Gold futures were solidly higher Friday after a reading of the pace of growth of the U.S. economy came in better than expected for the first three months of 2019, but other aspects of the report raised questions about the underlying strength of the economy.

The U.S. economy expanded at a 3.2% annual pace in the first three months of 2019, the government said Friday. The gain was well above forecasts for a 2.3% increase in gross domestic product. The economy grew at a healthy 2.2% rate in the final three months of 2018.

The gain in first-quarter GDP “would seem to make a mockery of claims that the economy is slowing as the fiscal stimulus fades,” said Paul Ashworth, chief U.S. economist at Capital Economics, in a note. However, “net exports added 1.0% point to overall GDP growth, as exports increased by 3.7% annualised and imports contracted by 3.7%. That won’t continue against a backdrop of very weak global trade.”

“Stripping out trade and inventories, final sales to domestic purchasers increased by only 1.4%, which is the smallest gain in more than three years. That is a much better guide to the underlying strength of the economy,” Ashworth said.

And “taking out the over-sized boosts from net trade, inventories and highways investment, which will all be reversed in the coming quarters, growth was only around 1.0%,” he said. “Under those circumstances, we continue to expect that GDP growth will slow this year, forcing the [Federal Reserve] to cut interest rates before year-end.

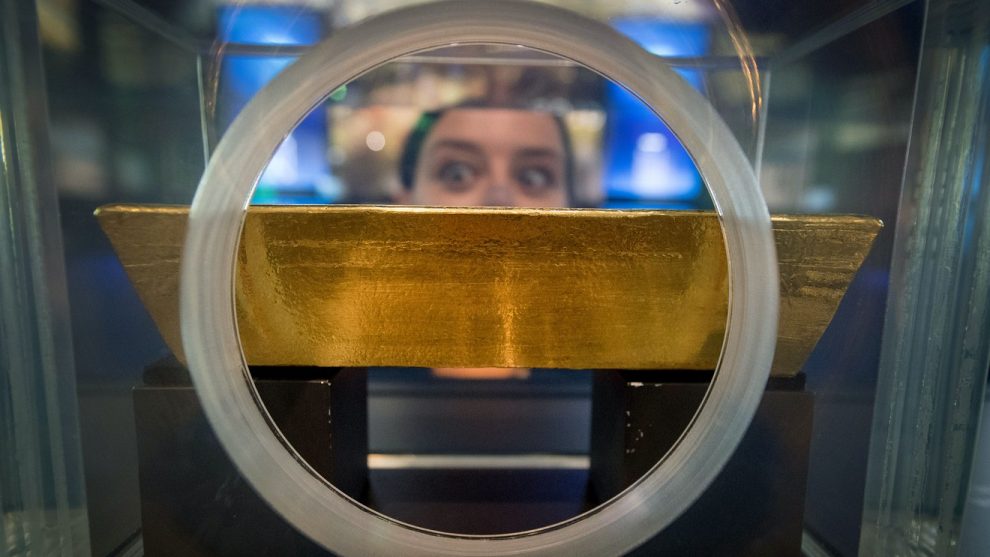

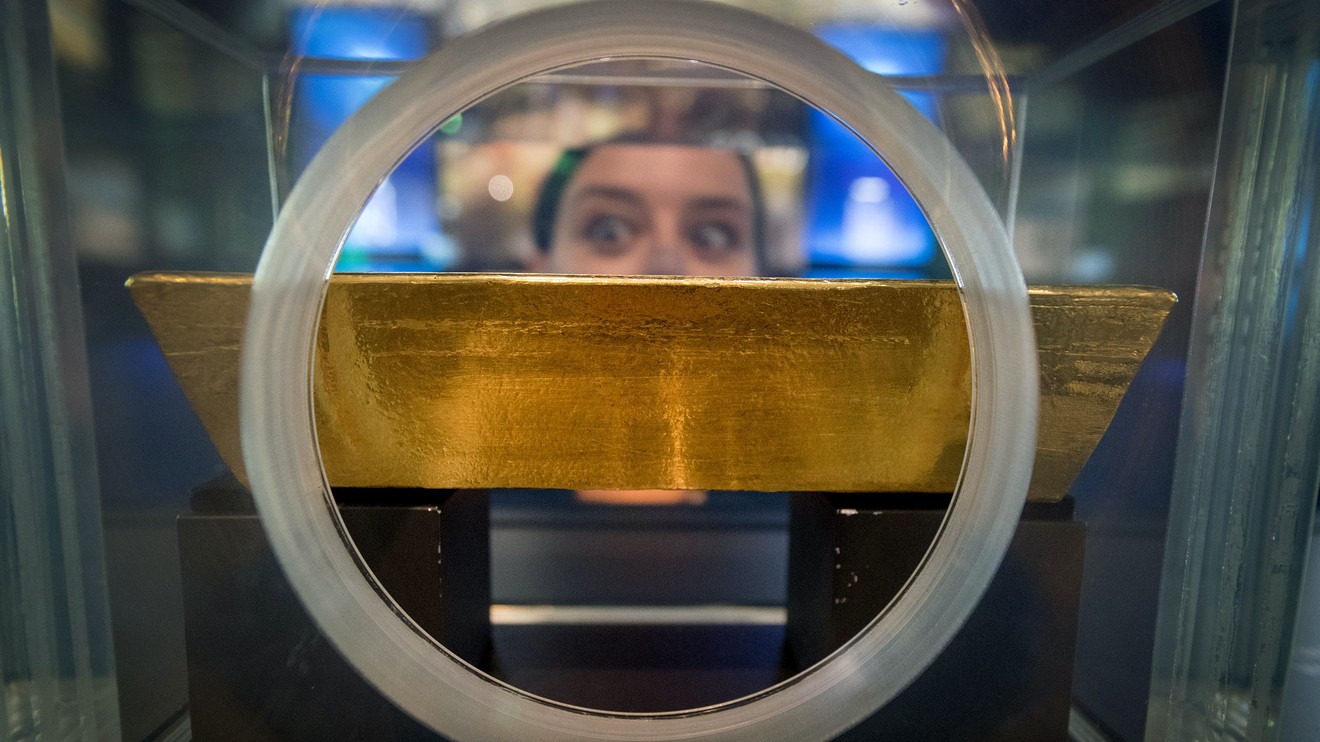

Against that backdrop, gold for June delivery GCM9, +0.70% tacked on $7.70, or 0.6%, at $1,287.40 an ounce. The most-active contract was on pace for a weekly gain of 0.9%.

May silver SIK9, +0.78% added 9.1 cents, or 0.6%, to $14.97 an ounce, with the precious metal on pace to end the week up 0.1%, based on Thursday’s settlement as major markets were closed at the end of last week in observance of Good Friday.

