Media giants have a message for Wall Street after a tough 2022: Expect better days ahead.

Two big names, Comcast (CMCSA) and Disney (DIS), have said that losses in the streaming business are at a peak or reaching one this year. And Paramount Global (PARA) says investment in its streaming service Paramount+ is at a high — meaning that investors can expect it will spend less in the future.

All of that could bode well for profitability, which is increasingly a focus for investors. The stock market wiped a whopping $500 billion-plus in market capitalization from the world’s biggest media, cable, and entertainment giants in 2022. Meantime, interest rates have gone up, making borrowing more expensive.

“As we now painfully know, money is no longer cheap,” MoffettNathanson analyst Robert Fishman said in a recent note. “Wall Street’s attitude towards streaming has now largely reversed course as more skeptics raise the question of whether streaming is a good business (a question we have long been asking). In turn, companies are no longer willing to spend whatever it takes, in part because attitudes and strategies have shifted and rationalized, but also because their balance sheets no longer have what it takes.”

‘Peak losses’ in sight?

Comcast’s fledgling streaming service Peacock saw its operating loss increase 47% to $2.5 billion in 2022 from the prior year, the company revealed in its latest earnings report.

Comcast president Michael Cavanagh told investors on the earnings call in January, “We believe 2023 will be peak losses for Peacock and from there, steadily improve.” He estimated losses will total about $3 billion this year.

“We spend quite a bit of money creating content so migrating some of that content as eyeballs move to a more streaming universe — we like what we’re doing,” Cavanagh said. “We think Peacock is absolutely the right strategy for our company.”

Meanwhile, Disney’s direct-to-consumer division shed a whopping $4 billion-plus in its fiscal 2022 ended on Oct. 1, after it spent an estimated $33 billion on content last year. On the company’s earnings call in November, Disney’s CFO Christine McCarthy said that “peak losses are now behind us.”

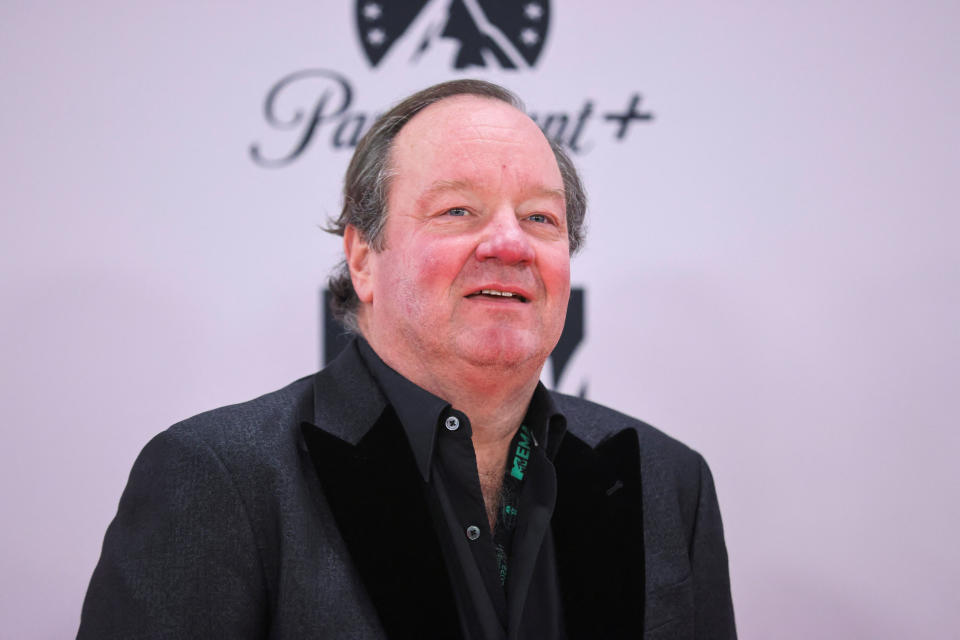

Other companies have emphasized that they are cutting costs. Paramount Global (PARA) CEO Bob Bakish said in February that “we are at peak investment in 2023” in Paramount+.

Paramount reported a direct-to-consumer loss of roughly $1.82 billion in 2022 — slightly above previous guidance of $1.8 billion.

And Warner Bros. Discovery (WBD), which has dealt with a slew of merger-induced challenges, reported a direct-to-consumer loss of $217 million in the fourth quarter — a $511 million improvement over last year. CEO David Zaslav told investors during the company’s Q4 earnings call, “The bulk of our restructuring is behind us. …We are one company now.”

The embattled media giant also announced it will be raising its $3.5 billion cost-savings target to $4 billion over the next two years.

Strategy shifts & restructuring plays

Expectations that streaming losses will ease come amid a backdrop of cost-cutting in the industry.

As media executives look to pare losses and cut down on costs, many have committed to sizable restructuring efforts — like Disney, which reorganized the business into three separate units and recently began the process of laying off 7,000 workers in an effort to slash $5.5 billion in costs.

In his prepared remarks during the company’s first quarter earnings report on Feb. 8, Disney CEO Bob Iger said the new strategic organization, “will result in a more cost-effective coordinated and streamlined approach to our operations, and we are committed to running our businesses more efficiently, especially in a challenging economic environment.”

Iger has also hinted Hulu could be on the chopping block as the deadline approaches for Disney to buy out Comcast’s 33% stake in the streaming business.

“I’ve talked about general entertainment being undifferentiated. I’m not going to speculate if we’re a buyer or a seller of it,” Iger said during an interview with CNBC last month. “But I’m concerned about undifferentiated general entertainment. We’re going to look at it very objectively.”

Paramount has also taken steps to restructure its business, unveiling a reorganization that combines Showtime with MTV Entertainment Studios. The move comes after the company announced it will be merging its Paramount+ and Showtime streaming services into one offering dubbed “Paramount+ with Showtime.”

As a result, Paramount said it will take a content impairment charge between $1.3 billion to $1.5 billion in the first quarter of 2023, but expects $700 million in future annual savings.

More price hikes, revenue initiatives

Price hikes and other profitability measures, such as ad-supported tiers and password-sharing crackdowns, have also emerged as top priorities for 2023.

Disney’s Iger admitted the company was “off” on pricing for its Disney+ streaming service, suggesting there’s room to raise prices after it debuted an ad-supported offering late last year. Current Disney+ pricing stands at $7.99 for the ad tier and $10.99 for the ad-free version.

Paramount, meanwhile, said price hikes will come later this year in an effort to stem losses. The new monthly price for the premium Paramount+/Showtime tier will jump to $11.99 — up from $9.99. The essential Paramount+ tier with ads will rise by just $1 to $5.99.

“Paramount+ is far from the industry price leader,” CEO Bakish said on the earnings call. “We’re on the value end of the pricing spectrum.”

Although Netflix (NFLX) has not yet raised prices this year, the streamer has committed to a sweeping password sharing crackdown even as intense backlash from users builds.

So far, the streamer has broadened the crackdown to include countries like Canada, New Zealand, Portugal, and Spain, in addition to the test countries like Chile, Costa Rica, and Peru. So far, there has been no announcement regarding U.S. users.

Netflix has also leaned on differentiated content like live comedy specials, in addition to advertising.

According to Bloomberg, Netflix’s ad-supported service reached roughly 1 million monthly active users in the U.S. after its second month on the market—bucking earlier reports the ad tier was off to a slow start.

Alexandra is a Senior Reporter at Yahoo Finance. Follow her on Twitter @alliecanal8193 and email her at [email protected]

Click here for the latest trending stock tickers of the Yahoo Finance platform

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube