Social media powerhouse Meta Platforms (NASDAQ: FB) —the parent company of Facebook, Instagram, Whatsapp, and digital wallet Novi — has been embroiled in controversies in 2021. The privacy violation issues have put tremendous pressure on the company to provide more transparency to its platforms. However, these issues did not stop the FB stock from appreciating 15.15% in the past year.

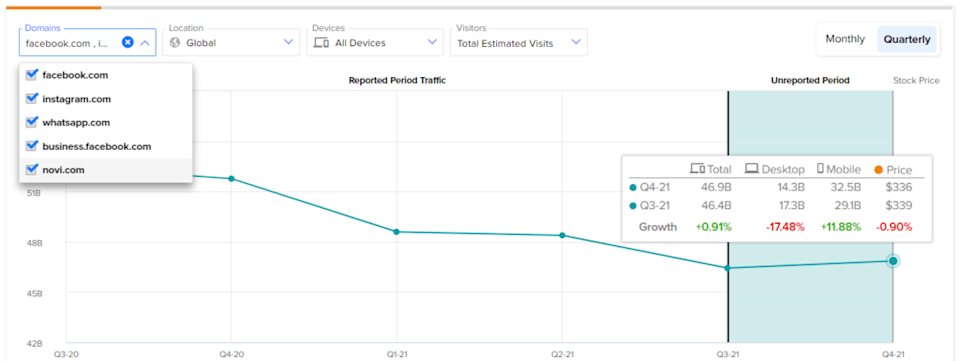

These controversies seemed to have affected user engagement on the platform, according to what we found using TipRanks’ new tool. The tool, which analyzes how many users have visited a company’s website, showed us that Meta Platforms witnessed persistent declines in website visits across all reported periods since 4Q20.

Being a social media company, the more the visits to its website means the more the potential revenue per user (average revenue per user, or ARPU, is an important top-line metric for Meta). Ahead of its earnings release on February 2, a decline in website visits cannot be good news for a social media company like Meta.

However, Q4 seemed to have given the company some hope. The final quarter saw an uptrend in total estimated visits to all the sites operating under Meta, combined. More precisely, users visiting the websites under Meta grew 0.91% from the previous quarter (3Q21). This growth has most likely translated into more revenues for the company in the quarter under review.

New research by app intelligence firm Sensor Tower found that in 4Q21, Instagram was the most downloaded app globally, whereas Facebook and WhatsApp grabbed the third and fourth spots respectively. This also supplements our findings from the tool we talked about earlier.

Some Dampers to User Footfall Stats

We dug deeper and found that despite being one of the most downloaded apps of Q4, user visits to Meta’s messaging app WhatsApp were down by 11.67% from the third quarter. This statistic is firmed up by the fact that many devices operating on Android and iOS stopped supporting WhatsApp during the course of the fourth quarter. This no doubt must have limited the monetizing opportunities for Meta.

Additionally, the year-over-year comparison also makes us a little cautious. There has been a 9.49% decline in website visits to all of Meta’s websites combined, to 46.9 billion worldwide. That might have, to some extent, affected the year-over-year ARPU comparison.

Top-Line Prospects by Region

Gripped by the insights that the tool empowered us with, we went further into the regional statistics to learn more. Geographically, we saw that in December, while 27.5% of monthly users visiting Facebook, Instagram, and WhatsApp combined came from the United States, monthly users from India took the second spot, having contributed to 9% of the total estimated visits to the three Meta families.

Meanwhile, only 2.3% of total estimated monthly visits came from Canada, and 3.6% came from the United Kingdom. This means that the higher ARPU regions, apart from the U.S., contributed less to the top line than the lower ARPU region of India. This may have dampened Meta’s revenue-generating potential in Q4.

Fun Fact

All things said, there is an important revenue-driving prospect to these statistics. The family daily active users (DAU), or the number of logged-in users visiting at least one of the Family products —Meta, Instagram, Messenger, and WhatsApp— in a day, has been increasing consistently for the past decade.

There is no indication of any drastic development that could have hampered this momentum, making us look at another quarter of DAU growth both year-over-year and quarter-over-quarter. This can have a significant positive impact on the top-line for the quarter.

Experts’ Opinions

Evercore ISI analyst Mark Mahaney reiterated a Buy rating on Meta with a price target of $430.

The rest of Wall Street is strongly optimistic about Meta, with a Strong Buy based on 12 Buys and 1 Hold. The FB price target is $406.54 on average.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure