Gains in some technology stocks this year have been nearly wiped out by what has been called a “value rotation.”

The narrative in much of investing media is that investors are concerned about earnings. But I believe it was a strategic move by some large investors to time the top of the stock market and pocket gains.

The rotation, which began in September and continued in October, was under-reported because investors dumped stocks directly after earnings reports were released. This made it appear as though the declines were due to an individual stock’s fundamentals. In reality, there were share-price decreases across the board, even as many companies reported earnings “beats.”

The term “value rotation” doesn’t accurately describe what occurred in early September. The proof is in the comparison between value IVE, +0.09% and so-called momentum MTUM, +0.19% indexes. Value hasn’t outperformed momentum.

Instead of a value rotation, the market is going through a cash rotation. As IVE and MTUM battle it out, cash positions are increasing. As reported by MarketWatch in October, research firm DataTrek said there was $3.4 trillion in U.S. money market funds last month, 14% higher than at the end of 2018.

As we see below, institutional selling of individual stocks has been much more severe over the past month than during last year’s fourth-quarter selloff. This matches the information from DataTrek.

A storyline is that growth is overvalued, with many software as a service (SaaS) stocks trading at 20 times sales with zero profits. Another is that the market is worried about soft IT spending. Third, there are concerns of weak growth. However, recent earnings prove that for some companies, growth and cloud spending are actually accelerating.

Alteryx

Alteryx AYX, +1.04% is a great example. The company beat analysts’ estimates on all measures, including revenue, profit and earnings per share (EPS) in the most recent quarter, yet the share price has dropped 35% in three months. Revenue jumped 65% to $103 million, with international business rising 43% to more than $28 million. Doing business overseas is always an important leap for U.S. software companies. Alteryx raised its full-year revenue outlook to $389 million-$392 million, up from $370 million-$375 million. Non-GAAP income from operations and non-GAAP EPS full-year guidance were also raised.

In the chart above, the large volume spikes coupled with noticeable price movements suggests institutional positioning. We see that selloff volume (red spikes) is much higher over the past two months than during the fourth-quarter selloff.

Alteryx’s shares were down in the days after the strong earnings report.

