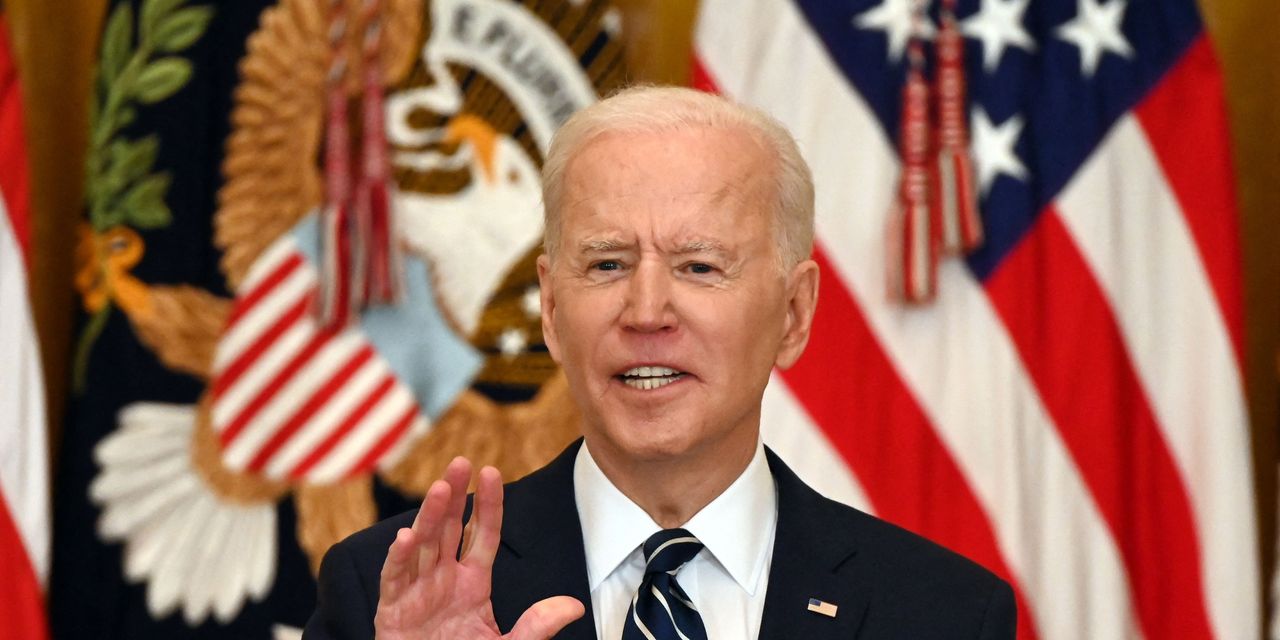

U.S. stock-index futures pointed to a mixed start for equities Wednesday, as investors awaited a speech from President Joe Biden outlining a multitrillion dollar infrastructure spending plan that’s expected to include higher taxes on corporations.

What are major indexes doing?

- Futures on the Dow Jones Industrial Average YM00, -0.07% fell 23 points, or 0.1%, to 32,902.

- S&P 500 futures ES00, +0.12% edged up 5 points, or 0.1%, to 3,953.

- Nasdaq-100 futures NQ00, +0.65% advanced 85 points, or 0.7%, to 12963.

On Tuesday, the Dow DJIA, -0.31% fell 104.41 points, or 0.3%, to close at 33,066.96, a day after eking out a record close. The S&P 500 SPX, -0.32% fell 0.3%, while the Nasdaq Composite COMP, edged down 0.1%.

What’s driving the market?

Biden is slated to unveil the first part of his “Build Back Better” plan in Pittsburgh later Wednesday that would detail $2 trillion or more in spending on infrastructure. It would be offset by raising the tax on corporate income from 21% back to 28% after being cut in 2017 from 35% to 21%.

Read: Here’s what’s in the White House infrastructure spending and corporate tax hike plan

News reports said the size of the plan could further rise to $4 trillion as additional parts are unveiled, offset by increases in tax rates on the wealthy and investors.

“We have always been of the opinion that markets never believed President Trump’s corporate tax cuts would be permanent. Raising them to the old levels would therefore not change our bullish outlook,” said Nicholas Colas, co-founder of DataTrek Research, in a note.

“Changes in individual tax rates, especially those related to capital gains, are another matter. Given the outstanding gains of the last few years, especially in speculative tech stocks, changes in cap gains would certainly cause taxable account selling with no near-term offset in demand,” he wrote.

The infrastructure plan comes less than a month after the passage of a $1.9 trillion package of COVID relief spending. The fiscal boosts have boosted inflation expectations, which have been cited as a cause of a bond-market selloff that has sent the yield on the 10-year Treasury note to its highest since January 2020. That’s put pressure on tech shares and other growth-oriented stocks.

Yields pulled back on Wednesday, however, with the 10-year Treasury rate TMUBMUSD10Y, 1.724% down 1.2 basis points at 1.721%.

In U.S. economic data Wednesday, payroll-processing company ADP showed private-sector payrolls jumped by 517,000 in March, in line with the 525,000 consensus forecast. It was the largest gain in six months. The government’s March jobs report, due Friday, is expected to show a surge in payrolls.

The Chicago purchasing managers index for March is due at 9:45 a.m., while a reading on pending home sales is set for release at 10 a.m.

Which companies are in focus?

- Shares of Walgreens Boots Alliance Inc. WBA, +0.25% were up than 2% in the premarket after the pharmacy chain reported fiscal second-quarter results and raised its outlook for fiscal 2021.

- Lululemon Athletica Inc. LULU, +0.29% said late Tuesday that its direct-to-consumer sales nearly doubled in the fourth quarter, making up half of its total sales as the retailer topped Wall Street expectations for the quarter. Shares were down 1.9% in premarket trade.

- Shares of Deliveroo, the U.K. food delivery company backed by Amazon.com Inc., AMZN, -0.66% slumped about 30% as it made its highly-anticipated stock market debut on the London Stock Exchange.

What are other assets doing?

- The ICE U.S. Dollar index DXY, -0.06%, a benchmark of the dollar’s value versus its major rivals, was flat at 93.28.

- The Stoxx Europe 600 index SXXP, +0.17% was up 0.2%, while the U.K.’s FTSE 100 UKX, -0.05% shed 0.1%. The Nikkei NIK closed up 0.9% lower, as did China’s CSI 300 index.

- The U.S. crude benchmark CL.1, +0.23% was trading 0.2% higher, near $60.66 a barrel on the New York Mercantile Exchange. Prices for gold futures GC00, -0.19% slipped 0.1% to trade near $1,684.90 an ounce.