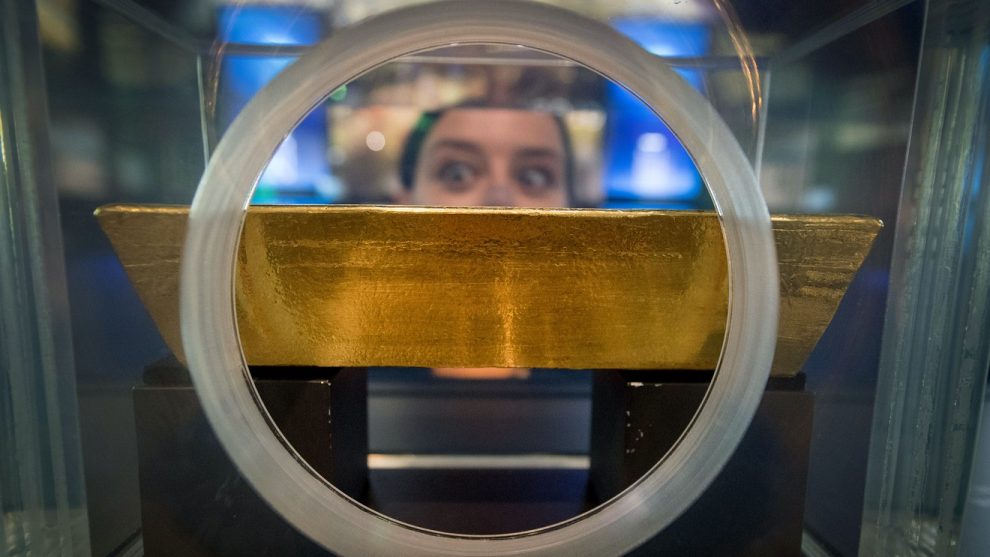

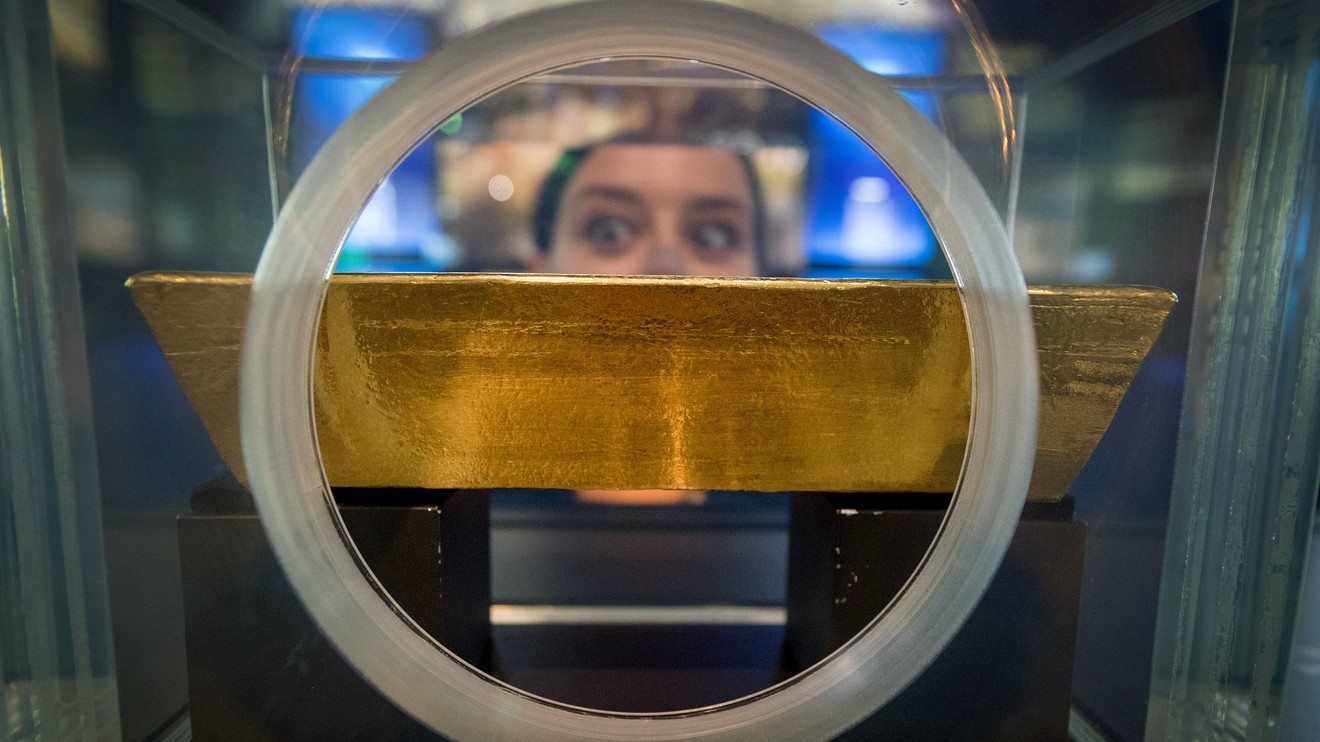

Gold futures saw slight gains Friday morning as U.S. equity markets looked set to retreat, along with the U.S. dollar and Treasurys, ahead of a closely watched reading of America’s economic performance in the first quarter.

Gold for June delivery GCM9, +0.23% tacked on $3.20, or 0.3%, to $1,282.90 an ounce. The most-active contract was on pace for a weekly gain of 0.5%.

May silver SIK9, +0.48% meanwhile, added 8 cents, or 0.5%, to $14.955 an ounce, with the precious metal on pace to end the week virtually unchanged, based on Thursday’s settlement as major markets were closed at the end of last week in observance of Good Friday.

A reading of U.S. gross domestic product for the first three months of 2019, is set to be released at 8:30 a.m. Eastern Time, with that report potentially providing a catalyst for broader assets. The GDP print, a preliminary estimate, comes as international economies have been consistently showing signs of contracting, even as the U.S. has remained steady — an environment that could support gold buying.

Economists surveyed by MarketWatch on average expect the report to show 2.3% annualized growth in the first quarter.

Read: Economy stumbled out of the gate in early 2019 but finished Q1 stronger, GDP to show

Early Friday, markets were subdued ahead of the GDP report, with the dollar edging back after a run to its highest level in about two years. The ICE Dollar Index, DXY, +0.01% which tracks the value of the buck against six of its trading rivals, was down less than 0.1% at 98.136.

The 10-year Treasury note yield TMUBMUSD10Y, -0.47% was at 2.53%, while U.S. stocks, the Dow Jones Industrial Average DJIA, -0.51% and the S&P 500 index SPX, -0.04% appeared set to pull back.

Softness in appetite for risky assets, like stocks, can provide support for haven gold, while a cooling of the dollar’s recent uptrend and lower bond yields could also buttress bullion because stronger greenback can make the commodity relatively more expensive to international buyers. Separately, subdued yields can diminish the relatively value of purchasing government paper over gold, which doesn’t bear a yield.

“Despite a significant drop in long-term real rates, gold prices have remained flat [year-to-date] as recession fears have receded since late last year. However, we believe gold prices have likely undershot fundamental value,” wrote commodity analysts at Goldman Sachs in a Thursday note.

The SPDR Gold Shares exchange-traded fund GLD, +0.08% added 0.3%, and the miner-focused VanEck Vectors Gold Miners ETF GDX, -0.71% traded up 0.5% in premarket action.