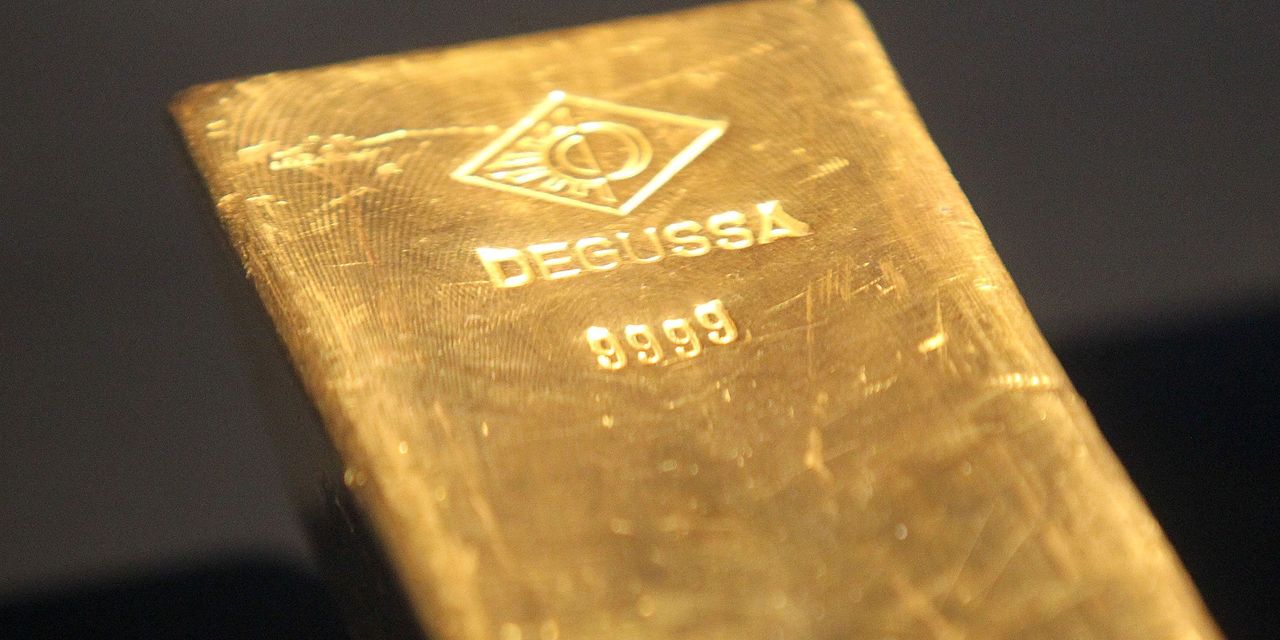

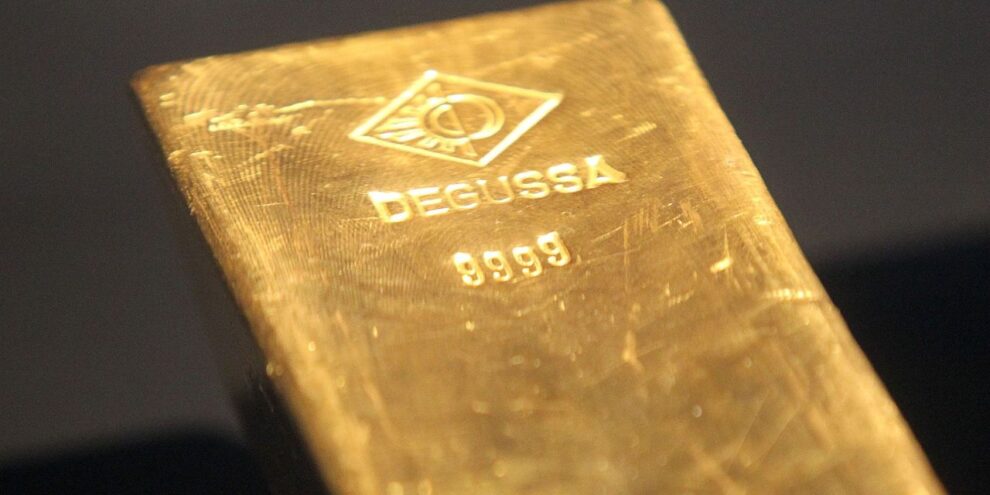

Gold prices climbed on Wednesday to their highest levels in more than six months as the precious metal’s latest winning streak continued, driven in part by a weaker U.S. dollar and lower Treasury yields.

Price action

- Gold prices due in February GC00, +1.07% GCG23, +1.07% advanced $13.10, or 0.7%, to $1,859 per ounce on Comex, FactSet data show.

- Silver prices for March SI00, +0.80% SIH23, +0.80% advanced 7 cents, or 0.3%, to $24.31 per ounce.

- Platinum prices for April PLJ23, +0.11% were essentially flat at $1,093 per ounce, while palladium due in March PAH23, +2.58% rose $26, or 1.5%, to $1,719 per ounce.

- Copper prices for March HGH23, -0.35% shed 4 cents, or 1.2%, to $3.722 per pound.

Market drivers

Gold’s winning streak continued on Wednesday as the dollar and Treasury yields again declined, while recession fears and hopes for more central-bank buying bolstered prices of the yellow metal.

“A macroeconomic landscape characterized by heightened recession risks and central banks concluding their tightening cycles bodes well for gold this year, with the next major barrier to watch on the upside being the $1,875 region,” said Marios Hadjikyriacos, senior investment analyst at XM.

Gold declined for much of 2022 after peaking north of $2,000 per ounce in March. Precious metals traders are now watching to see whether it will return to those levels. Other precious metals, including silver and platinum, have also seen strong gains lately.

The ICE U.S. Dollar Index DXY, -0.46% was down 0.4% to 104.14, while Treasury yields were broadly lower, with the 10-year yield TMUBMUSD10Y, 3.677% off 10.8 basis points to 3.678%.

Add Comment