U.S. stocks on Friday retreated from their highest levels since mid-February as investors digested strong big bank earnings, weak retail sales, and hawkish comments from a Federal Reserve official.

How are stocks trading?

- The Dow Jones Industrial Average DJIA, -0.74% shed almost 222 points, or 0.7%, to about 33,808.

- The S&P 500 SPX, -0.64% fell by 25 points, or 0.6%, to 4,121.

- Nasdaq Composite COMP, -0.91% dropped 113 points, or 0.9%, to 12,053.

For the week, Dow is on pace to rise 1%, while the S&P 500 is on track to gain 0.4% and the technology-heavy Nasdaq Composite is heading for a 0.3% decline, according to FactSet data, at last check.

What’s driving the market?

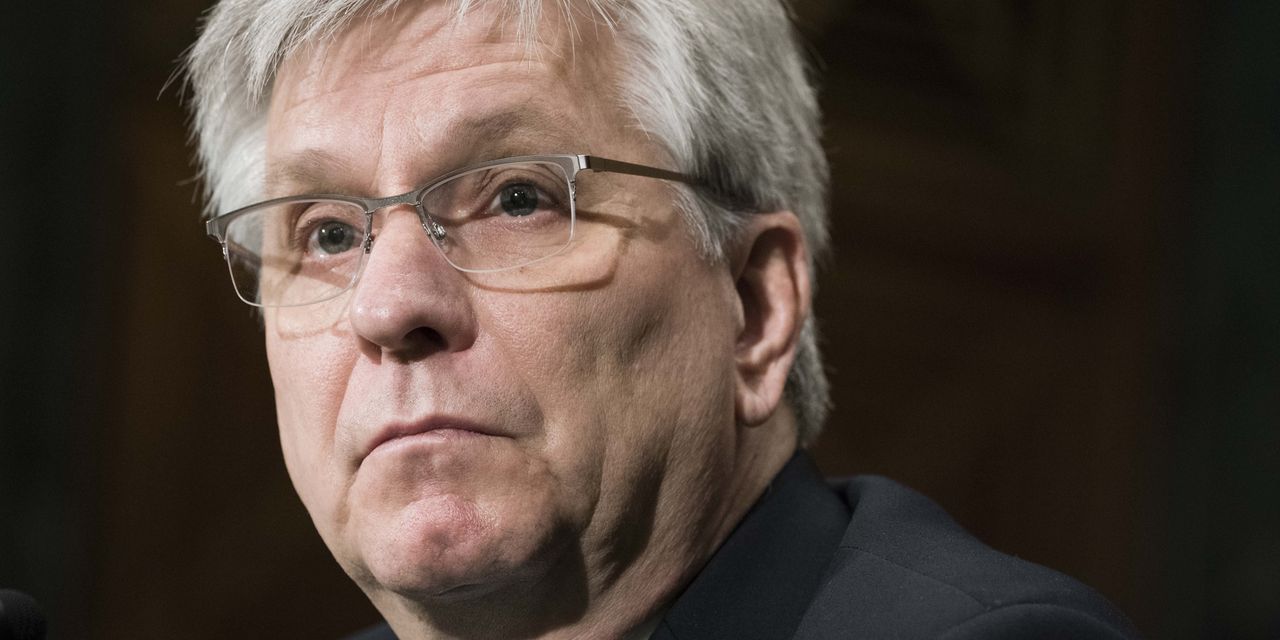

U.S. stocks were trading lower Friday afternoon as investors digested retail sales data showing spending deteriorated again last month as well as Federal Reserve Governor Christopher Waller’s remarks that the Fed needs to keep hiking interest rates because inflation is still much too high.

“Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further,” Waller said Friday during a speech in San Antonio, Texas.

Waller’s comments were “pretty hawkish,” said Jackie Rogowicz, an investment analyst at Penn Mutual Asset Management, in a phone interview. She said she’s expecting the Fed to raise its benchmark interest rate by a quarter percentage point in May, and at least at this stage, sees some potential for another rate hike in June.