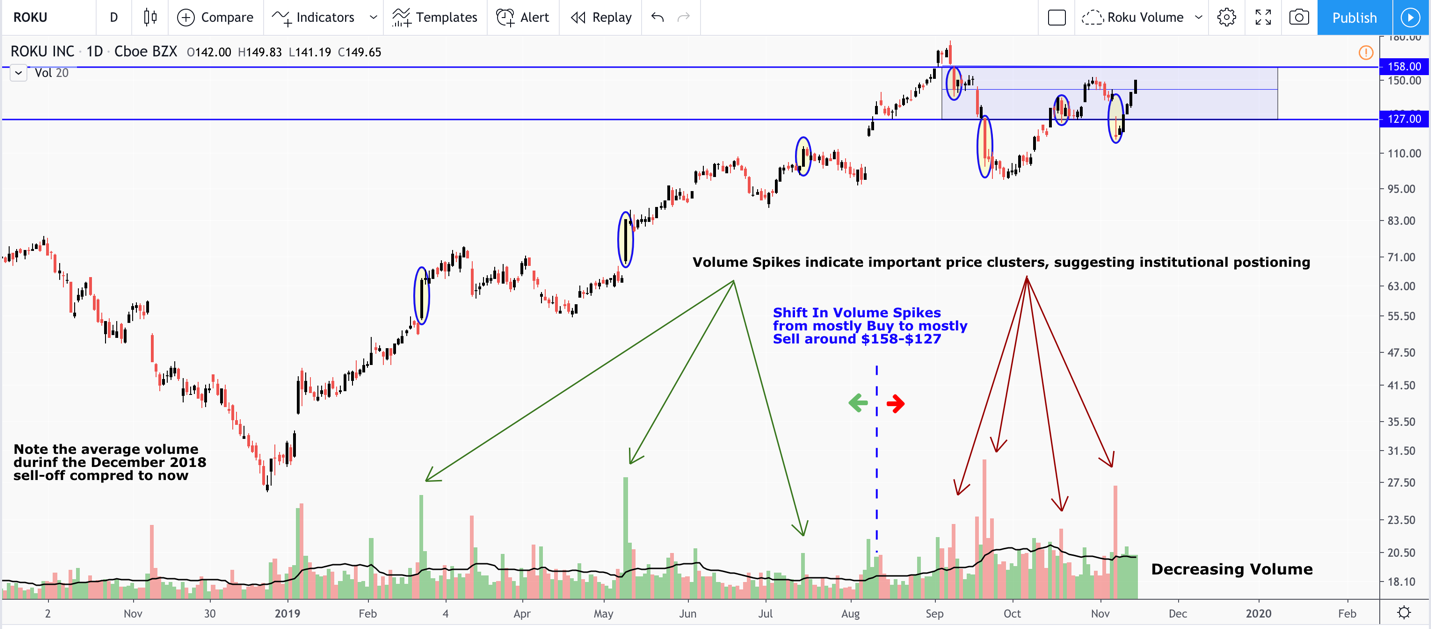

Roku

Roku’s ROKU, +1.79% stock also fell, even though the company beat estimates for every single number. Revenue of $260.9 million was above the Wall Street consensus of $257 million. Platform revenue surged 79%, while ad revenue more than doubled. Roku had an adjusted loss of 22 cents a share, better than the 28-cent loss expected by analysts. Still, the stock plunged 16%. While the shares have recovered, there was steep institutional selling going into the earnings that was similar to what happened to Alteryx.

The chart above also shows large-volume selling, suggesting institutional positions. The selloff volume is much higher than it was during the fourth-quarter decline.

Veeva Systems

Veeva Systems VEEV, -0.91% is another example. The company’s operating margins expanded from 17% in 2016 to 27% in the most recent quarter. Veeva beat on earnings, reporting 55 cents per share, compared with estimates of 48 cents. Full-year guidance exceeded analysts’ estimates. Veeva is also strong on cash flow, having increased it from $40 million in 2014 to almost $400 million in the most recent quarter. The company has $1.4 billion in cash reserves and no debt.

Despite this, Veeva’s stock price has dropped 12% from its three-month high of $168.42 and was immediately down 3% after earnings in late August.

Pinterest PINS, -0.20% had one of the more interesting reports this earnings season. The company beat on EPS of 1 cent compared with an expected 4-cent loss. The company also beat on monthly active users, with 322 million reported versus 311.8 million expected. Analysts had forecast $280.6 million in revenue, while Pinterest reported $279.7 million.

The company actually raised guidance on the low end, but analysts elected to set the bar higher, and therefore, it was reported as lowered guidance. The miss of less than $1 million resulted in a 21% share-price drop, or a $3 billion loss in market cap.

Earnings erosion

The overall market is experiencing an earnings erosion, with a 4.1% decline from a year earlier, exceeding the estimated 3.3% decline, as discussed by MarketWatch’s Phil van Doorn. On that note, both Intel INTC, +0.50% and Apple AAPL, +0.50% reported flat year-over-year growth, yet the stocks rallied post-earnings as the market was pacified by EPS numbers that were goosed with buybacks.

The tech decline in 2018’s fourth quarter created a lot of fear, as did the September “value rotation,” yet the October earnings selloff was more muted. It could have been that the recent declines weren’t as orchestrated by large institutions or as impactful on investors’ psyche.

The truth is that many of these growth stocks are stronger than they were in the previous quarter. The stocks that declined have one thing in common: They produced substantial gains in 2019, which means there was cash to pocket. They were not dogs in the first half of 2019; they were actually market leaders.

Know your winners

Instead of a rotation into value, the current trend reveals many institutions are, in fact, taking gains and rotating into cash. While many prognosticators are predicting a recession or black-swan event, investors haven’t panicked. There has been a slow and steady drain.

In a previous analysis on MarketWatch, I had cautioned investors to know their winners as the market clearly did not have a method for differentiating beyond traditional valuation metrics. The safest way to trade tech stocks is to align investments with an overall macro technology trend in addition to fundamental analysis (the macro trend will prevail), and to have an exit strategy, such as a trailing stop, for risk management.

We’ve seen some stocks quickly recover, such as Roku, and others that haven’t rebounded, such as Veeva and Alteryx. Even the more solid recoveries suggest they are boosted by momentum and swing traders as they remain between support and resistance, as well as retail investors, as implied by lower volume.

The true test will be the upcoming cloud-software earnings reports to determine if the pattern will continue.

The writer has owned Roku shares since the IPO, and also call options on Pinterest.

Beth Kindig is a San Francisco-based technology analyst with more than a decade of experience in analyzing private and public technology companies. She owns Roku shares. Kindig publishes a free newsletter on tech stocks at Beth.Technology and runs a premium research service.