GameStop GME, +7.14%, the videogame retailer that is the posterchild for so-called meme stocks, reports results after the close of trading, a chance for the outside world to mark message-board hype to reality.

Hype or not, the Reddit WallStreetBets message board is undeniably chalking up victories. Fast-food chain Wendy’s WEN, +25.85% surged 26% on Tuesday, as users of the WallStreetBets message board championed the stock, and the company’s social-media team was quick to make sly jokes about its new status.

Another favorite, online e-commerce platform ContextLogic WISH, +49.87%, jumped close to 50% on Tuesday.

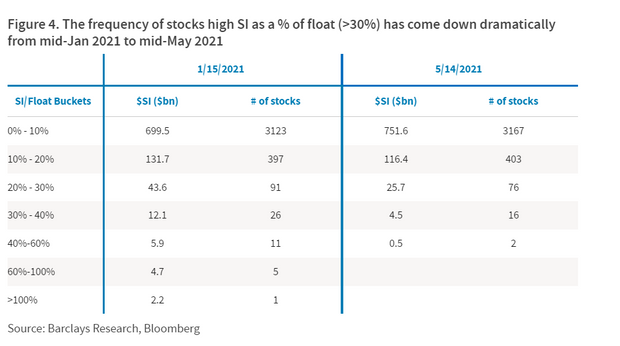

Here’s both the good and bad news for the retail-investing community. Analysts at Barclays point out that the number of stocks with high short interest as a percent of their float has come down drastically.

This in turn explains why the broader stock market really isn’t moving much, even as the fortunes of the meme stocks take wild rides. “The current short squeeze is more localized probably because the number of stocks with high short interest has come down dramatically,” said strategists led by Maneesh Deshpande.

Perhaps that is a Pyrrhic victory, because it means there are fewer opportunities for Redditors to exploit.

The chart

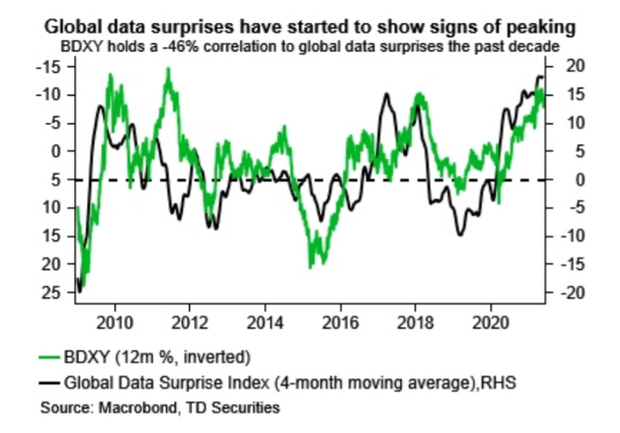

The U.S. dollar DXY, -0.10% has tended to weaken when global economic data have come in surprisingly strong. But those surprises seem to be peaking. Mark McCormick, global head of foreign exchange strategy at TD Securities, says the best-case scenario for the U.S. dollar combines higher real rates, softer global data and a pullback in risk.

The economic docket is quiet ahead of Thursday’s release of U.S. consumer-price data. In China, producer prices accelerated by 9% year-over-year in May, while consumer prices edged up 1.3%.

The market

Ho-hum. The most notable move was in the yield of the 10-year Treasury TMUBMUSD10Y, 1.509%, which fell to 1.51%.

U.S. stock futures ES00, +0.02% were steady, as were most other asset classes. Bitcoin rose as El Salvador officially adopted the cryptocurrency as legal currency.

Random reads

After French President Emmanuel Macron was slapped in the face, here’s a roundup of famous incidents involving politicians.

A herd of wild elephants is captivating China.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

Add Comment