Inflation data released earlier in the week showed a larger-than-expected slowdown in wholesale prices, while so-called core consumer-price inflation remained stubbornly high as it ticked higher to a rate of 5.6% year-over-year.

Read: This ETF designed to protect against inflation is attracting inflows as price pressures persist

Marvin Loh, senior global strategist at State Street, said Waller’s comments were a departure from the more dovish tone evinced by other senior Fed officials since the Fed’s March policy meeting.

“This is one of the more hawkish comments over the past week. A lot of the Fed speak has leaned toward ‘one and done’ in terms of rate hikes,” Loh said during a phone call with MarketWatch.

Investors also digested commentary Friday from Chicago Fed President Austan Goolsbee, who said the U.S. economy could slip into recession. His remarks echoed Fed staff concerns expressed in the central bank’s March meeting minutes released on Wednesday.

Meanwhile, fresh economic data on Friday showed sales at retailers, a critical component of consumer spending, dropped 1% in March, declining for the fourth time in the past five months. The decline was sharper than the contraction that economists polled by the Wall Street Journal had anticipated.

A popular consumer-sentiment survey released Friday showed respondents’ outlook has risen slightly to 63.5 in April, rebounding from a four-month low. However, it also reflected slightly higher anxiety about inflation.

While consumer spending hasn’t fallen off a cliff, it has continued to weaken from the elevated levels seen in the aftermath of the COVID-19 pandemic, economists said.

“The cumulative effect of historically high inflation, rising interest rates, and reduced access to credit is already taking a toll on consumers’ ability and willingness to spend,” said Lydia Boussour, senior economist at EY Parthenon, in emailed commentary. “And the full effect of recent banking-sector turmoil and the associated tightening in credit conditions has yet to be felt.”

The first bank earnings reports since regional banks including Silicon Valley Bank failed last month offered some optimism though. Shares of JPMorgan Chase & Co. JPM, +7.31%, the U.S.’s biggest bank, jumped after it reported earnings and revenue well above forecasts.

JPMorgan CEO Jamie Dimon said the U.S. economy looked “generally healthy,” but warned the coast was not completely clear. “However, the storm clouds that we have been monitoring for the past year remain on the horizon, and the banking industry turmoil adds to these risks,” he said.

Need to Know: Bank earnings season is here. This popular value fund just bought Kroger and a regional lender.

Wells Fargo & Co. WFC, +0.13% and Citigroup Inc. C, +5.01% also beat forecasts for profits and revenue, while Pittsburgh lender PNC Financial Services Group Inc. PNC, -1.79% reported higher earnings and deposits. BlackRock Inc. BLK, +2.75%, meanwhile, reported a decline in profit as assets under management fell 5%, although its shares traded higher.

Investors have been anxious to see how the banks would perform as analysts have been cutting earnings estimates for both large and regional banks in the wake of the crisis.

“So far it seems the numbers are coming in pretty good,” said State Street’s Loh. However, “we have to wait for more smaller lenders to start reporting” to get a better picture of how banks are doing in the wake of last month’s turmoil.

Companies in focus

- Outside the banking sector, shares of Boeing Co. BA, -6.28% dropped after the jet maker warned late Thursday that a manufacturing hangup could cause problems for production and delivery of “a significant number” of 737 Max planes.

- U.S.-listed shares of Curaleaf Holdings Inc. CURA, -7.46% fell following the decision by the New Jersey Cannabis Regulatory Commission to deny the renewal of the Massachusetts-based company’s cultivation and retail licenses for adult use.

- Shares of CXApp Inc. CXAI, +87.31% surged as the workplace experience platform appeared helped in part by the artificial intelligence craze.

- Shares of General Electric Co. GE, +0.86% rose after bullish UBS analyst Chris Snyder raised his price target by 15%. The company’s shares have surged this year thanks to a planned spin off.

—Barbara Kollmeyer contributed to this report.