Following the GDP report, the dollar was trading lower, easing back in the wake of a recent run to its highest level in about two years. The ICE Dollar Index, DXY, -0.21% which tracks the value of the buck against six of its trading rivals, was down 0.2% at 98.001.

The 10-year Treasury note yield TMUBMUSD10Y, -1.60% was at 2.50%, while U.S. stocks, the Dow Jones Industrial Average DJIA, +0.00% and the S&P 500 index SPX, +0.01% declined.

Softness in appetite for risky assets, like stocks, can provide support for haven gold, while a cooling of the dollar’s recent uptrend and lower bond yields could also buttress bullion because stronger greenback can make the commodity relatively more expensive to international buyers. Separately, subdued yields can diminish the relative value of purchasing government paper over gold, which doesn’t bear a yield.

“Despite a significant drop in long-term real rates, gold prices have remained flat [year-to-date] as recession fears have receded since late last year. However, we believe gold prices have likely undershot fundamental value,” wrote commodity analysts at Goldman Sachs in a Thursday note.

The Goldman analysts lowered their gold forecast but said they still remain bullish. They reduced their three-month view to $1,300 from $1,350, the six-month view to $1,325 from $1,400 and 12-month view to $1,375 from $1,450.

“While we are closing our long gold trading recommendation from late last year, we now believe long gold and short silver is a better approach as silver does not benefit from central bank buying and remains in physical surplus,” analysts at Goldman said. They also reduced their silver forecasts, including the 12-month view to $15.50 from $16.

On Friday, The SPDR Gold Shares exchange-traded fund GLD, +0.77% added 0.7%, and the miner-focused VanEck Vectors Gold Miners ETF GDX, +1.99% traded up 1.8%.

Among other metals, May silver HGK9, +0.70% rose 0.6% to $2.88 a pound, looking at a weekly loss of 1.4%. July platinum PLN9, +0.84% rose 0.8% to $897.10 an ounce, poised for a weekly loss of 0.7%, while June palladium PAM9, +2.35% traded at $1,433 an ounce, up 1.9% for the session and up 2.5% week to date.