CFRA Vice President of Equity Research John Freeman joins Yahoo Finance Live to examine Activision Blizzard’s Q2 earnings report, their price target on the stock, and the outlook of Microsoft’s acquisition of the video game developer.

Video Transcript

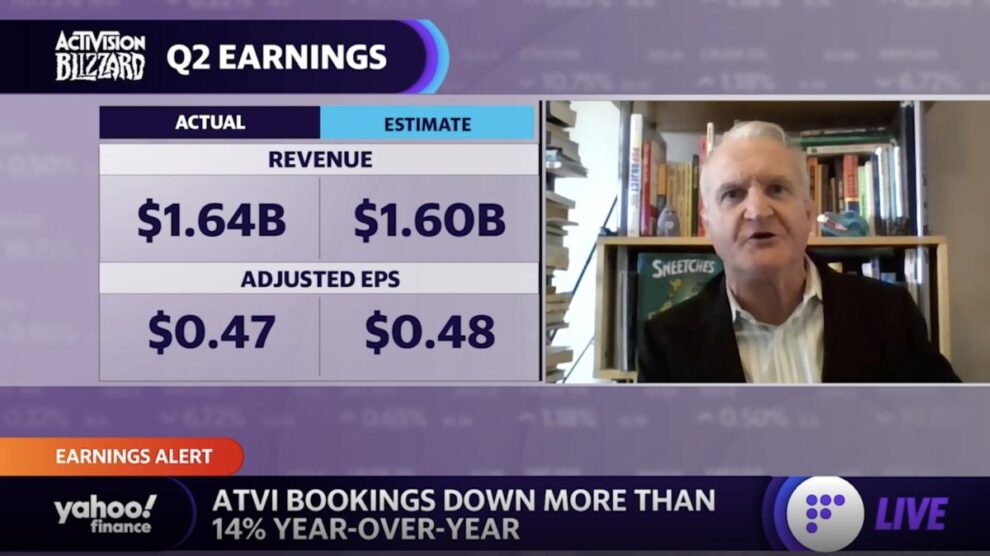

RACHELLE AKUFFO: All right, Activision Blizzard shares, as you can see, they’re still in mildly positive territory, up about 1/3% after reporting earnings after the bell. Well, here to break down the numbers for us is John Freeman, CFRA Vice President of Equity Research. So good to have you on the show. So what are your big takeaways from this earnings report?

JOHN FREEMAN: Well, thank you for having me, first of all. Yeah, you know, it wasn’t surprising. It was interesting to me that– how the spread, with– you know, consensus numbers, was all over the place, which kind of happens with video game stocks. There’s, you know, typically a greater deal of variance than you would normally have. But this was– you know, it certainly met expectations, but it’s still a pretty substantial decline. I mean, they did $2.3 billion in– in net bookings last year in the second quarter, and now it’s down to 1.64. That’s a pretty big slide.

And I think it’s– it’s really the result of two things. One is the halo or the glow of the console refresh, which does affect, you know, games like “Call of Duty,” which, you know, drives a lot of the revenue for Activision. And then, of course, you know, the– sort of the glow of– the afterglow of the bump in engagement that we had with– post-COVID, right, because of the lockdowns and all of that stuff.

So both of those two kind of hits the– you know, hits that– hits that number. But of course, you know, what really is going to drive the stock is, is Microsoft going to be able to pull off its acquisition? And as you mentioned earlier, you know, at $80, it kind of seems like investors are thinking maybe that Microsoft, you know, is going to have more bumps– there’s going to be more bumps in the road, or maybe a lower offer. You know, it’s tough to tell. But certainly the acquisition isn’t going to be– you know, we’re not going to get any clarity on that, I think, for at least another quarter or two.

DAVE BRIGGS: Yeah, and just to refresh everyone’s memories, the $95 price guarantee from Microsoft, what do you expect from the FTC? And do you expect to hear anything in the earnings call from Activision about this merger?

JOHN FREEMAN: So I– you know, it’s tough to say. I don’t think they’re going to venture to, you know, make a lot of commentary about what the SEC is– is going to do. I don’t know– of the FTC, rather, is going to do. I don’t know. To me, it seems like Microsoft will– is going to have to make some concessions. So that is why I downgraded from buy to hold, because this is the kind of thing that is really tough to figure out. And you know, this is the kind of risk arbitrage that, you know, it’s– it’s fun for play money, but you know, best left to the professionals, you know, is kind of my view because it’s hard to get a viewpoint on it, like, what the FTC is going to do.

It seems to me that they’re going to ask for concessions. And maybe Microsoft says, at some point, you know, it’s too much. The concessions are too much, and they pay that $3 billion breakup fee, which they can do because they’ve got plenty of cash, right? So that’s– you know, I– with this kind of spread, it seems like there’s a lot of doubt whether the acquisition will be completed.

