The optimism sparked a week ago by better-than-expected results from some of U.S. banking’s big beasts has faded. The first quarter earnings season now might generously be described as mixed.

If news on corporate profits can’t push the S&P 500 SPX, -0.60% through the top of its five-month range between 3,800 to 4,200 then bulls may soon start re-focusing on macroeconomic factors for support — specifically a boost to sentiment from a belief the Federal Reserve is finished raising interest rates and will start cutting soon.

But is this Fed-pause-and-cut rally narrative realistic? Analysis from Wells Fargo and Evercore ISI suggest that over the medium term it is not.

We may reach the pivot point in just a dozen days. Markets place an 83% chance on the Fed increasing borrowing costs by another 25 basis points to a range of 5% to 5.25% on May 3rd. The probability of a similar sized hike in June are priced at just 21.7%, and still lower thereafter. Cuts are deemed likely by early fall.

Consequently, many investors think the Fed will say in its next statement that it is in wait-and-see mode. However, there is much debate about how long the central bank may pause before cutting rates again, and this may cause some disappointment for equity investors.

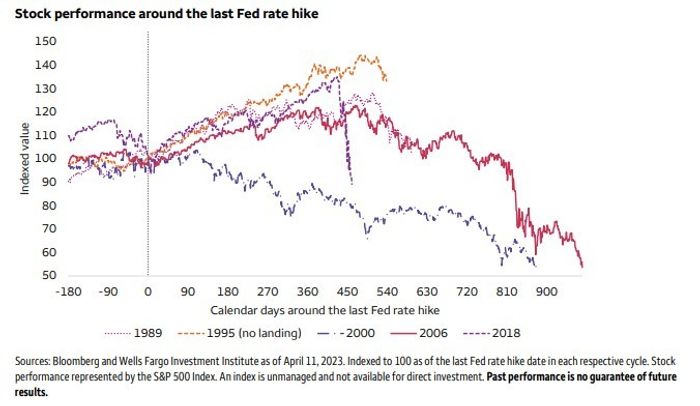

And according to Austin Pickle, investment strategy analyst at Wells Fargo, any pop from indications that a monetary tightening cycle is over is likely to be short-lived.

He produced the chart below which shows the S&P 500’s performance around the end of the past five rate hiking cycles and how it fares until the barometer’s subsequent notable low.

“The chart illustrates that since 1989, stocks have rallied after the hiking cycle headwind is removed, Historically, though, outside of the 1995 ‘no landing’ scenario, the rally fizzles out and stocks are dragged lower as the macro environment deteriorates.” says Pickle.

Indeed, Pickle reckons much of the S&P 500’s 15% bounce off the October lows already reflects the expected removal of the uncertainty about additional Fed rate hikes and so: “As markets refocus on the deteriorating economic and earnings realities…we expect the stock rally to struggle.”

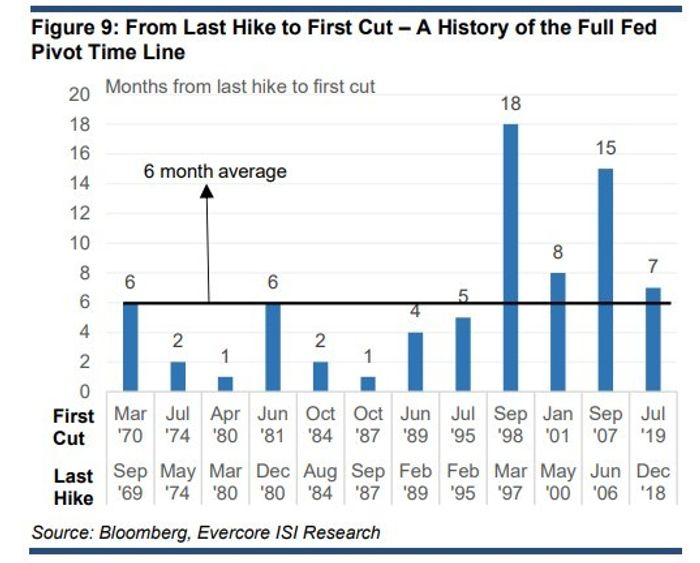

Furthermore, any quick move to cutting rates of the kind some in the the market are hoping for will only occur if a dire situation already exists, reckons Julian Emanuel at Evercore ISI.

The average time before the Fed’s last hike and first cut is 6 months as the table below shows.

“While 2 months from last hike to first cut is obviously not unprecedented, such action would likely require a stock market crash like 1987, the current banking turmoil to deepen like 1984’s Continental Illinois episode, a recession in the midst of one of the great interest rate spikes of all time like 1980, or 1974’s classic Burns Blunder, where the recession and inflation collided with an American president (Nixon) on the verge of resignation, creating complete governmental chaos,” says Emanuel.

