Gold futures on Friday headed modestly lower for the day and week, with bullion defying its usual inverse correlations with a softer U.S. dollar and slumping stocks.

“It remains broadly aligned with risk assets but not necessarily reliably so at this point and even its relationship with the dollar has become a little sketchy,” wrote Craig Erlam, senior market analyst at Oanda, in a daily research note.

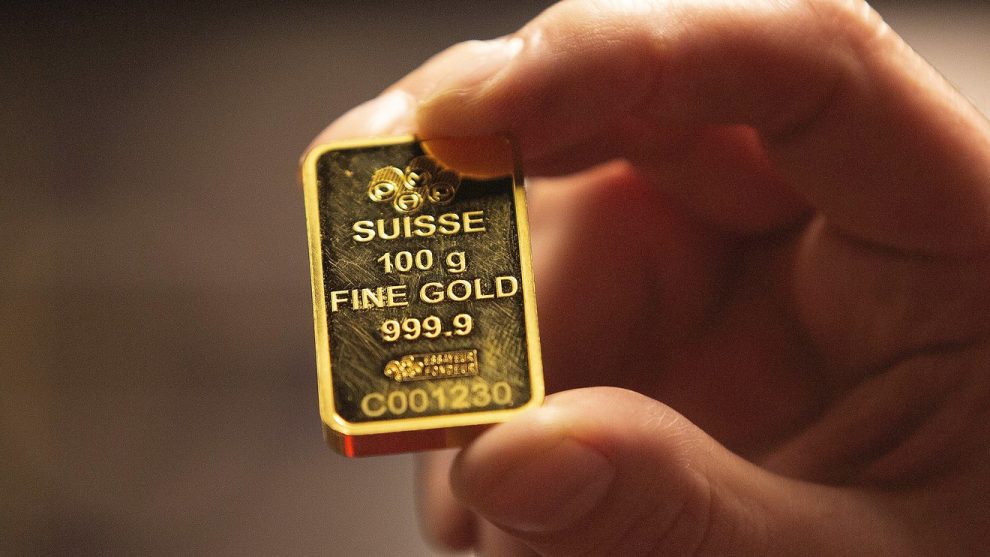

Gold for June delivery GCM20, -0.41% was off $7, or 0.4%, at $1,687 an ounce, after sinking 1% a day ago, amid a slide in the broader equity market. The metal, however, put in a gain in April of 6.1%, which has suggested to experts that a pullback from gains about $1,700 isn’t unexpected.

“It seems after a period of turbo-charged volatility, the yellow metal has settled into a consolidation phase, with $1,660 providing the floor and $1,750 the ceiling,” Erlam wrote.

U.S. equity markets having come off the best monthly gains since 1987 are struggling to find further gains, with investors searching for clarity on the future in the aftermath of the COVID-19 pandemic that has infected more than 3 million people globally and claimed more than 200,000 lives globally.

Weakness in earnings from the likes of Amazon.com Inc. AMZN, +4.26% and Apple Inc. AAPL, +2.11%, megacap tech-related companies that have helped lead the charge for assets perceived as risky from their coronavirus lows.

On top of that, markets were digesting threats from President Donald Trump of levying tariffs or retaliating against China for its handling of the outbreak of the novel strain of coronavirus, which was first identified in Wuhan, China.

Still, gold’s moves have been muted despite a gauge of the dollar retreating about 0.1% on Friday and 1.4% for the week, as gauged by the ICE U.S. Dollar Index DXY, -0.08%. Gold tends to rise when the U.S. currency weakens because gold is priced in dollars. The yellow metal also has seemingly bucked a trend of gaining altitude as government bond yields hold near historic lows.

The 10-year Treasury note TMUBMUSD10Y, 0.617% yield was at 0.62%, compared with 0.618% from last Friday, according to FactSet data.

Meanwhile, July silver SIN20, +0.21% picked up 3 cents, or 0.3%, at $15.005 an ounce, following a 2.2% gain from the previous session. Gold’s sister metal for the month rose of 5.8%, the biggest since October.

Add Comment