Gold futures edged higher Tuesday, extending a bounce from a three-month low as the U.S. dollar backed off from a nearly two-decade high.

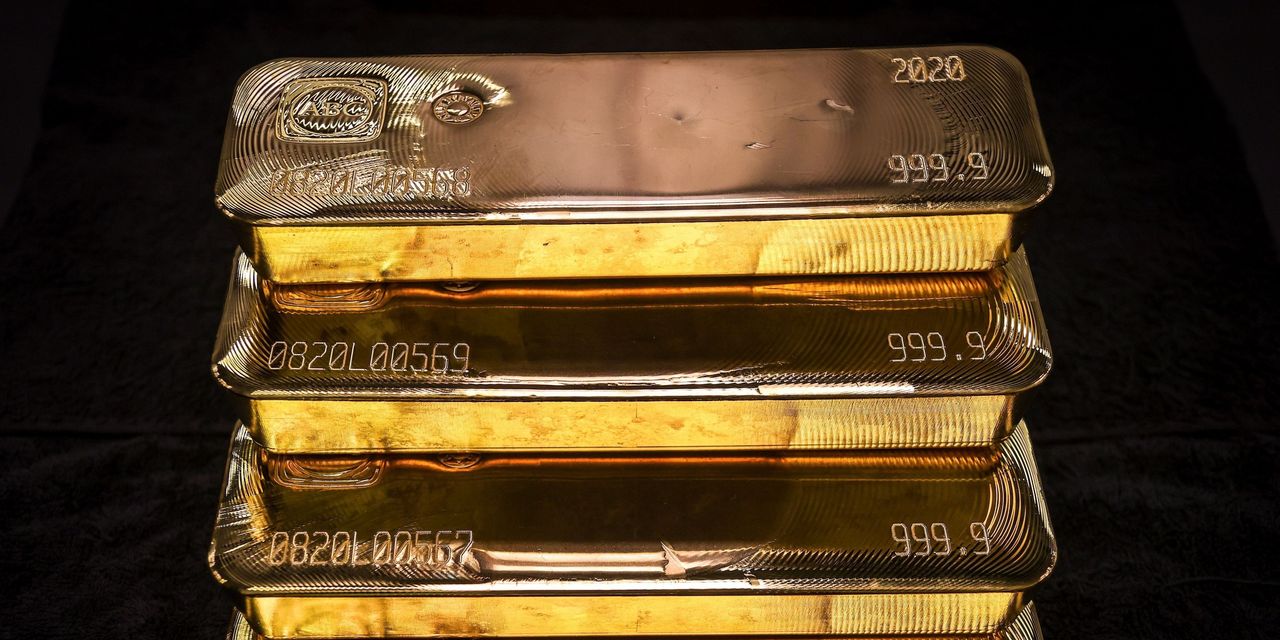

Gold for June delivery GC00, +0.32% GCM22, +0.32% rose $5.20, or 0.3%, to $1,819.30 an ounce on Comex, after rising 0.3% in the previous session and trading below the $1,800-an-ounce threshold. July silver SIN22, +0.97% was up 19 cents, or 0.9%, at $21.75 an ounce.

“Gold is on an uptrend,” Sameer Samana, senior global market strategist at the Wells Fargo Investment Institute, wrote in a weekly client note.

“Support should be found at the 200-day moving average” of $1,835 an ounce, followed by the recent low $1,787, Samana said, adding that resistance likely will take hold at the 50-day moving average of $1,933, followed by the key

$2,000 threshold and the recent $2,051 high.

The dollar has been calling the tune for gold in recent weeks. The ICE U.S. Dollar Index DXY, -0.85% has pushed to its highest in around 20 years as the Federal Reserve has kicked off an aggressive interest rate-hiking cycle in a bid to get inflation under control. A stronger dollar is seen as a negative for commodities priced in the currency, making them more expensive to users of other currencies.

“A weaker dollar and slight retreat in Treasury yields were seen as key factors triggering a move to the upside. Regardless of recent gains, the precious metal is certainly not out of the woods yet,” said Lukman Otunuga, senior research analyst at FXTM, in a note.

U.S. retail sales released Tuesday pointed to a solid economic backdrop, rising 0.9% in April, slightly below the 1% advance forecast by economists surveyed by The Wall Street Journal. Industrial production gained 1.1% in April, according to the Fed, topping expectations for a 0.5% gain.

Fed Chairman Jerome Powell speaks Tuesday afternoon at The Wall Street Journal’s Future of Everything event.

In other metals trade, July copper HGN22, +1.32% rose 1.4% to $4.25 a pound.

July platinum PLN22, +1.85% rose 1.8% to $942.30 an ounce, while June palladium PAM22, +2.17% was up 2.2% at $2,046 an ounce.