selling some services for devices made buy Huawei, which relies on Google’s Android software to run its smartphones.

Meanwhile, chances of further trade talks between the U.S. and China appeared to take a hit over the weekend, after CNBC reported that scheduling for the next round of negotiations is “in flux,” because neither side appears willing to agree to concessions that would further progress. The South China Morning Post also cited several China-based analysts who argued that China has little incentive to engage in further talks until U.S. negotiators show willingness to compromise.

What are strategists saying?

“Market volatility continues to stem from announcements and interpretations of what is going on in trade disputes between the US and its trading partners, but principally China,” wrote Jasper Lawler, head of research at London Capital Group, in a daily research note.

Which stocks are in focus?

Shares of Tesla Inc. TSLA, -7.58% were under pressure before the start of trade Monday, after analyst Dan Ives at Wedbush slashed his price target, citing “major concerns” about the trajectory of the electric car maker’s growth prospects. The stock was down 3.7% in premarket trade.

Dow component Intel Corp. INTC, -1.41% stock was down 2.1% in premarket trade, setting it up for the lowest open in five years.

Shares of Apple Inc. AAPL, -0.57% were also on track to be a drag on the Dow, down 2.8% before the bell, Monday.

Shares of money manager Legg Mason Inc. LM, -1.67% could be in focus after reports that it is nearing a settlement with Trian Fund Management LP that would give the activist investor 3 to 4 seats on the company’s board.

Shares of Blue Apron Holdings Inc. APRN, -0.89% were in focus after the meal-kit preparation company said Monday it is pursing plans for a reverse stock split.

Which data and Fed speakers are ahead?

A reading of the Federal Reserve’s National Activity Index is due at 8:30 a.m. Eastern Time.

Atlanta Federal Reserve Bank President Raphael Bostic is due to speak at the Annual Financial Markets Conference held by the Atlanta Federal Reserve Bank in Amelia Island, FL. at 8:50 a.m.

Philadelphia Federal Reserve Bank President Patrick Harker will speak at 9:30 a.m. at the 65th Anniversary Conference in Boston.

New York Federal Reserve Bank President John Williams and Federal Reserve Vice Chair Richard Clarida will both participate in the “Fed Listens” roundtable discussion on monetary policy strategy and tools at 1 p.m.

How are other markets trading?

Stocks in Asia closed mostly lower on Monday, with Hong Kong’s Hang Seng Index HSI, -0.57% falling 0.6%, while China’s Shanghai Composite Index SHCOMP, -0.41% and Shenzhen Composite index 399106, -0.75% both lost ground on the day. Japan’s Nikkei 225 NIK, +0.24% meanwhile rose 0.2%.

European stocks were also under pressure, with the Stoxx Europe 600 SXXP, -1.22% down 1.1%.

In commodities markets, the price of oil CLM19, -0.08% was on the rise, while gold GCM19, +0.13% was edging higher. The U.S. dollar DXY, -0.08% edged lower against its peers.

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.