Microsoft (NasdaqGS:MSFT) is currently experiencing a mix of significant growth and emerging challenges. The company has reported impressive gains in cloud revenue and strategic expansions, while facing pressures from its Activision acquisition and regional market fluctuations. In the discussion that follows, we will explore Microsoft’s financial strengths, potential vulnerabilities, future growth prospects, and external factors that could impact its market position.

Click here and access our complete analysis report to understand the dynamics of Microsoft.

Core Advantages Driving Sustained Success for Microsoft

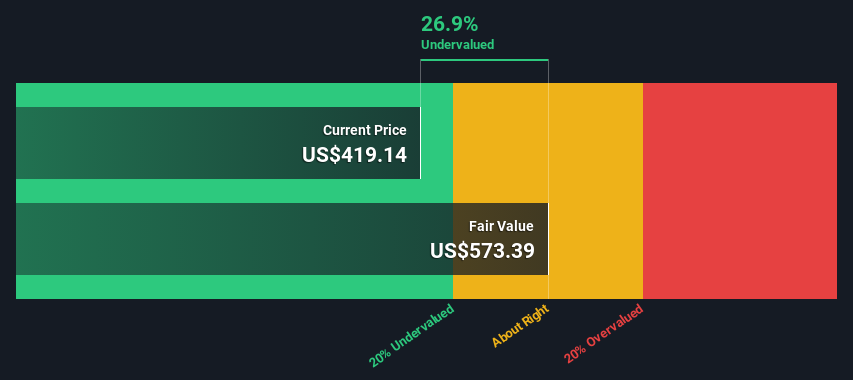

Microsoft’s financial health is evident in its impressive annual revenue of over $245 billion, marking a 15% year-over-year increase. Satya Nadella, Chairman and CEO, highlighted the significant growth in Microsoft Cloud revenue, which surpassed $135 billion, up 23%. This growth is further supported by strategic initiatives such as the expansion of GitHub’s revenue run rate to $2 billion, with Copilot contributing over 40% of this growth. The company’s strategic alliances and product innovations, such as Azure Arc and Azure AI, continue to drive customer engagement and revenue. Additionally, Microsoft’s strong financial position is reflected in its trading at 26.9% below its estimated fair value, suggesting potential for future appreciation.

Vulnerabilities Impacting Microsoft

Microsoft faces certain vulnerabilities, notably highlighted by Amy Hood, CFO, who pointed out that Activision contributed a net impact of approximately 3 points to revenue growth but was a 2-point drag on operating income growth. Additionally, the company experienced slightly lower-than-expected growth in some European regions, and a decrease in devices revenue by 11%, aligning with a focus on higher-margin products. Despite being undervalued based on its Price-To-Earnings Ratio compared to industry averages, it remains expensive compared to peer averages. These factors indicate challenges in maintaining growth momentum in certain segments and regions.

Future Prospects for Microsoft in the Market

Looking ahead, Microsoft’s strategic expansions and product-related announcements present significant opportunities. The company is investing in data center expansions across four continents, positioning itself for long-term growth. The launch of Copilot+ PCs and the extension of Copilot to industries like healthcare demonstrate Microsoft’s commitment to innovation. Satya Nadella emphasized the potential of these initiatives to drive future growth. Additionally, the expected increase in capital expenditures for FY ’25 indicates a proactive approach to scaling operations and enhancing market presence.

External Factors Threatening Microsoft

However, certain external factors pose threats to Microsoft’s growth trajectory. Amy Hood noted constraints on AI capacity and some softness in European geos affecting non-AI consumption. The competitive pressures in the PC market, despite a 4% increase in Windows OEM revenue, underscore the challenges Microsoft faces in maintaining its market share. Furthermore, the anticipated acceleration of Azure growth hinges on successful capital investments to meet growing demand, which could be impacted by external economic and market conditions.

To gain deeper insights into Microsoft’s historical performance, explore our detailed analysis of past performance. To dive deeper into how Microsoft’s valuation metrics are shaping its market position, check out our detailed analysis of Microsoft’s Valuation.

Microsoft’s strong financial performance, driven by a significant increase in cloud revenue and strategic product innovations, positions the company for continued success. The company faces challenges such as lower growth in certain regions and competitive pressures in the PC market, while its investments in data center expansions and new product offerings like Copilot+ PCs highlight its commitment to future growth. The company’s trading price, which is 26.9% below its estimated fair value, suggests that it may be undervalued compared to industry averages, offering potential for appreciation as Microsoft continues to capitalize on its strategic initiatives. However, external factors, including constraints on AI capacity and economic conditions, could impact its growth trajectory, necessitating careful navigation to maintain its market leadership.

Make It Happen

Curious About Other Options?

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.