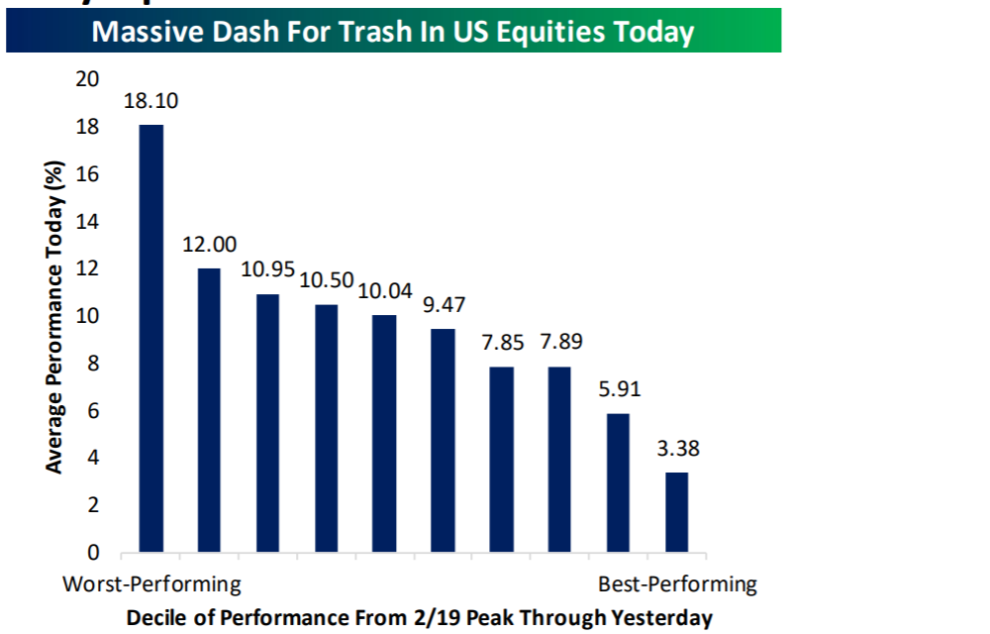

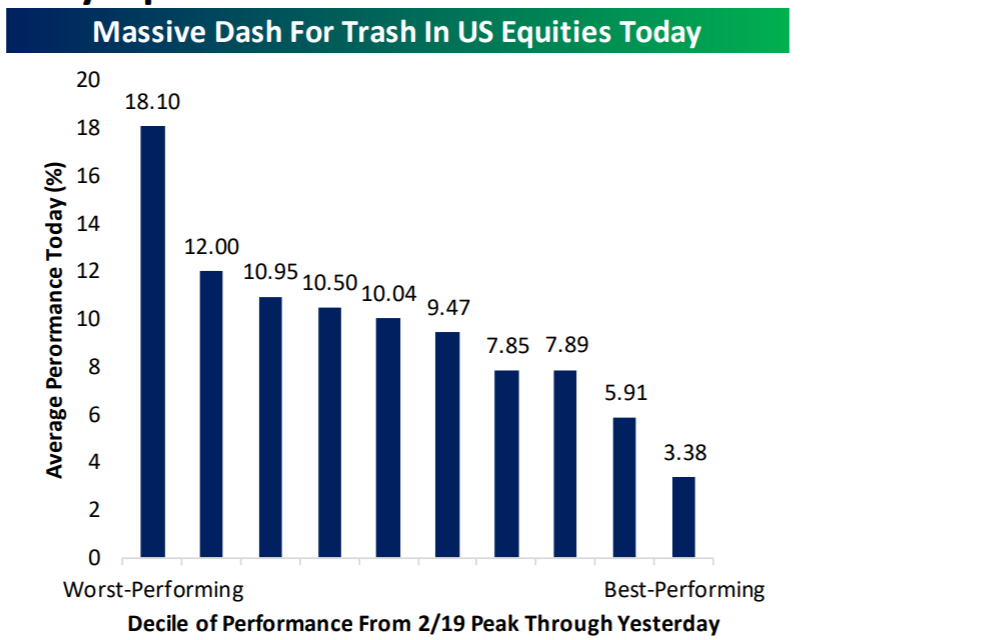

Not just Turnaround Tuesday — Wall Street just had what could best be called a Trashy Tuesday.

According to Bespoke Investment Group, the average stock in the bottom 10% performers since Feb. 19 shot up an average of 18%.

After the Senate reached agreement on a $2 trillion stimulus bill, even the bond king, DoubleLine CEO Jeffrey Gundlach, seemed to accept U.S. stocks have plenty of upside.

The S&P 500 SPX, +9.38% closed at 2447.33. Gundlach did not follow up on the tweet.

So how much is the stimulus really worth to the U.S. economy?

Tom Porcelli, chief U.S. economist at RBC Capital Markets, did some back-of-the-envelope calculations. The U.S. economy was running at a $21.5 trillion, or $413 billion per week, rate before the virus hits. Assuming the economy is 30% shut down, the $2 trillion probably gets you through 16 weeks, he said.