DAVE BRIGGS: Yeah, it’s fascinating, right? You’re talking about 17%, 18%, seems like an easy arbitrage bet to make. What type of concessions are we talking about? Are we discussing the exclusivity or potential exclusivity of “Call of Duty”?

JOHN FREEMAN: Right. I think you’re probably going to have a number of, you know, keep the– keep the Xbox platform as open as possible, you know, with, you know, not the kinds of preferential treatment that have today, that kind of thing. Or you know, maybe divesting of some of their game– their previous acquisitions, like “Minecraft.” You know, is that on the table to be– you know, for– for divestiture, for forced divestiture? That’s certainly, I think, what the FTC is probably looking at. And you know, remember that these acquisitions are– these face and– and hit the consumer.

So rather than sort of enterprise software acquisitions where, you know, the FTC doesn’t have as big a political motivation to make a move, things that hit the consumer, right, they’re going to take more care and probably ask for a greater degree of– of concessions from Microsoft is– is kind of my thinking on this.

SEANA SMITH: Hey, John, we just had our tech reporter, Dan Howley, saying that Activision has a huge lineup here of titles coming. And that includes a new “Call of Duty.” When we take a look at the slowdown that’s happening in the gaming sector, I guess, to what extent will that help Activision offset some of that slowing that we were maybe expecting to see in the second half of the year?

JOHN FREEMAN: Yeah, I think, you know, the– the next “Call of Duty,” I think there’s a “Modern Warfare,” and then there’s– there’s also a “War Zone” title and I think an “Overwatch”– an “Overwatch” upgrade as well. So that’s kind of all– I think, all built in. They had been talking about this, previously, for the fourth quarter.

But you know, it’s kind of– it’s kind of tough when you are, you know, comping pretty unbelievable numbers over the last– in 2021 for “Call of Duty,” right? So you know, it’s– I don’t think they’re going to be able to do anything with these titles that, you know, blows– you know, blows numbers out of the water in the fourth quarter to the degree where, you know– maybe, you know, where it moves the stock, you know, well above, you know, where it is now.

I think– and I think, obviously, you’ve got that cap. Like the Microsoft acquisition, you know, if you take that out of it, I think the stock is probably fairly priced where it is right. So it’s all about that arbitrage between the Microsoft– you know, whether the Microsoft deal gets done at $95 and what concessions, you know, Microsoft is going to have to make to complete the deal.

RACHELLE AKUFFO: And with Activision having these huge titles– because as you mentioned, “Overwatch,” “World of Warcraft,” “Call of Duty”– what are some of the nuances? As you look industrywide and you look at how– versus how Activision is performing, what are your expectations there?

JOHN FREEMAN: Well, it’s kind of interesting. So the video game industry kind of ebbs and flows back and forth between the large publishers, you know, dominating the top 10 titles, which you could see NPD publishes this monthly. And year to date, “Call of Duty” was the only one. It was number six, right, whereas last year, I think it was far and away number one.

So that was the only title. And there was a lot of– there are a lot of, like, new, smaller studios that had titles in that top 10. And so you know, it kind of ebbs and flows back and forth. So now, you know, as part of Microsoft, you know, I can see Microsoft maybe real– rethinking this deal, you know, as the industry goes back and forth. And it seemingly, right now, independent– the smaller independent studios seem to be doing really, really well at the expense of the larger guys, with Activision being the largest, right?

SEANA SMITH: It’s going to be real interesting. John, a lot of great commentary there on the deal, because that’s the big thing investors want to know at this point. Real quick, though, before we let you go, hiring at Activision, the headcount grew 25% year over year, even in a very challenging economic environment. What does that tell you, I guess, about the strength of the company and the position that it’s in?

JOHN FREEMAN: That– I thought that was a little odd too. So right as they’re prepping for– to be acquired, they’re going to up their headcount by 20%? You know, is– was Microsoft OK with that? Right? You know, it kind of makes you wonder what motivated that. And so that’s just a question mark. And I think that, you know, obviously, in a normal situation, that would be a very bullish sign, saying, hey, we’ve got a lot of stuff in the pipeline. We need to bring it all to the finish line. And you know, we have– and it shows confidence in the business.

But now, with the Microsoft deal hanging over it, it’s like– does it really show that kind of confidence, or are they just trying to bulk up before they get bought? It’s– it’s kind of an interesting– interesting sort of dynamic that is– it’s a question mark. I’ll have to say that it.

SEANA SMITH: It did– it did jump out to me, 25% year-over-year growth, something you don’t really see every day, especially when a company is getting acquired, potentially, by Microsoft.

JOHN FREEMAN: And with the revenue down.

SEANA SMITH: Yeah.

JOHN FREEMAN: And with revenue down.

SEANA SMITH: Yeah. Good point. All right, John Freeman. Always great to have you. Thanks so much for joining us.