(Bloomberg) — Microsoft Corp.’s cloud-computing and Office software businesses fueled stronger-than-projected quarterly revenue growth, a sign that the company’s hefty investments in artificial intelligence are starting to pay off.

Most Read from Bloomberg

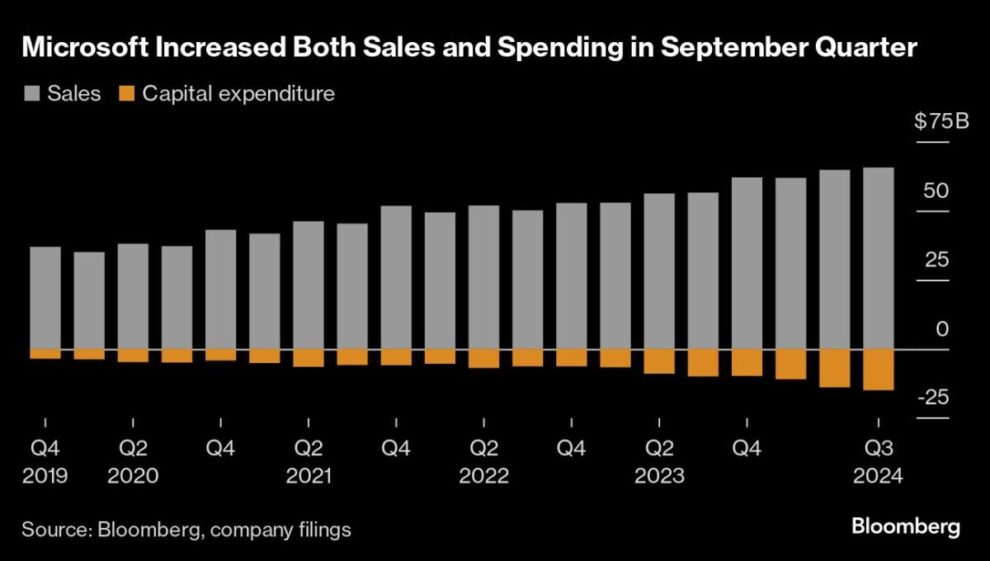

Sales in the first quarter, which ended Sept. 30, increased 16% to $65.6 billion, the company said in a statement Wednesday. Profit rose to $3.30 a share. Analysts on average estimated sales of $64.5 billion and per-share earnings of $3.11, according to Bloomberg data.

The Azure cloud computing division posted a 34% revenue gain in the quarter, adjusted for currency fluctuations. That decelerated slightly from the 35% growth in the previous period but was ahead of Microsoft’s earlier forecast, according to some analysts.

Chief Executive Officer Satya Nadella has overhauled the software maker’s product line with AI models from partner OpenAI. He’s now seeking to recruit enough paying customers to the souped-up software and services to drive Microsoft’s growth for years to come. At the same time, corporations are tapping the company’s data-center capacity to power development of their own AI applications, buoying demand in its closely watched Azure business.

“People are shifting from just talking about artificial intelligence and testing and piloting artificial intelligence to actually putting it into production,” said Jackson Ader, an analyst at Keybanc.

Microsoft shares gained about 1% in extended trading following the report. They had closed up less than 1% to $423.53 in New York. The stock fell 3.7% in the quarter compared with a 5.5% increase in the Standard and Poor’s 500 Index, reflecting Wall Street concerns that Microsoft isn’t yet realizing sufficient gains from its AI investments, and may risk falling behind as rivals pile into the market.

AI Contribution

The company’s main sources of AI-related income fall into two categories — cloud services and AI-enhanced productivity assistants baked into Office, which help workers summarize emails, transcribe conference calls and create slideshows. The company said 12 percentage points of Azure’s growth was attributable to AI, compared with 11 points in the June quarter.

Microsoft’s overall cloud revenue, a mix of sales from products such as Office and Azure cloud sales, rose 22% to $38.9 billion.

The results come a day after Alphabet Inc.’s Google posted quarterly cloud sales that grew more than analysts had projected, rising to $11.4 billion, a 35% increase from the year-earlier period.

Like Amazon.com Inc. and Google, Microsoft has ramped up spending to construct and rent the data centers required to fuel power-hungry AI services. Capital expenditures, closely watched by investors as Microsoft embarks on this historic build-out, jumped to $55.7 billion in the fiscal year ended June 30. The company has forecast a further increase in the current year. Microsoft’s AI electricity needs are so significant it struck a deal to purchase nuclear power from a restarted reactor at Three Mile Island.

In July, Microsoft Chief Financial Officer Amy Hood forecast that Azure growth would continue to slow in the September quarter, but said investments in data centers would let the company capitalize on demand and accelerate Azure growth in the second half of fiscal 2025.

Microsoft has been signing up corporate clients to use its AI-infused Office services, which carry a monthly list price of $30 per user, in addition to the cost of the basic Office product. Because of that expense, and because the products are still at an early stage of readiness, some clients have moved slowly with trials and deployments.

(Updated with context throughout.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.