Not all the “Magnificent Seven” stocks are strong buys right now.

“Magnificent Seven” stocks refers to a phrase coined by Bank of America analyst Michael Hartnett to describe the cohort leading the market. They are:

- Apple (AAPL 0.12%)

- Microsoft (MSFT -0.76%)

- Nvidia (NVDA -2.13%)

- Alphabet (GOOG 0.89%) (GOOGL 0.75%)

- Amazon (AMZN -1.67%)

- Meta Platforms (META -0.09%)

- Tesla (TSLA 2.46%)

Tesla lagged behind the others this year due to a decreased demand for electric vehicles, but the other six have done quite well. However, a few of them have reached points where they are no longer attractive buys, leaving only a few that I’d buy right now.

There are four stocks I’m not interested in right now

If you don’t have a generative artificial intelligence (AI) product, you don’t belong in this group. Although Tesla isn’t actively engaged in generative AI, its AI research is focused on full self-driving (FSD) capabilities, which is another worthy endeavor, so I’ll give it a pass.

However, Apple was considerably late to the AI party and couldn’t even get its Apple Intelligence product ready to go for the iPhone 16 launch. Couple that with the fact that Apple is extremely expensive (30 times forward earnings) with flattening revenue growth, and it quickly falls off the list of good buys.

As mentioned, the EV market is going through a downward demand wave, so I’m not interested in Tesla.

Both Nvidia and Microsoft are quite pricey, although they may still be good investments in their own right. However, they just don’t have the value of Amazon, Meta, and Alphabet.

AWS is on the rise

Amazon makes the list of stocks to buy because of its resurging cloud computing division, Amazon Web Services (AWS). Although Amazon is expensive in its own right, with a forward price-to-earnings (P/E) ratio of 32 times, it has the potential to drastically decrease that price tag thanks to AWS.

Despite accounting for 18% of Amazon’s Q2 revenue, AWS accounted for 64% of its operating profit. This means that if AWS grows at a faster pace than the rest of Amazon’s business, Amazon’s profits will rise at a faster pace than revenue growth. Couple that with several profit-boosting initiatives, and Amazon’s case to grow profits rapidly takes form.

As a result, I’m not concerned with Amazon’s price tag, and it presents itself as a very attractive buy.

Alphabet is much cheaper than the market

Alphabet’s investment case is fairly simple: It’s cheap. The parent company of Google, YouTube, and the Android operating system has a healthy but growing ad business, which helps fund its other endeavors.

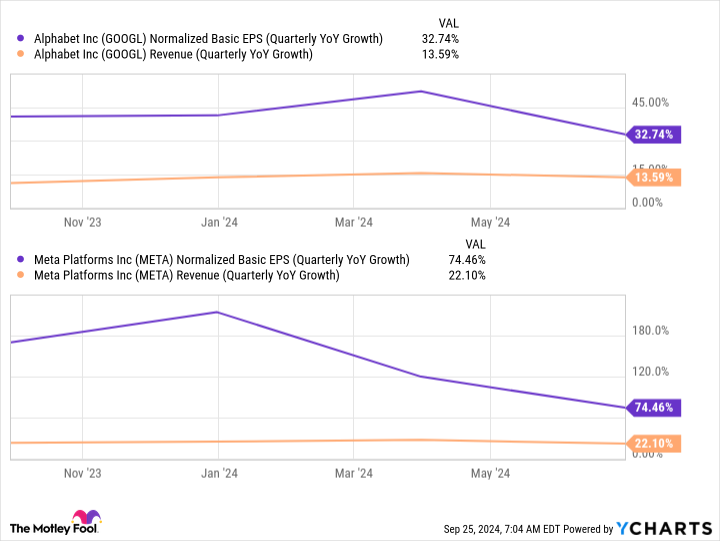

Unless its AI tools really take off, Alphabet’s growth isn’t going to be spectacular, but it will likely be consistently in the low double digits, which is enough to provide market-beating growth. Couple that with an improving operating margin and hefty stock buybacks, and you get a stock that can consistently grow earnings in the 20% range (it grew them by over 30% in Q2).

Despite this, Alphabet’s stock trades for 18.6 times forward earnings, which is cheaper than the S&P 500, which trades at 23 times forward earnings. Alphabet has the formula to steadily outperform the S&P 500, yet trades at a discount. This is a huge mismatch, and it makes the stock a screaming buy right now.

Meta is rapidly growing profits and revenue

Lastly, Meta Platforms sneakily posted the second-highest year-over-year revenue growth of the group over the past year (behind Nvidia’s incredible growth).

Like Alphabet, Meta’s business is driven by ads on its social media sites, including Facebook and Instagram. This allows Meta to fund its AI endeavors, buy back stock, and grow its dividend.

Basically, Meta is doing the same thing as Alphabet — but at a faster pace.

GOOGL Normalized Basic EPS (Quarterly YoY Growth) data by YCharts

As a result, you’ll pay a slightly higher premium for Meta’s stock at 23.6 times forward earnings. But I think this is a worthy premium to pay, as Meta is currently executing at a high level.

Even though the Magnificent Seven have had a strong 2024, there are still reasons to buy some of the group, and I suspect that their performance will continue to be strong moving forward.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.