Markets are buckled into the fighting chair as another day of the retail-led feeding frenzy on shorted stocks is about to come online.

In case you thought the trading mania was a limited battle between internet day traders and Wall Street hedge funds: videogame retailer GameStop was one of the most traded stocks by value in the U.S. on Wednesday.

Amateur investors, many based on the Reddit group WallStreetBets, are jumping into heavily-shorted stocks, driving prices to astronomical levels and forcing hedge funds to sell bigger, safer bets to cover losses.

Selloff is creeping to other investments and spooking sentiment. Major indexes took a 2% to 3% ride down on Wednesday and are set to continue surfing.

A must-read: Tendies? Diamond hands? Your guide to the lingo on WallStreetBets, the Reddit forum fueling Gamestop’s wild rise

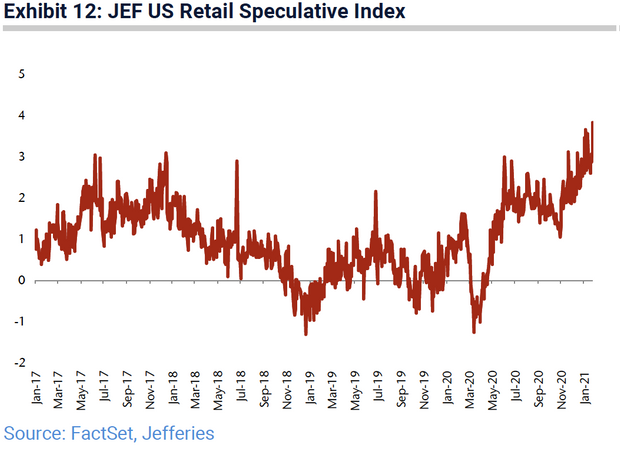

Our call of the day comes from the U.S. equity researchers at Jefferies, led by global equity strategist Sean Darby, with a bonus call from Sébastien Daly, a strategist at Nordea Asset Management.

The team at Jefferies is clear that the correction in share prices has little to do with fundamentals. Rather, what’s happening is a reflection of a “sentiment shift within some of the more overbought and speculative parts of the market.”

The group’s retail speculative index, measuring the deviation from trend of assets where value is hard to determine, is high at 4 standard deviations. “Hence, there is plenty of air to come out of the riskier financial assets,” the team said.

Darby’s team noted that the short-term worry is whether the “popping” of riskier parts of the market will create a domino effect, as mainstream equities are liquidated to stem losses.

But Galy, of the Nordic asset manager Nordea, says it is too early to buy the dip, because there is more to come.

The big moves to cover shorts at a time of high leverage typically forces more deleveraging, Galy said. This is because the constraint on capital from the risk of losses on investments is ratcheting up.

“As a consequence, the cost of hedging downside risk has sharply increased,” Galy said. “This risk reduction could last a few days followed by a sharp liquidity driven rebound in U.S. and to a lesser extent European stocks.”

Galy said that even a dovish Federal Reserve meeting on Wednesday couldn’t turn around this market, which is another signal that it may last.

The buzz

Shares in GameStop GME, +134.84% touched the $500 level in the premarket before pulling back. The stock was just $19 heading into 2021. Fashion brand Nakd NAKD, +252.31% is another stock making a big leap in the premarket, up 130%.

In a Securities and Exchange Commission filing this morning, cinema-theater chain AMC AMC, +301.21% revealed that holders of the company’s convertible bonds have chosen to convert the notes into stock, as shares in the company have rallied around 330% since Tuesday.

Apple AAPL, -0.77%, Facebook FB, -3.51%, and Tesla TSLA, -2.14% posted earnings after the close yesterday. Technology giant Apple topped $100 billion in quarterly revenue for the first time, crushing expectations, as social-media company Facebook also beat estimates, with sales soaring 156% from “other revenue” — like virtual-reality headsets and video-chat devices. Electric-car maker Tesla reported its sixth straight quarter of profit, but it was a miss on expectations.

But if you can peel your eyes away from the stock market, it is a big day on the economic front. Initial and continuing jobless claims are due at 8:30 a.m. EST, with around 875,000 people expected to have filed for unemployment last week. Gross domestic product figures for the fourth quarter of 2020 will come at the same time, before new home-sales figures for December are reported at 10 a.m.

After the Federal Open Market Committee decided to hold monetary policy steady yesterday, Fed Chair Jerome Powell gave dovish signals that the central bank wasn’t done restoring the COVID-19 pandemic-ravaged economy to health. “We have not won this yet,” he said.

The markets

It looks like another wild day on Wall Street. Yesterday’s tumult saw the Dow Jones Industrial Average DJIA, -2.05% tumble more than 630 points, and stock market futures YM00, +0.13% ES00, -0.05% NQ00, -0.48% are pointing down, set to continue the selloff. Asian markets NIK, -1.53% HSI, -2.55% HSI, -2.55% fell across the board and European indexes SXXP, -0.47% UKX, -0.70% DAX, -0.43% PX1, +0.16% are firmly in the red.

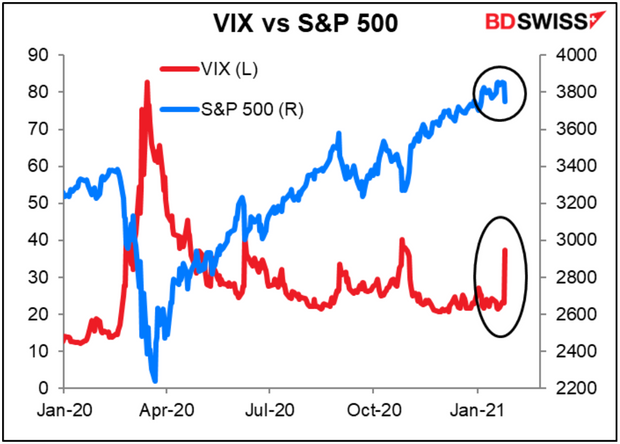

The chart

Our chart of the day, from Marshall Gittler at BDSwiss, shows how the S&P 500 SPX, -2.57% dropped by the most since October 2020, and the VIX index of expected volatility saw its biggest one-day rise since the COVID-19 pandemic hit in March 2020.

The tweet

When the sharks root for the fish. Billionaire entrepreneur and investor Mark Cuban — of “Shark Tank” fame — is rooting for Reddit’s WallStreetBets traders.

Random reads

An Oklahoma lawmaker has proposed a ‘Bigfoot’ hunting season with a new bill.

Key West wants to ban people from feeding fat, feral, free-roaming chickens.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.