In this piece, I evaluated two e-commerce stocks, MercadoLibre (MELI) and Amazon (AMZN), using TipRanks’ Comparison Tool to see which is better. A closer look suggests long-term bullish views of both.

While both companies are online retailers, MercadoLibre is based in Argentina and serves Latin America, providing solutions for buying, selling, paying and collecting, generating leads, and comparing lists via e-commerce transactions. The company operates in 18 countries.

Meanwhile, U.S.-based Amazon ships to customers in over 100 countries and regions and provides a web platform called Amazon Web Services (AWS), which provides computing, storage, database, and other web services.

Shares of MercadoLibre are up 3.5% year-to-date and 32% over the last 12 months, while Amazon stock has jumped 21% year-to-date and gained 35% over the last year.

With such a different year-to-date performance that has Amazon outperforming MercadoLibre stock, it may come as a surprise that Amazon is the one trading at a discount to its Latin American counterpart. We’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other.

While both companies are profitable, the broader online retail industry is not, so an industry comparison of P/E is unhelpful. However, the industry is trading at a price-to-sales (P/S) ratio of 3.9x, slightly higher than its three-year average of 3.1x.

MercadoLibre (NASDAQ:MELI)

At a P/E of 74.9x and a P/S of 5.6x, MercadoLibre is trading at a premium to Amazon and the online retail industry. However, on a forward basis, the company’s value improves to a P/E of 45.8x. Thus, a bullish view seems appropriate.

The company has been putting up some tremendous revenue growth, with sales rising 36% year-over-year in the latest quarter to $4.3 billion. Net income rose 76% on a comparable basis on the back of “outstanding results” in Mexico and Brazil, which offset below-inflation growth in its home market of Argentina.

Gross merchandise volume rose 30% in both Mexico and Brazil year-over-year on a currency-neutral basis. Meanwhile, assets under management increased 90% year-over-year while user count was three times higher year-over-year in Mexico, two times higher in Argentina, and double in Brazil. MercadoLibre’s credit portfolio also grew 46% year-over-year to $4.4 billion, driven by the strong adoption and performance of its credit card offerings.

All of these trends are truly excellent, as is the company’s long-term share-price growth. MercadoLibre stock is up 167% over the last five years and 1,791% over the last 10, making it one to consider buying and holding for the long term. With the company’s stock starting to slow, this is beginning to look like the early stages of an attractive buy-the-dip opportunity.

What Is the Price Target for MELI Stock?

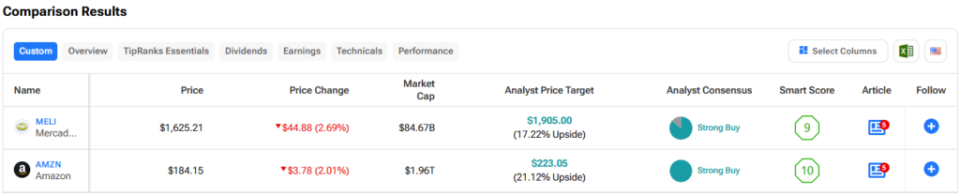

MercadoLibre has a Strong Buy consensus rating based on 12 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $1,905, the average MercadoLibre stock price target implies upside potential of 17.4%.

Amazon (NASDAQ:AMZN)

At a P/E of 52.8x and a P/S of 3.3x, Amazon’s valuation looks attractive, especially considering that it’s trading at the lower end of its valuation range since at least 2019. Thus, a bullish view seems appropriate for the long term.

On a P/E basis, Amazon is trading toward the lower end of its usual range of about 50x to 110x during its profitable periods over the last five years, making it too cheap to ignore. The company continues to rake in the money, although its growth is decelerating because it’s coming on top of a larger and larger base.

In the latest quarter, Amazon’s revenue rose 12.5% to $143.3 billion, while its net income surged 228.9% to $10.4 billion. The company continues to post thin margins, but its net profit margin nearly tripled to 7.28% in the latest quarter.

Finally, Amazon’s per-share price growth makes it look like one to buy and keep in a portfolio for as long as possible. The stock is up 91% over the last five years and 942% over the last decade. While that’s nowhere near as high as MercadoLibre’s share-price growth because the company is priced as a growth stock, Amazon’s long-term share-price increase should not be ignored, especially at its current valuation.

What Is the Price Target for AMZN Stock?

Amazon has a Strong Buy consensus rating based on 44 Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $223.05, the average Amazon stock price target implies upside potential of 21.2%.

Conclusion: Bullish on MELI and AMZN

E-commerce has long been a popular space on Wall Street, and that’s unlikely to change anytime soon, as industry growth seems virtually endless based on Amazon’s results. Importantly, MercadoLibre is priced like a growth stock, while Amazon is slipping into value territory.

However, Amazon is unlikely to fall out of favor in the near term, making it one to buy and hold, in my view. Similarly, MercadoLibre is putting up impressive growth that should keep it a Wall Street darling for quite some time.