So whether markets have correctly priced the virus outbreak turns to the probabilities of how long it will be present. “Markets have to account for some probability that all outcomes are not bad outcomes. Unfortunately, in the current narrative, it seems we have a large left tail and only modest right tail in terms of the distribution,” he said.

The buzz

Senate Majority Leader Mitch McConnell and Minority Leader Chuck Schumer said from the floor that a deal was struck on the stimulus package. The bill includes provisions to extend bridge loans to companies, boost the duration and size of unemployment benefits and provide tax rebates, among other features.

The Senate is due to reconvene at noon Eastern.

The bill is expected to easily clear the Senate and then move to the House of Representatives, which will try to pass it by a procedure called unanimous consent. If any House member were to object, the full House would have to convene, no easy feat given that most lawmakers are back in their home districts.

The eurozone, meanwhile, is considering ideas including using 2% of gross domestic product from its bailout out fund as a credit line, and issuing a so-called coronabond. European leaders are due to meet on Thursday.

According to the Johns Hopkins tracker, there are over 425,000 cases worldwide. Deaths in Italy surged again after tentative signs of slowing.

Asset manager BlackRock BLK, +13.52% was tapped to run the Federal Reserve’s purchases of commercial mortgage-backed securities.

The markets

U.S. stock futures YM00, +0.40% ES00, -0.22% were pointing to further gains, and overseas stocks SXXP, +0.69% rallied.

Gold GC00, -0.29% futures slipped while most other commodities rose.

The yield on the 10-year Treasury TMUBMUSD10Y, -3.03% edged higher.

The chart

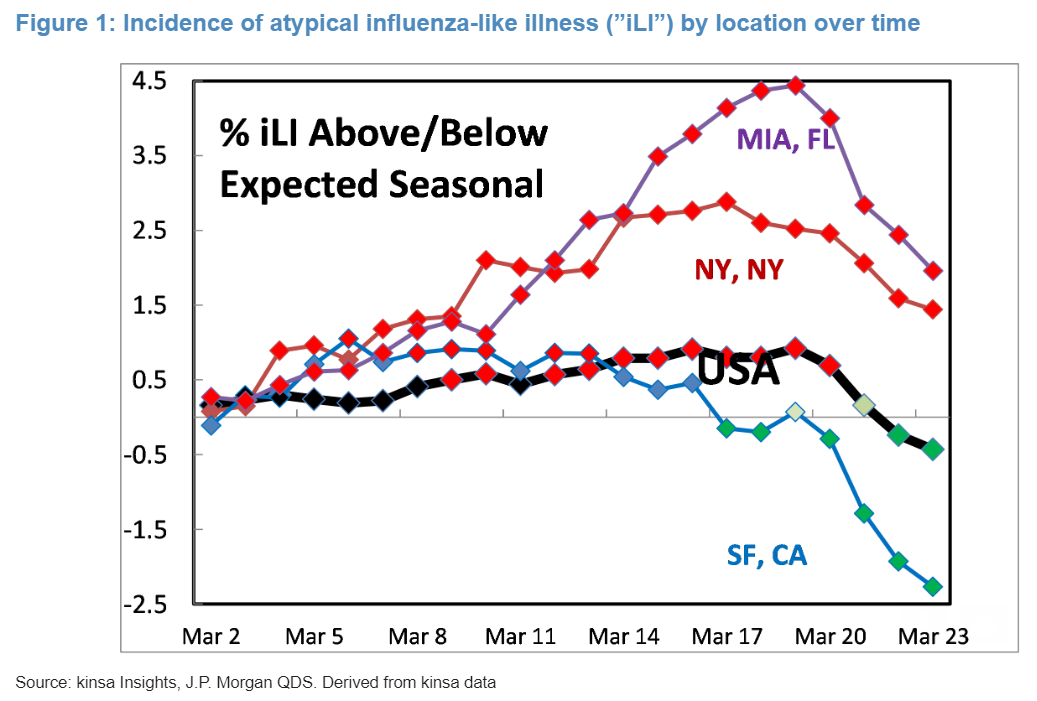

So-called “smart” thermometers are a way to get insight into how the pandemic is spreading. Atypical readings are likely — though not definitely — associated with COVID-19. The chart here, drawing on data from Kinsa Insights and reformatted by JPMorgan, shows that an outbreak in Miami, Florida could be coming. But it also shows that, nationally, the shutdowns and social distancing efforts have had a positive effect. “Taking into account the unprecedented monetary and fiscal measures being implemented, as well as unprecedented asset declines over the past month, we maintain that asset price recovery is likely and our pre-pandemic equity price target for 2020 is achievable sometime in the first half of 2021,” said Marko Kolanovic in a note to clients.

Random reads

Breakfast-chain Waffle House — whose operations are used by federal emergency officials as a proxy for the current state of a community — has closed 365 locations.

Scientists say there may have been life once on Mercury.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>