Markets

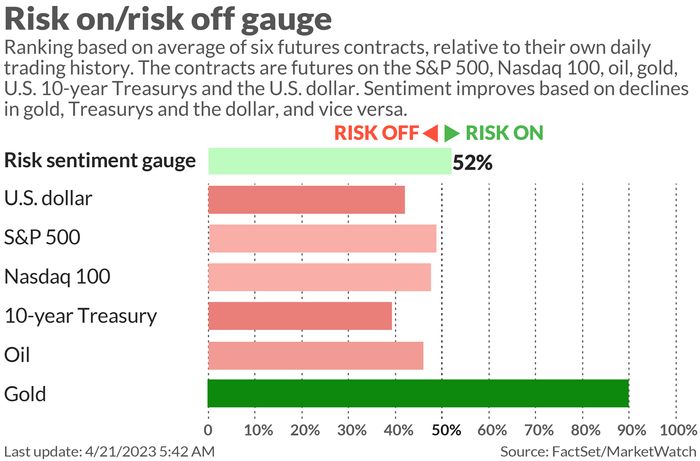

Stock futures ES00, -0.22% NQ00, -0.43% YM00, -0.10% and 10-yearTreasury yields TMUBMUSD10Y, 3.535% were little changed in early trading. Gold GC00, -1.07% dipped back below $2,000 an ounce and oil CL.1, +0.05% traded near three week lows.

Try your hand at the Barron’s crossword puzzle and sudoku games, now running daily along with a weekly digital jigsaw based on the week’s cover story. To see all puzzles, click here.

The buzz

Tesla shares TSLA, -9.75% are rallying a touch in premarket action but their 10% stumble on Thursday helped deliver a near $13 billion hit to Elon Musk’s wealth.

It’s a somewhat thinner session for company earnings, but among those presenting their numbers are Proctor & Gamble Co. PG, +0.37%, Schlumberger Ltd. SLB, -1.25%, and PPG Industries Inc. PPG, +0.64%.

U.S. economic data due Friday, include the S&P flash services and manufacturing PMI’s for April, released at 9:45 p.m. Eastern.

It’s a thankfully quieter day for Fedspeak with just Governor Lisa Cook in line to make comments, at 4.35 pm.

The pound GBPUSD, -0.41% fell back after U.K. retail sales fell in March by a larger-than-expected 0.9%. In unrelated news Britain’s deputy prime minister Raab resigned after bullying claims.

Best of the web

When will I retire? How about never.

China building cyber weapons to hijack enemy satellites.

Rural Americans are importing tiny Japanese pickup trucks.

The chart

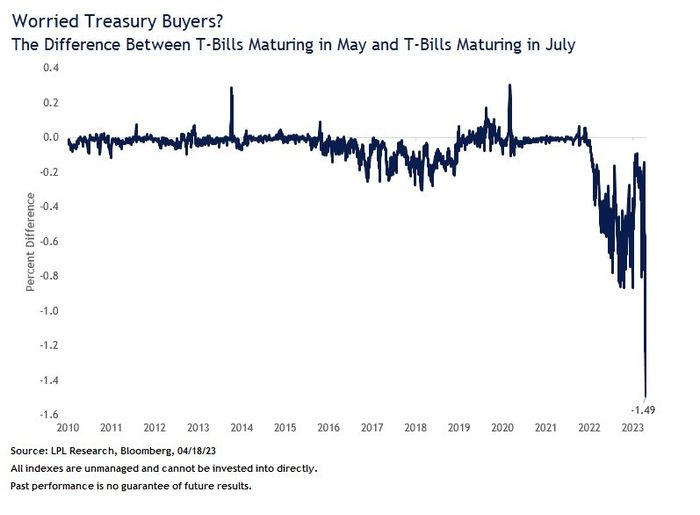

It is generally reckoned by equity analysts that the market is so far dismissing any concerns about the chances of the U.S. debt ceiling not being raised in coming months and the government technically defaulting on its obligations, possibly as soon as June. However, as Lawrence Gillum, fixed income strategist at LPL Financial Research notes, the bond market is paying attention.

“Treasury bills (t-bills) that mature in May are yielding around 1.2% less than t-bills that mature one month later (around June) and a record 1.49% less than t-bills that mature in July. As Treasury is likely able to make the May payment, investors have bid up the price of these securities seemingly at the expense of debt that matures around the expected x-date(s),” Gillum writes. Read: Growing worries over U.S. debt ceiling send 1-month T-bill yield tumbling

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, -9.75% | Tesla |

| BBBY, -35.34% | Bed Bath & Beyond |

| MULN, -5.78% | Mullen Automotive |

| BUD, -0.82% | Anheuser-Busch InBev ADR |

| AMC, -2.55% | AMC Entertainment |

| GME, -5.11% | GameStop |

| NIO, -5.80% | NIO |

| AAPL, -0.58% | Apple |

| NVDA, -2.96% | Nvidia |

| AMZN, -0.47% | Amazon.com |

Random reads

Michelangelo had a high opinion of himself. Very high.

Elephant seals survive on 2-hour underwater power naps.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton