Microsoft (NasdaqGS:MSFT) is navigating a dynamic environment characterized by recent strategic partnerships and strong financial health, yet faces challenges such as increased operating expenses and competitive pressures. Highlights include substantial growth in AI and cloud services, contrasted by regulatory hurdles and market risks. In the discussion that follows, we will explore Microsoft’s financial stability, strategic initiatives, growth opportunities, and the competitive pressures it faces to provide a comprehensive overview of its current business situation.

Click to explore a detailed breakdown of our findings on Microsoft.

Unique Capabilities Enhancing Microsoft’s Market Position

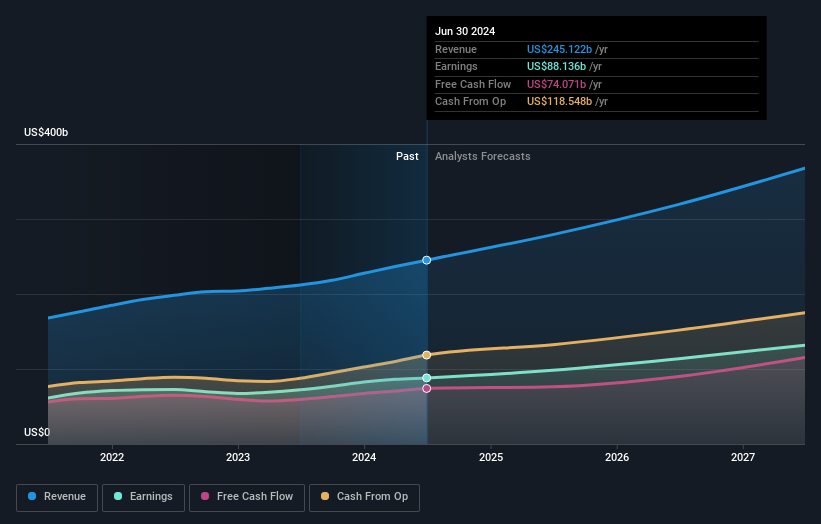

Microsoft’s financial health is underscored by a significant total shareholder equity of $268.5 billion and a manageable debt-to-equity ratio of 19.2%. The company’s EBIT of $109.4 billion supports an impressive interest coverage ratio, highlighting its financial stability. The strategic alliances, such as those with Enbridge and Pivot Energy, leverage Microsoft’s AI and cloud capabilities, enhancing its market leadership. Microsoft’s commitment to innovation is evident in its AI and cloud leadership, with substantial revenue growth driven by these sectors. The company is trading at $419.14, below the estimated fair value of $573.39, indicating a potential investment opportunity. Its management team, with an average tenure of 6.7 years, brings seasoned expertise, contributing to strategic goals and long-term growth.

Internal Limitations Hindering Microsoft’s Growth

Microsoft faces challenges such as high operating expenses, which increased by 13% due to the Activision acquisition. The company’s price-to-earnings ratio of 35.3x, while favorable compared to the US software industry average of 40.4x, is higher than the peer average of 32.8x, suggesting a relative overvaluation. Additionally, Microsoft’s earnings growth of 21.8% over the past year lagged behind the software industry average of 23.3%. The European market presents challenges with lower-than-expected growth, impacting overall performance. These factors, coupled with the high-risk nature of its funding sources, pose potential hurdles to sustained growth.

Emerging Markets Or Trends for Microsoft

The expansion into AI and cloud services offers significant growth opportunities, particularly with the introduction of innovative products like GitHub Copilot and healthcare AI models. Strategic partnerships, such as those with Infosys and KT Corporation, are poised to enhance Microsoft’s market position by driving technological advancement and expanding its reach in emerging markets. The gaming sector also presents a promising avenue for growth, with over 500 million monthly active users. Microsoft’s focus on healthcare innovations, including AI-driven solutions, positions it to capitalize on the growing demand for digital transformation in the healthcare industry.

Competitive Pressures and Market Risks Facing Microsoft

Microsoft is navigating several external threats, including capacity constraints in AI, which could hinder its ability to meet growing demand. Economic uncertainty, particularly in European markets, poses risks to revenue growth. The competitive environment is intensifying, with rivals like Apple potentially investing in AI firms like OpenAI, challenging Microsoft’s market share. Regulatory challenges, such as unexpected tax rate increases, add further complexity to its operational environment. These factors, combined with significant insider selling, highlight the need for strategic agility to maintain competitive advantage and market position.

To gain deeper insights into Microsoft’s historical performance, explore our detailed analysis of past performance. To dive deeper into how Microsoft’s valuation metrics are shaping its market position, check out our detailed analysis of Microsoft’s Valuation.

Conclusion

Microsoft’s strong financial position, highlighted by its substantial shareholder equity and low debt-to-equity ratio, provides a solid foundation for leveraging strategic alliances and driving growth in AI and cloud services. Challenges such as rising operating expenses and slower earnings growth compared to industry peers exist, but Microsoft’s market position is bolstered by its innovative product offerings and strategic partnerships, particularly in emerging markets like healthcare and gaming. The company’s current trading price of $419.14, below its estimated fair value of $573.39, combined with a favorable price-to-earnings ratio relative to the industry, presents a compelling investment opportunity. However, to sustain its growth trajectory, Microsoft must navigate competitive pressures and market risks with strategic agility, ensuring it capitalizes on its strengths while addressing internal and external challenges.

Taking Advantage

-

Hold shares in Microsoft? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

-

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.