Zillow Group had a wealth of data, access to millions of dollars in capital and executives with the hubris to believe they could use these tools to outsmart both a volatile housing market and startups specializing in buying and selling houses.

They failed, and lost more than half a billion dollars in the process.

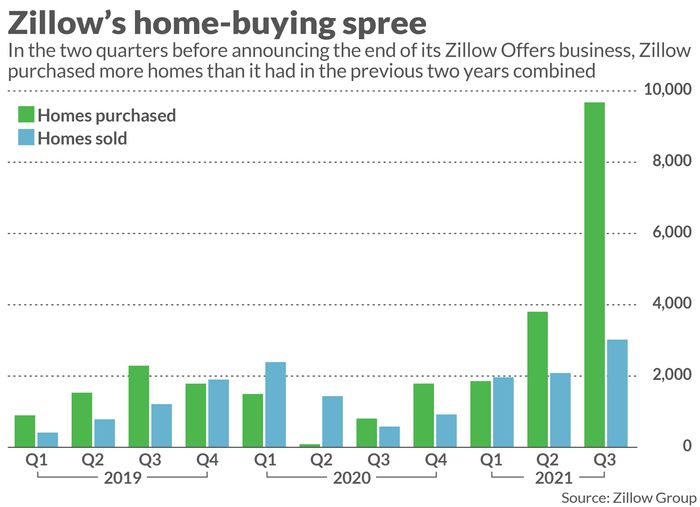

Zillow Z, -22.49% ZG, -21.54% said it will permanently exit the so-called iBuying business Tuesday, after going on an unprecedented home-buying spree that saw the internet-based real-estate-services company buy more than 14,000 homes in just six months. Only after that spree did Zillow executives realize that they had overspent, and were sitting on massive losses in the months to come.

The result is more than $550 million in combined losses for the third and fourth quarters, and the dissolution of a business that had been rapidly growing — the layoffs will pare 25% of Zillow’s entire staff. The board decided to kill the nearly four-year-old Zillow Offers business Tuesday, and sent its co-founder and chief executive out to swing the axe.

“Our aim was to become a market-maker, not a market risk-taker, and this was underpinned by the need to forecast the price of homes accurately three to six months in the future,” Zillow CEO Rich Barton said in a conference call Tuesday.

The algorithm that Zillow used to forecast the prices of homes in the future — in a real-estate market that has been volatile amid the pandemic — proved to be problematic. Bloomberg recently reported that Zillow tweaked its algorithms to make higher offers as the real-estate market continued to heat up, but that move proved to be fatal.

Barton described the real-estate market as initially frozen during the pandemic, and then shifting into a supply-demand problem, which led to big price swings. The company said it experienced “higher conversion rates than previously observed in Zillow Offers as a result of unintentionally purchasing homes at higher prices than our current estimates of future selling prices,” resulting in a $304 million write-down in the third quarter.

“Our observed error rate has been far more volatile than we ever expected possible and makes us look far more like a leveraged housing trader than the market-maker we set out to be,” he said.

These comments sound a lot less like problems in the real-estate market, however, and more of an issue with Zillow’s algorithms, and/or those running the company.

“My sense is that this is a Zillow problem,” Jason S. Helfstein, head of internet research at Oppenheimer & Co., bluntly said in an email to MarketWatch.

Some rivals sought to capitalize on Zillow’s woes, with Opendoor Technologies Inc. OPEN, +1.63% tweeting that it is open for business.

“We have demonstrated strong growth and unit economics, and we are energized to help homeowners nationwide move with simplicity, certainty and speed,” the company said, sounding confident ahead of its own earnings on Nov. 10, the same day as rival Offerpad Solutions Inc. OPAD, -4.12%.

Redfin Inc. RDFN, -2.32% told MarketWatch in a statement that it remains committed to iBuying, while avoiding saying much ahead of its earnings on Thursday afternoon. Redfin also noted that while competition is always fierce — with Opendoor’s offers being especially aggressive in 2021 — its biggest issue has been hiring labor to renovate homes.

Investors will continue to watch the market in the coming days to see if Zillow’s move is a precursor to more bad news in the real-estate market and at other iBuyers. But the Zillow news is also a cautionary tale about too much adherence to algorithms. Facebook FB, +0.14% is already under attack for its algorithms that prefer posts that goad users and stir up emotional reactions, while Zillow’s algorithms appear to be behind decisions that cost hundreds of millions of dollars and more than a thousand jobs.

But people write and control those algorithms, and one of the two components of that formula got way too confident this year. If the current volatility in the real-estate market leads other iBuyers with similar algorithms — and possibly even less data than Zillow — into more “black swan events,” as Barton described the situation, investors can blame the humans in charge.

MarketWatch reporter Jacob Passy contributed to this report.

Add Comment