(Bloomberg Opinion) — It looks like SoftBank Group Corp.’s Masayoshi Son may be struggling to start his next epic journey.

A month after announcing an eclectic mix of investors for its Vision Fund 2, SoftBank is leaning on its own employees for cash, planning to lend them as much as much as $20 billion to buy stakes in the venture-capital vehicle, the Wall Street Journal reported at the weekend. The report adds to signs of possible funding gaps in the $108 billion cash pile Son is targeting. SoftBank itself is already putting in $38 billion.

Add the potential contribution from employees, and we’re looking at 54% of the money coming from directly inside the SoftBank family. Son may account for $15 billion of that $20 billion target, the Journal reported. SoftBank is looking to charge staff interest of around 5% and in most cases will require little money down, the newspaper said. That hints at desperation.

Encouraging, or even enabling, workers to own stock in their employer isn’t so unusual. Companies do that often, and it’s common practice within the hedge fund industry. There’s an argument to be made for allowing employees to have skin in the game, which then aligns corporate and employee incentives.

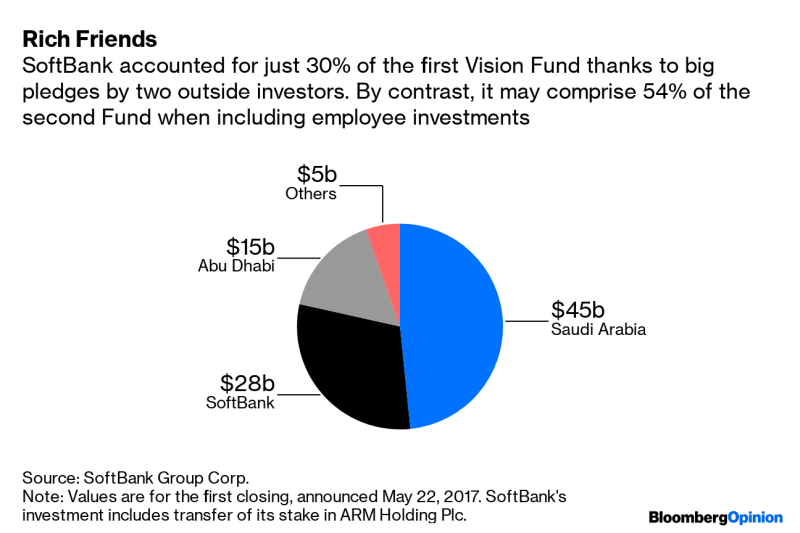

Yet this doesn’t feel like a simple case of share and share alike. When SoftBank announced the size of Vision Fund 2 on July 27 and listed some of its participants, the lack of an external cornerstone investor stood out. That’s in stark contrast to news of the first Vision Fund back in October 2016. While both press releases spoke of memorandums of understanding, rather than signed pledges, the first incarnation had a clear lead investor – Saudi Arabia’s Public Investment Fund – and a specific figure: $45 billion.

The 2016 statement even had a quote from Saudi Crown Prince Mohammed bin Salman, who’s the chairman of PIF. (This connection now casts a dark shadow over the Vision Fund given Saudi links to the murder of journalist Jamal Khashoggi.) The original Vision Fund later grabbed another $15 billion from Abu Dhabi’s Mubadala Investment Co.

So far, however, there’s no big outside name behind the second fund. With the news of loans to employees, it looks like SoftBank itself will take on the cornerstone role. No corporate is likely to pledge more and the only sovereign the July announcement mentioned was Kazakhstan. Beyond that one nation, the investors appear to fall into two categories – industry buddies such as Apple Inc., Microsoft Corp. and long-time friend Foxconn Technology Group – and a collection of Japanese banks. It’s telling that not one of these was quoted or had a dollar amount put against their name.

Having two big outside backers and a slew of unicorns to pick from made raising the first fund relatively easy, as I noted previously. The lack of those rich uncles and the slowing pace of unicorn births mean Fund 2 doesn’t look quite as compelling.

In the end, SoftBank will probably scrape together the money it needs by casting a wider net and calling in favors. The company will use plenty of FOMO (fear of missing out) to try to convince fence-sitters to pull out the checkbook. But when it does get there, I suspect few investors will big as enthused about Son’s latest big adventure as they were for the first.

To contact the author of this story: Tim Culpan at [email protected]

To contact the editor responsible for this story: Matthew Brooker at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology. He previously covered technology for Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”32″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.