In January 2022, when Microsoft Corp. (NASDAQ:MSFT) first announced it had struck a deal worth $69 billion to acquire popular video game developer Activision Blizzard Inc. (NASDAQ:ATVI), investors applauded the news. It seemed like a perfect way to utilize Microsofts $104 billion cash hoard, as it would strengthen the company’s already significant position in the gaming industry and help reduce competition.

The first regulatory hurdle to the deal came on Dec. 8, 2022, when the U.S. Federal Trade Commission sued to block Microsoft and Activisions combination. The markets did not have much of a reaction to the development at all, and Microsofts shares rose just 1% that day, which is well within the realm of normal daily fluctuations.

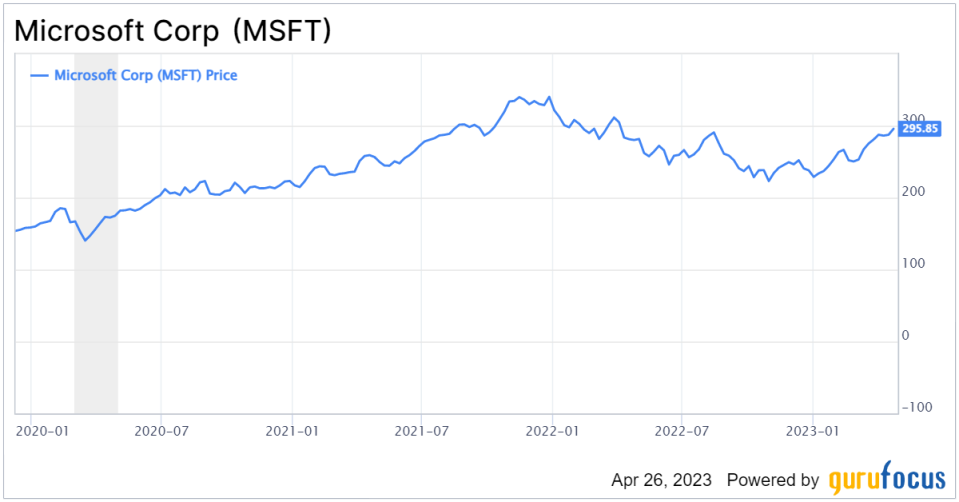

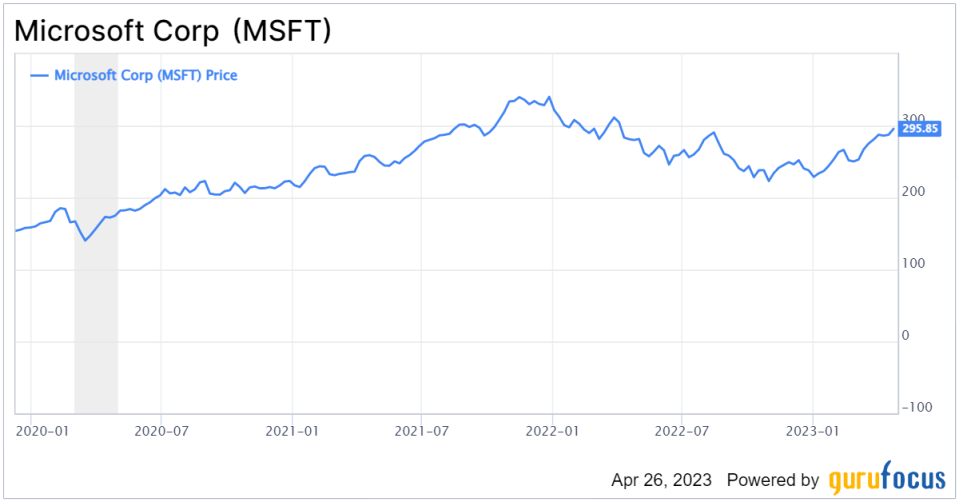

However, it appears that investor sentiment may have changed since then. On April 26, when the U.K. Competition and Markets Authority voted to block the deal on anti-competitive grounds, Microsoft shares soared more than 7%, even as Activision was down 11%.

Just what was it that changed investors outlook on Microsoft and Activision to the point where optimism for Microsoft soared following a major blow to what could have been a blockbuster value-accretive deal?

For one, some investors were already certain that regulators would succeed in blocking the deal and had factored that into their valuations, so they may have been discounting Microsoft as a result. Another thing to consider is that, as the economic outlook in general and Activisions outlook in particular have worsened, fears began to crop up that Microsoft might be over-paying. Lastly, but perhaps most importantly, Microsoft had reported positive earnings results the previous morning, so there may have been some leftover trading enthusiasm from that, even though the share price did drop the day of the earnings report.

Regulatory opposition was not unexpected

From the moment Microsoft declared its intention to acquire Activision, it was clear there would likely be some form of opposition from regulators. In addition to being the third-largest maker of game consoles with its Xbox, Microsoft also dominates the PC gaming market and is buying its way into mobile games. Microsoft even has 23 in-house game development studios for Xbox, PC and mobile.

The gaming community was quick to point out that Microsoft would have both the means and the incentive to make Activisions games lower quality on competitors platforms. Microsoft tried to placate gamers and regulators by promising not to take such actions, but the fact remains that even if it signed contracts to that effect, those contracts would expire and new games would be developed that the contracts did not cover.

Thus, some investors may have taken a cautious approach on Microsoft due to fears that a regulatory block on the Activision deal could hurt the share price. That may be why the first regulatory blow did not move the stock much, and the second blow validated the view that the deal would likely be successfully blocked in the end, though nothing is set in stone yet.

Pressured earnings lower Activisions perceived value

Even if a good chunk of investors were just waiting for the Activision acquisition to be blocked, why did that become such a positive development for Microsoft in the markets eyes? To help answer this question, lets take a look at Activisions quarterly revenue and earnings per share numbers:

As we can see, Activisions earnings per share are down since the acquisition was announced, though revenue per share has grown. There is a general expectation that people are likely to spend less money on games when the economy is struggling, which is hurting Activisions outlook as fears arise that Microsoft may be paying too high of a price tag.

Additionally, even Microsofts fortress-like balance sheet would take a hit from a $69 billion all-cash acquisition. Its strong balance sheet has always worked in Microsofts favor, so why would it put that in jeopardy, especially in a rising interest rate environment?

Did positive earnings play a role?

There is also a chance that Microsofts positive earnings report from the day before impacted the April 26 price movement. For its third quarter of fiscal 2023, the company reported revenue was up 7% year over year while earnings per share grew 10%, both beating analysts expectations.

Microsofts share price actually dropped slightly during normal trading hours on earnings day, but it spiked sharply in after-hours trading. The U.K. is five hours ahead of New York time, so it is actually difficult to discern whether the price spike was due to the regulatory announcement, a vast amount of in-the-money options being automatically exercised at the markets closing price (as is always a danger with a heavily-traded stock like Microsoft) or a combination of the two.

Will the deal really be blocked?

Despite regulatory pushback, Microsoft is one of the most powerful publicly traded companies in the world, so it is possible the Activision deal may go through after all. The company has already shown it is willing to go to lengths such as a decade-long contract with Samsung Electronics (XKRX:005930) to make Call of Duty releases available on the same day for PlayStation and Xbox. It will probably take a lot more than that to satisfy regulators, but if Microsoft is willing to make enough concessions, it might have a chance.

Overall, I do not think it matters one way or another for Microsofts long-term results. Anti-competitive acquisitions can sometimes be less valuable than anticipated because they essentially boil down to paying money for a development that slows down overall industry growth, which extends the break-even timeline.

This article first appeared on GuruFocus.