Nvidia Corp. has completely escaped the crypto hangover. The question now is what happens on the other side.

Nvidia projected Thursday that revenue will begin growing again in the current period, after four consecutive quarters of year-over-year declines, but that is mostly because the quarter a year ago was intensely withered by a sudden decline in crypto-mining sales. The revenue forecast called for sales to drop sequentially, was lower than analyst estimates heading into the report, and is well off the highs that Nvidia hit before the downturn began at the end of last year.

Investors certainly seemed to be hoping for more, after sending Nvidia shares up nearly 40% in the past three months on expectations that the high-growth AI powerhouse of early 2018 was set to return. The stock sank more than 1% in after-hours trading Thursday.

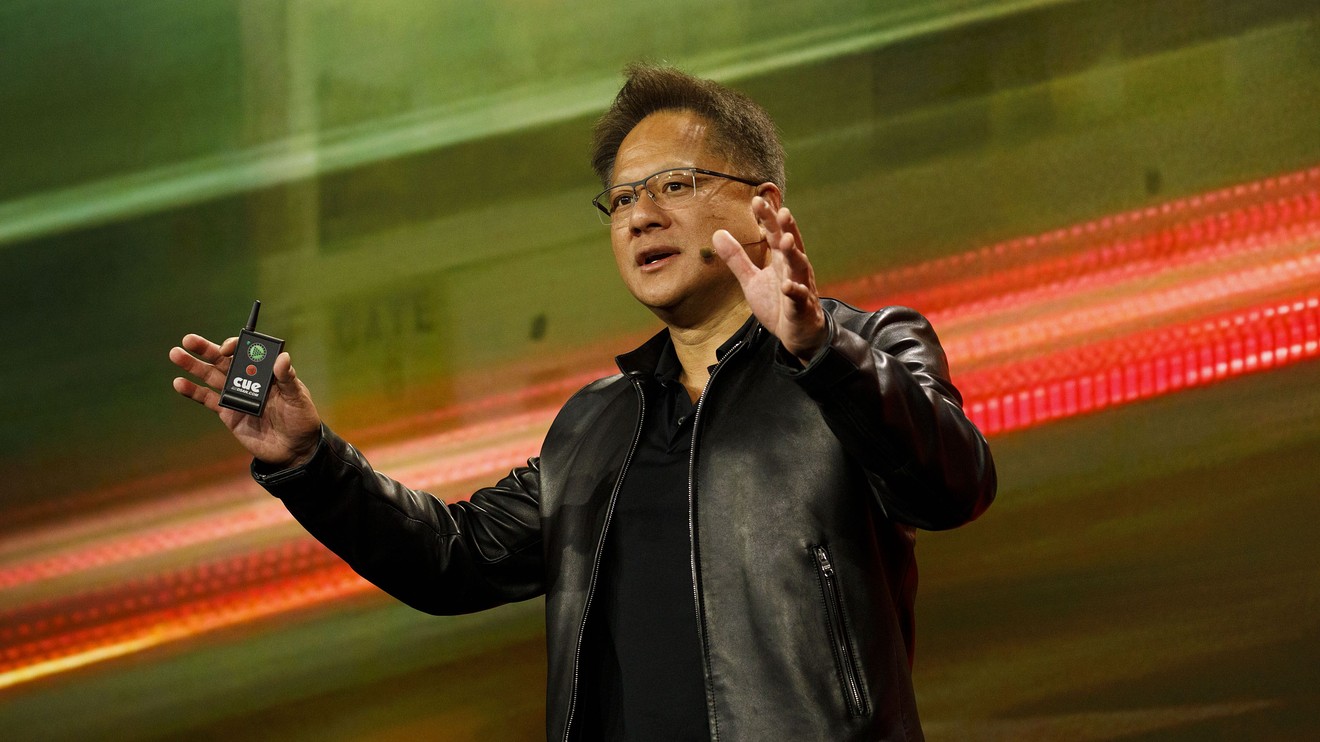

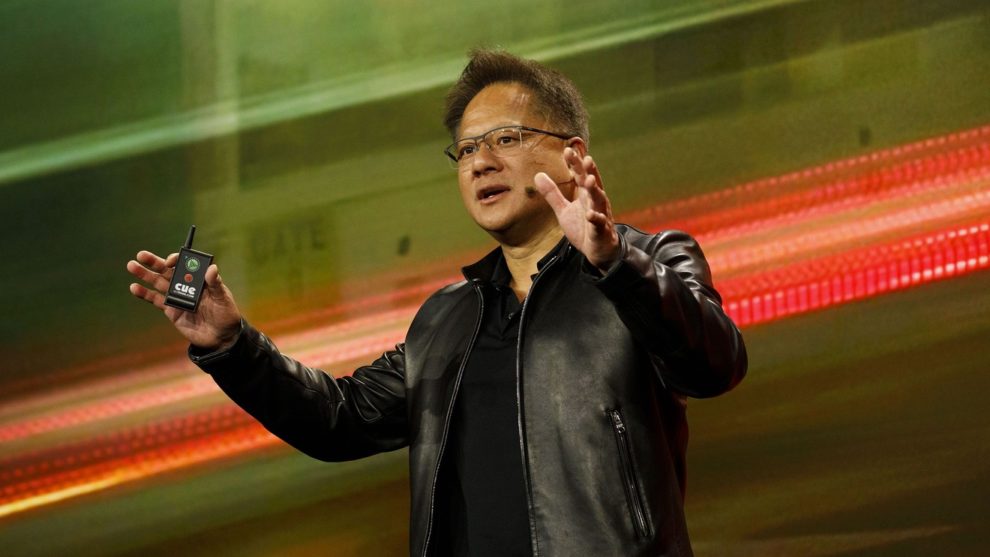

Chief Executive Jensen Huang sounded unconcerned and confident, though, in a brief interview with MarketWatch on Thursday afternoon. When asked what could lead to a reinvigoration of Nvidia’s revenue growth, Huang stuck to the two talking points that have been his mantra during the past year of financial struggles for the company he co-founded: Ray-tracing and artificial intelligence.

Ray-tracing refers to the new capabilities of Nvidia’s videogame technology, but it will be hard for Nvidia to turn that edge into huge revenue gains because it already owns so much of the market for gaming chips. The opportunity for Nvidia to still find large revenue gains rests on AI, specifically advanced data-center sales and autonomous driving.

“It’s hard to exactly say how big the AI semiconductor business is, but my guess is it’s tens of billions of dollars,” Huang said in a telephone chat following Nvidia’s conference call.

Full earnings coverage: Nvidia earnings point to end of a year of revenue declines

