Both Microsoft MSFT and Alphabet GOOGL posted positive earnings reports Tuesday, beating analysts’ estimates. Admittedly, analysts had rather tepid expectations for the tech giants as GOOGL beat with just 3% YoY growth in sales, and MSFT with 7% YoY sales growth, its first single digit percent gain in years.

Both stocks have been performing extremely well with GOOGL +17% YTD and Microsoft +24%. These strong performances come off the back of a very challenging 2022 where MSFT was down nearly -40% off its all-time high and GOOGL was down -45%. Nonetheless, as two of the premier companies in the world, both have outperformed the market considerably over the last five years.

Image Source: Zacks Investment Research

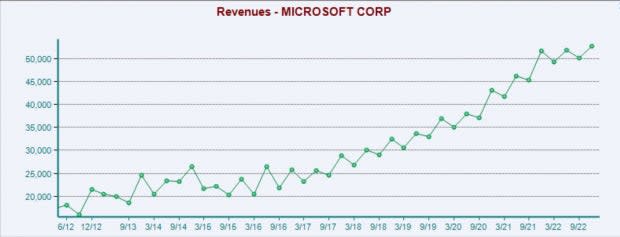

Microsoft Earnings

Sales of $53 billion for the quarter was the highest reported quarter in the company’s history and beat analysts’ expectations of $51 billion. Microsoft has increased their revenues by a CAGR of 13% over the last 10 years, an enviable rate for one of the world’s largest companies.

Image Source: Zacks Investment Research

Microsoft was very quick to highlight its exciting new AI developments and say that they aim “to create a new era of computing.” According to MSFT management, demand for AI products is very strong, and they are pleased with the engagement.

They also noted that AI will create a huge opportunity for its Microsoft Bing search engine, which already has the newest version of GPT (the language model from partner OpenAI) integrated into it. Google investors have been watching these developments closely.

While most segments of MSFT business saw steady growth, two segments were down bad. Devices continue to lag severely, showing a -30% drop in sales growth YoY. Windows OEM, formerly Microsoft’s bread and butter, also saw a YoY decline in sales of -28%.

Cloud services and Azure led the top line with 22% and 27% YoY sales growth respectively. As impressive as those numbers are, cloud sales are clearly decelerating. Azure sales in the prior quarter showed YoY growth of 31%.

Alphabet Earnings

Alphabet was projecting a YoY decline in sales growth going into the report but was able to eek out a small gain. At $76 billion in revenue for the quarter, GOOGL posted its largest quarter in the company’s history. However, the once unstoppable growth machine has experienced a multi-quarter bout of single digit and negative sales growth.

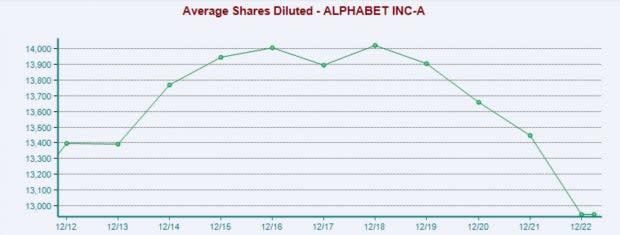

Management also announced a massive $70 billion buyback plan. GOOGL has made a concerted effort to reduce share count since 2019 and has cut the number shares outstanding by 7% since then.

Image Source: Zacks Investment Research

Ad revenue broadly, and Ad revenue from YouTube beat expectation, but were unable to surpass number from a year ago. In an effort to address the weakness in advertising revenue, Alphabet has cut costs and scaled back significantly. GOOGL laid off some 12,000 employees over the last year, reducing its headcount by ~6%.

Google Cloud provided some exciting news, noting that it was the first quarter on record where the segment posted positive net earnings. Revenue from the Cloud segment showed 27% YoY growth, which as impressive as it is shows a slowdown in cloud sales growth.

It was an overall okay quarter for the search engine giant. Managing to show revenue growth and profitability in the cloud was a necessity. It will be very interesting to see how Alphabet fares if the economy continues to weaken.

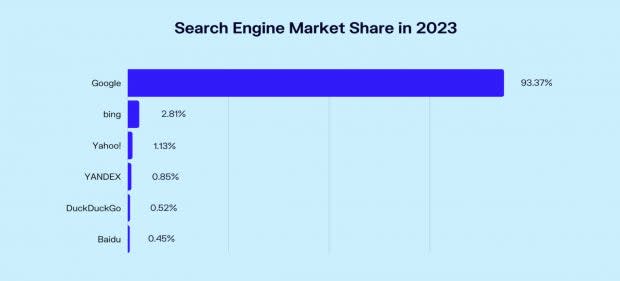

Search and AI

First things first, Google is still the unequivocal king when it comes to search engine usage. At 94% of total market share Google absolutely dominates all competitors. But that doesn’t mean Microsoft’s new and improved Bing search engine can’t start chipping away at that lead.

Image Source: Oberlo

Google’s Bard, their response to AI enabled Bing has experienced a lot of criticism. With the first iteration being written off as “worse than useless.”

In another scary moment for Alphabet, Samsung announced that it may dump Google search for Bing. While that is certainly a major threat, default search on devices is more about money than quality. Alphabet pays Samsung a reported $3.5 billion a year and Apple $20 billion to be the default search engine on the products.

This may just be an attempt by Samsung to bargain with Alphabet, but GOOGL is taking these threats seriously. Management at GOOGL have now merged its two separate AI teams and spent $3.3 billion in the quarter on AI developments.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.