Two weeks ago, investors cheered when Qualcomm Inc. and Apple Inc. settled their patent and royalty mega-feud just as a trial was starting.

On Wednesday, when Qualcomm QCOM, +0.28% reported its fiscal second-quarter results, those investors were reminded that the nice, big settlement from Apple AAPL, +4.91% isn’t going to change the chip company’s underlying issues with its core business. Qualcomm’s stock paid the price, falling 3.6% after hours. The shares are up nearly 52% year to date, compared with a 16.6% gain from the S&P 500 index SPX, -0.75% , with a big chunk of that run-up coming since the big settlement with Apple.

Qualcomm said Wednesday that it expects the Apple deal to contribute about $4.5 billion to $4.7 billion in revenue in the third quarter, but admitted that without that windfall, adjusted earnings are expected to be just 70 cents to 80 cents a share for the third quarter. So while the company’s patent and royalty licensing business is seeing a boost from the Apple deal, its core communications chip business is not getting any better.

“The core business is getting worse,” said Stacy Rasgon, a Bernstein Research analyst, adding that he had been estimating 88 cents a share for the third quarter without the Apple deal. “It’s getting offset by market weakness. The smartphone market sucks,” he said.

More from Therese: New Intel CEO rips the Band-Aid off

Qualcomm executives basically admitted that, with cautionary comments about market demand in a conference call Wednesday, while trying to color it as a brief “pause” in the market before 5G smartphones are released in volume.

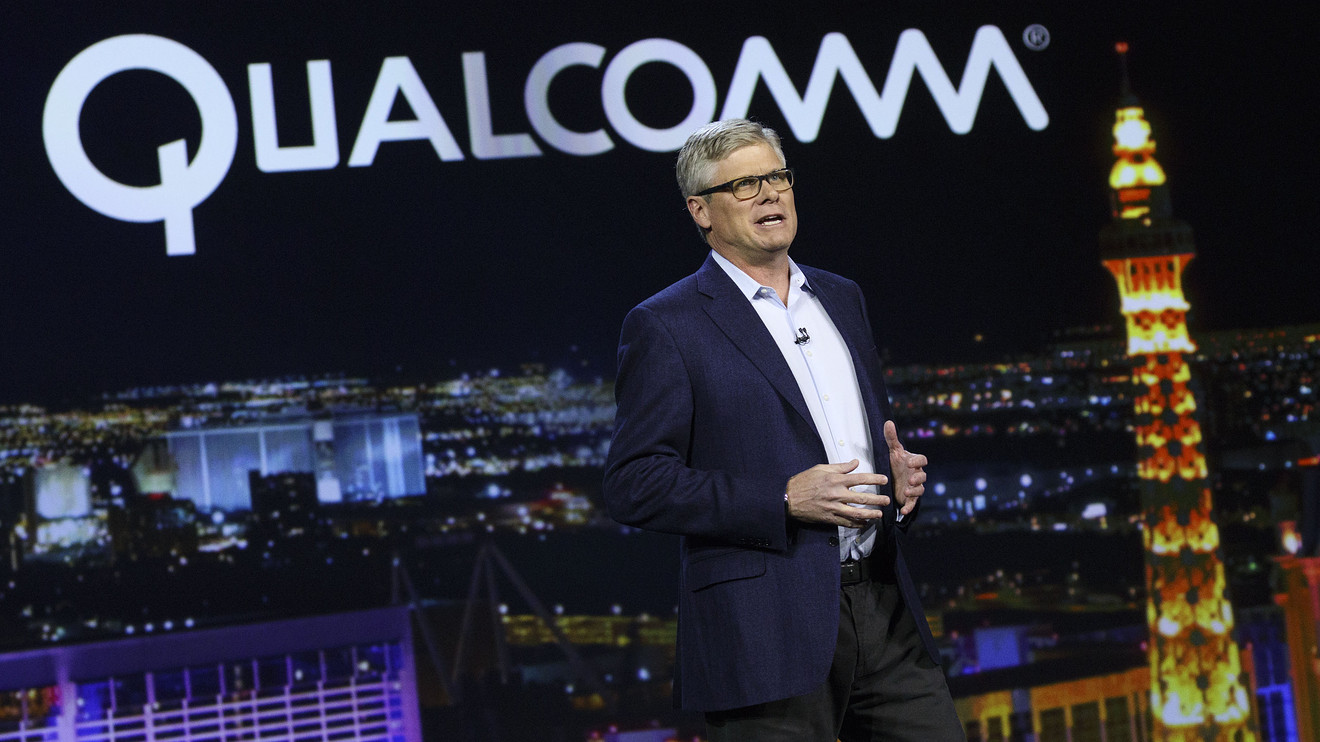

“The rest of the fiscal year will be impacted by a slower market for devices, particularly in China, upstream of the larger rollouts of 5G worldwide,” Qualcomm Chief Executive Steven Mollenkopf said in his opening comments.

Later in the call, Chief Financial Officer David Wise lowered Qualcomm’s estimate for calendar 2019 communications-chip shipments by 50 million units “due to continued weakness in China and a lengthening of handset replacement cycle, potentially reflecting a pause in advance of 5G rollouts.”

See also: AMD optimism reigns despite ‘ho-hum’ earnings

Investors were also reminded of Qualcomm’s other outstanding legal issues — General Counsel Donald Rosenberg blithely referred to it as getting back to the “normal litigation cadence.” The company is still waiting for a ruling on a Federal Trade Commission case, in which the FTC has alleged that Qualcomm has a monopoly in the cellphone industry, and is seeking a resolution in a dispute with Huawei over royalty payments of its intellectual property.

There was euphoria that the Apple cloud is no longer hanging over Qualcomm. Now that party is over, and investors have to deal with the hangover that is Qualcomm’s core business.

Want this type of analysis sent to your inbox? Subscribe to MarketWatch’s free MarketWatch First Takes newsletter. Sign up here.