No matter how much you like a given stock, you can usually find another you like even better. Eventually, though, you’ll get to the one stock that stands above all the rest.

In January, I identified stocks that I especially liked for 2024. One ranked at the top of the list as my highest-conviction stock. Luckily for me, that stock has trounced the market this year. What is this stock, and should you buy it for 2025?

My highest-conviction stock for 2024

I won’t build the suspense further. My highest-conviction stock for 2024 was…Amazon (AMZN 0.73%). With only a few days remaining in the year, Amazon’s shares have soared around 47% — roughly twice as much as the S&P 500 index.

Why did Amazon rank so highly for me? In part because I didn’t view the company’s business as risky. After all, Amazon is the 800-pound gorilla of e-commerce. It’s the leader in the cloud services market. I liked (and still like) its moat.

Amazon’s growth opportunities also seemed obvious to me at the beginning of 2024. I fully expected the company’s Amazon Web Services (AWS) unit to deliver strong growth as organizations shifted their IT spending to the cloud. My take was that artificial intelligence (AI) would continue to serve as a major tailwind for AWS.

I also recognized in January that Amazon was focusing intently on increasing its profitability. The company’s earnings had more than tripled year over year in its most recent quarterly update. I wrote, “I expect these efforts to show up in Amazon’s quarterly results this year and provide nice catalysts that further boost its share price.”

Why Amazon has performed so well this year

It didn’t require Nostradamus-like powers to predict any of those things. Amazon is one of the most well-known companies in the world. Anyone who even cursorily examined its business would realize it was a good investment.

Also, well over 100 other stocks with market caps of $10 billion or more delivered even greater gains than Amazon has so far in 2024 (including several that I own). Perhaps one of them should have been my highest-conviction stock for the year.

However, Amazon has nonetheless performed very well in 2024. And it did so for exactly the reasons I (and plenty of other investors) thought it would. The company’s e-commerce business has unsurprisingly hummed along with Prime Day yet again notching record sales. AWS has continued its momentum with more AI offerings to customers.

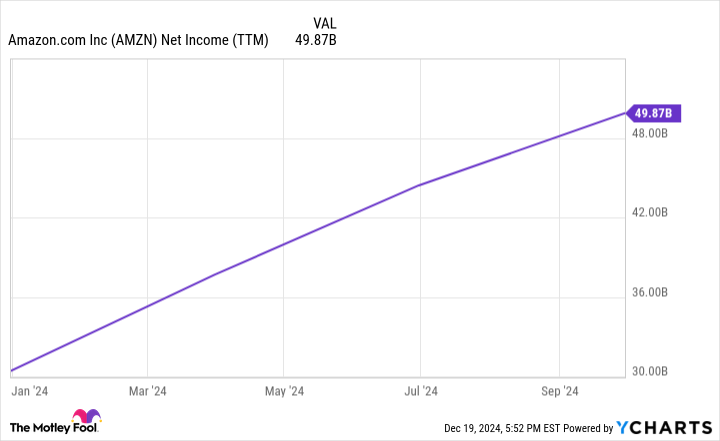

Arguably most importantly, though, Amazon’s focus on profitability has paid off as anticipated. The chart below shows how the company’s trailing-12-month net income has increased over the last year.

AMZN Net Income (TTM) data by YCharts

As earnings go, so go share prices (at least over a long enough period). I would have been stunned if Amazon stock hadn’t risen significantly this year considering the progress it’s made on improving its bottom line.

Is Amazon stock a good pick for 2025, too?

I’m thankful Amazon has been a solid winner for me this year. But is the stock a good pick for 2025, too? I think so.

The investing thesis I laid out for Amazon in early 2024 remains intact. The company still has a tremendous moat. It still has strong growth prospects, particularly with AWS. Amazon CEO Andy Jassy is sticking with his prediction that the current mix of roughly 85% of global IT spending on-premises versus 15% in the cloud will flip over the next 10 years or so. AI continues to serve as a massive tailwind for AWS. Amazon’s profitability will likely increase further next year.

All things considered, Amazon will still rank among my highest-conviction stocks going into 2025. Will it retain its position at the top of my list? I’m still thinking about that question.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.