An uneasy mood is rippling through markets.

For starters, we’ve had chaotic scenes out of Hong Kong where police have been firing tear gas on protesters who amassed in the thousands to push back against a China extradition bill. That news has hit local stocks hard, and may be partly why we’re seeing some safe haven moves to gold, Treasury bonds and the Japanese yen.

But there’s also some buyer’s remorse playing out across Wall Street, as remarks by President Donald Trump on Tuesday curtailed some optimism over a China trade deal, and amid talk that investors are too optimistic about U.S. rate cuts. Consumer price inflation coming ahead of the open may shed more light on those rate-cut prospects.

Onto our call of the day from Oxford Economics, which has updated its quarterly outlook and admits the global economic is looking slightly weaker. The good news? Their base case isn’t alarming, as they say the world’s economy should still grow 2.7% this year and a bit more in 2020.

But they’ve got a couple of grim worst-case scenarios. One envisages the U.S. economy slowing sharply from the third quarter of this year, then falling into recession as corporate profits, hitting business and investor sentiment. The fallout from this could trigger a 30% drop in the S&P 500 SPX, -0.03% in the third quarter. Within a year the U.S. would be in recession, with the Fed cutting interest rates aggressively to “stave off the worst of the shock,” says the economic forecasters.

The other downbeat scenario pictures bleak fallout from a trade-war escalation. The U.S. slaps a 25% tariff on China and Mexico imports, and a 10% blanket tariff on Europe goods, and 25% on non-North American cars. Based on those assumptions, U.S. stocks could be 15% lower by late 2019, the firm says.

But let’s leave things on a happy note. Under yet one more scenario they predict further stimulus from China, de-escalation in trade tensions supportive policy from central banks and much improved investor sentiment across the globe. All that good news could mean a boost in the high single digit percentage ballpark by the first quarter of 2020.

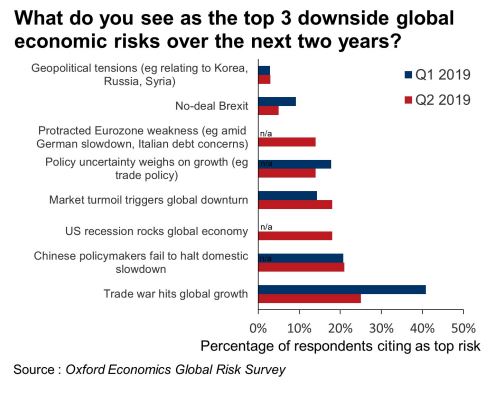

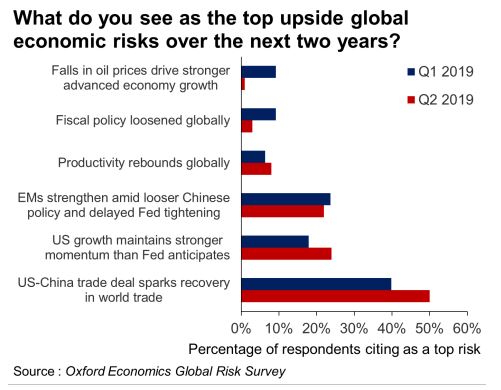

Here are Oxford’s charts showing top downside and upside global economic risks for the next three years:

The market

As we wait for consumer price data, Dow YMM19, -0.26% S&P ESM19, -0.26% and Nasdaq NQM19, -0.44% futures are lower. On Tuesday, the Dow snapped a six-day win streak.

Gold GCQ19, +0.58% is climbing and the dollar DXY, +0.06% is flat.

Read: Why Trump’s tweets about the U.S. dollar might soon pack a lot more punch

Europe stocks SXXP, -0.57% are under pressure, while Asia was largely lower, led by a 1.7% drop in a tense Hong Kong HSI, -1.73%

The chart

Our chart of the day looks at a big mover for Wednesday — crude CLN19, -2.65% which is sliding after an industry report showed climbing U.S. supplies and investors wait for official Energy Information Administration data later.

“With oil now trading back near the recent lows, we could see a real test of whether there was actually any substance behind last week’s rebound,” Craig Erlam, senior market analyst at OANDA, told clients.

The economy

Consumer price inflation data will be followed by federal budget figures.

The buzz

In the biggest protests since 2014, thousands of demonstrators in Hong Kong surrounded government headquarters on Wednesday, forcing the delay of a legislative session to vote on a bill that would allow criminal suspects in Hong Kong to be sent for trial in mainland China. Police opened up with tear gas and water cannons and those protesters are still on the streets.

Tesla TSLA, +1.98% shares are up after CEO Elon Musk told shareholders late Wednesday that “there’s not a demand problem. Sales have far exceeded production and production has been pretty good,” he said.

Medidata MDSO, +4.36% shares are off after French technology group Dassault DSY, -1.54% said it would buy the U.S. health software group in a $5.8 billion deal. And private equity group KKR KKR, +0.33% announced a $7.7 billion takeover offer for German media group Axel Springer SPR, +11.65%

As a U.S. ban starts to sting, Chinese tech group Huawei has been forced to cancel a new laptop launch and halt production of its personal-computer business. Nintendo 7974, -3.53% meanwhile, has reportedly shifted some output of its popular Switch gaming device away from China to sidestep U.S. tariff action.

A “deepfake” video of Facebook FB, +1.88% CEO Mark Zuckerberg is making the rounds.

Random reads

U.K. to put into law a plan to cut its greenhouse emissions to zero by 2050

A deadly Ebola outbreak in Congo has reached Uganda, leaving one child dead

13-0 victory by U.S. women’s soccer team highlights a major pay dispute

A Colorado Christian cakeshop is in trouble again

Meatless fast-food burgers — not much healthier, and a lot more expensive

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.