Data-center sales showed the strongest sequential growth since April 2018 in Thursday’s report, and Huang said one reason was a doubling of sales for inference. Building and using deep-learning algorithms requires two stages, training and inference, with training referring to developing the algorithm and inference meaning actual use of the results. Nvidia’s specialty has long been training, but it has been trying to find a business in inference as well, which isn’t easy when there are so few large customers for that type of technology.

“The number of very large inference customers in the world is probably 10,” Hunag admitted. “It’s not a handful, but its a couple of handfuls.”

Nvidia will need to nail down those customers and keep them buying, along with much more, to get its data-center business back to the reliable revenue growth it was experiencing before the downturn. Chief Financial Officer Colette Kress said Nvidia had “expectations for strong sequential growth in data center” for the fourth quarter.

Still, Nvidia is likely to run into the problem of expectations potentially running ahead of the results. Even before reporting strong growth in the third quarter and predicting more of the same, analysts were modeling fourth-quarter data-center revenue of $840 million, which would be a quarterly record for Nvidia’s data-center segment and require sequential growth to jump from less than 11% to nearly 16%.

See also: The big worries facing stock investors in 2020, according to Citi’s top equity strategist

Nvidia’s automotive business is still more fantasy than reality at this point. Revenue declined sequentially and failed to top $200 million for the quarter, and Kress admitted that the legacy business of providing chips for infotainment centers within cars is half or more of that total. Huang spoke the truth when he said in the conference call that automotive companies “have slipped [timelines for autonomous vehicles] out a couple of years or so,” which pushes Nvidia’s opportunity for big returns out as well.

In short, Nvidia is back to where it was before the sudden downfall a year ago: Hoping to maintain its position in videogames and eventually find huge growth in chips for servers and autonomous cars. After suffering through the past year, investors will still have to wait to see exactly when “eventually” arrives, and likely temper their expectations.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment