For the first time in two years, McDonald’s quarterly earnings fell short of estimates as its promotions struggled to lure U.S. customers away from the competition.

Shares of the company fell 4% in morning trading. McDonald’s stock, which has a market value of $156 billion, is up 14% so far this year. But those gains trail the stock of Burger King’s parent company Restaurant Brands International, which has gained 31% so far in 2019, giving it a market value of $31 billion. Shares of Wendy’s, valued at $5 billion, are up 38% in the same time period.

Here’s what the company reported compared with what Wall Street was expecting, based on a survey of analysts by Refinitiv:

- Earnings per share: $2.11 vs. $2.21 expected

- Revenue: $5.4 billion vs. $5.5 billion expected

- Global same-store sales: 5.9% vs. 5.6% expected

McDonald’s U.S. business, which accounts for more than a third of the company’s total revenue, stumbled after ending one of its nationwide limited-time value deals, the 2 for $5 Mix and Match promotion. In the first half of the year, the Chicago-based company pointed to the promotion as a key sales driver.

The burger chain unveiled another promotion — buy one, get one for $1— for core menu items like Big Macs and Filet-O-Fish in mid-August. The deal tends to be pricier than the 2 for $5 promotion, according to SunTrust analyst Jake Bartlett.

In September, the last month of the quarter, the fast-food giant introduced a line of spicy barbecue chicken products, but the company did not refer to the menu addition as a significant reason for sales growth in its home market.

.1571751560678.png)

Instead, McDonald’s pointed to menu price increases, national and local promotions, and tech-focused upgrades to stores drove domestic same-store sales growth. Price hikes contributed about a third of the same-store sales growth. The company has been renovating U.S. stores with features that usually encourage customers to spend more, like self-order kiosks and digital menu boards.

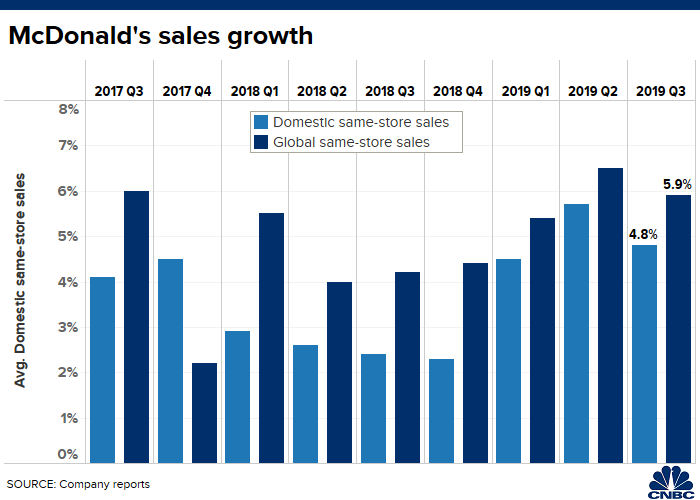

The company said U.S. same-store sales grew by 4.8% during the quarter, falling short of Wall Street’s estimates of 5.2%. Notably, traffic to U.S. locations continued to decline.

“It’s still negative. As I mentioned, it’s still our largest opportunity, but not a meaningful change in trend in the third quarter versus second quarter,” CFO Kevin Ozan told analysts on the conference call.

McDonald’s competition has been generating more buzz when it comes to menu additions. With some help from social media, Popeyes Louisiana Kitchen, which is owned by Restaurant Brands International, sold out of its chicken sandwich in less than a month after its launch this summer. Wendy’s brought back its popular spicy nuggets. As a result, Ozan said that McDonald’s lost some chicken market share, although it continued to gain back burger market share.

Burger King has also been stealing some spotlight from McDonald’s with the nationwide launch of its plant-based Impossible Whopper. In September, McDonald’s announced plans to test a burger made with a Beyond Meat patty in select restaurants in Ontario, Canada.

“I would say there was certainly some competitive pressure in mid-August probably through mid-September,” Ozan said.

Still, Ozan said that U.S. locations performed similarly during all three months of the quarter.

McDonald’s breakfast, which has seen its sales growth falter, returned to growing at the same pace as the rest of the day. Next year, it will face more competition when Wendy’s launches its own breakfast menu nationwide. The rival burger chain is planning a big advertising push and expects breakfast to become 10% of its daily sales relatively quickly.

“Having another entrance in next year will ensure that the market share fight remains as competitive as ever,” McDonald’s CEO Steve Easterbrook said.

The fast-food giant reported fiscal third-quarter net income of $1.6 billion, or $2.11 per share, unchanged from $1.6 billion, or $2.10 per share, a year earlier. Analysts surveyed by Refinitiv were expecting earnings per share of $2.21. The strength of the U.S. dollar negatively affected McDonald’s earnings per share by three cents, Ozan said.

Net sales rose 1% to $5.4 billion, narrowly missing expectations of $5.5 billion. The company reported global same-store sales growth of 5.9%, thanks to strong performance in its international markets.

As McDonald’s aims to hit $4 billion in global delivery sales this year, the fast-food chain has been expanding its delivery program. The company now has delivery partnerships with UberEats, DoorDash and GrubHub. McDonald’s delivery is popular with its overseas customers.

The company’s international operated segment, which includes top markets like Germany and France, reported same-store sales growth of 5.6% during the quarter, in line with Wall Street’s estimates. That business makes up more than half of the chain’s total sales.

Restaurants in McDonald’s smaller international licensed segment, which includes Brazil, China and South Korea, saw same-store sales growth of 8.1%.

Read McDonald’s full release here.

Add Comment