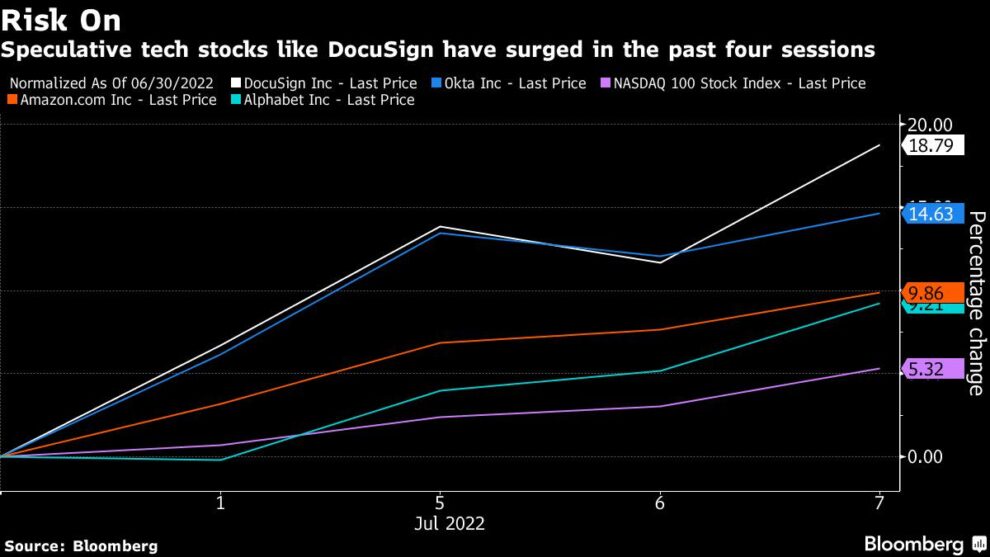

(Bloomberg) — A rally in risk assets this week is sending traders to some of the most speculative corners of the technology sector, where gains in beleaguered stocks are more than double those of Nasdaq 100’s advance.

Most Read from Bloomberg

Shares in e-signature company DocuSign Inc., cybersecurity software maker Okta Inc. and Atlassian Corp. have jumped 19%, 15% and 14% respectively as a four-day rally in the Nasdaq 100 gains momentum. The tech-heavy index is up 5% this week, on track for its longest stretch of gains since March.

While most of the gains in the Nasdaq and other broad indexes is coming from tech stalwarts such as Apple Inc., Amazon Inc. and Microsoft Inc., higher demand for companies with lower profitability and higher valuations, indicates investors’ willingness to embrace more risk.

For now, at least.

This week’s rally has occurred amid a drop in US Treasury yields, whose rapid rise this year has made the technology sector one of the worst performing in the stock market.

The selloff has weighed most heavily on the shares of companies such as Netflix Inc. and software maker Zscaler Inc., which are down 69% and 48% so far in 2022. Overall, a group of unprofitable tech companies tracked by Goldman Sachs is down more than 40% this year, compared with 26% drop for the Nasdaq 100.

“A lot of these names are down 60% to 70% in some cases, so it’s understandable for them to have some type of bounce here,” said Michael O’Rourke, chief market strategist at Jonestrading.

Netflix is up 5.2%, while Zscaler has gained 7% this week. The Nasdaq 100 ended the session 2.2% higher.

Thursday’s broad advance came after the number of Americans applying for jobless benefits rose, offsetting fears that the Federal Reserve may require more interest-rate hikes if labor market growth is slowing. The Labor Department’s monthly jobs report is due on Friday.

Attention next week will turn to the start of the second-quarter earnings season, with anxieties still running high about a potential recession and in tech, slowing demand for everything from seminconductors, to iPhones. However, better-than-expected results from Samsung Electronics on Thursday helped spark gains in chipmakers.

Jason Benowitz, a senior portfolio manager at Roosevelt Investments, said the prospect of more tightening from the Fed brings too many risks.

“We are waiting for clearer signs that we are closer to a bottom and we’re not there yet,” he said.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.