Wall Street is off to a solid start for Wednesday, as investors continue to emerge from their hiding places looking to see if the coast is truly clear from that pesky banking crisis.

That brings us to our call of the day, which is rallying around bank stocks and suggesting investors do the same, from Ed Yardeni, president and chief investment strategist at Yardeni Research, along with Joe Abbott, chief quantitative strategist.

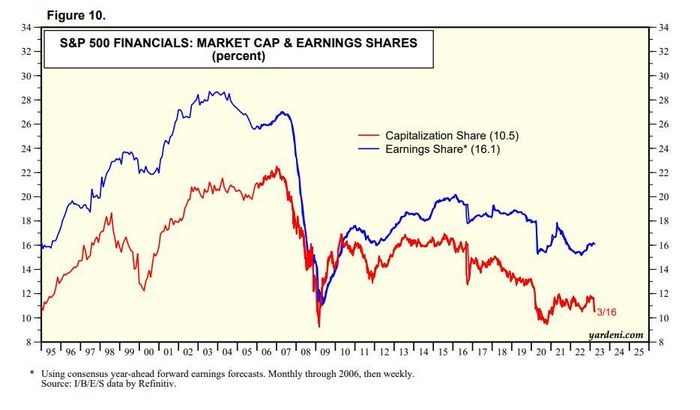

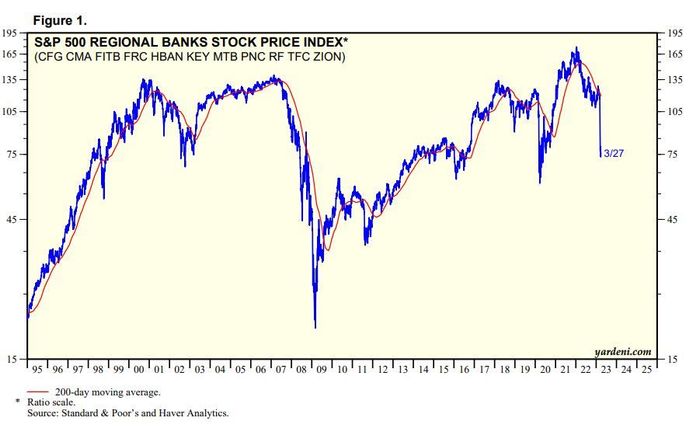

“The SVB debacle has depressed the S&P 500 Financials SP500.40, +1.50% sector’s market-cap share further below its earnings share. And the S&P 500 Bank Composite hasn’t ever been this cheap relative to the S&P 500 SPX, +1.42% (i.e., since the mid-1980s start of the data),” the pair told clients in a note on Wednesday.

“We liked the financials sector before SVB imploded and like it even more since, as the fallout we expect doesn’t include systemic contagion and does include more M&A activity,” they said.

Yardeni and Abbott say the SVB debacle has left banking stocks cheaper, and they continue to like related stocks because their economic outlook hasn’t changed.

“We don’t expect more bank runs, a credit crunch and a recession. We do expect that banks will have to raise their deposit rates to avert disintermediation. That undoubtedly will squeeze the profit margins of many banks, especially the small community and regional banks,” said the pair. “The result is likely to be lots of M&A activity aimed at cutting costs through consolidation.”

That would also help out the S&P 500 Investment Banking & Brokerage industry SP500.40203020, +1.55%, they said.

Looking ahead to bank results due in the second and third week of April, Yardeni and Abbott said investors should expect profits to be weighed by higher provisions for loan losses. “Given the recent banking crisis, even if bank managements aren’t that concerned about loan losses, they might still want to show the banking regulators that they’re being prudent,” they said.

“They might prefer to downplay the impact of the banking crisis on their profitability to calm the nerves of their investors, or at least not overdramatize it,” said Yardeni and Abbott.

A less-bullish note on banks came from Credit Suisse, which will sooner or later be under new management.

A team led by Andrew Garthwaite, chief global equity strategist, notes U.S. banks have underperformed by about 28% in 2023, versus the normal bear market drop of 42%, while Europe banks are down about 10% — for “good reason” — versus a historical bear market underperformance of 35%. They rattled off a list of what will get them to start adding to the sector again.

- Bond-to-equity correlations turning positive again. “They key macro driver of banks in 2022 was that as equities fell, rate expectations/bond yields rose,” but in March this correlation turned negative.

- The yield curve uninverting, as it’s still flashing a “mild warning signal” for the sector.

- Banks getting cheaper on Credit Suisse’s favorite measure — price-to-book relative to the market, which was neutral in early March.

Tactically, they’d like to see banks start to become oversold and positioning among investors lighten up, as Credit Suisse sees the sector as most consensus long, or bullish.

Best of the web

Why I abandoned my 529 college savings plan and switched to Series I bonds instead

Russian father arrested, daughter sent to an orphanage over Ukraine war objection.

Get ready for the Great Shoulder Resurgence of 2023.

The chart

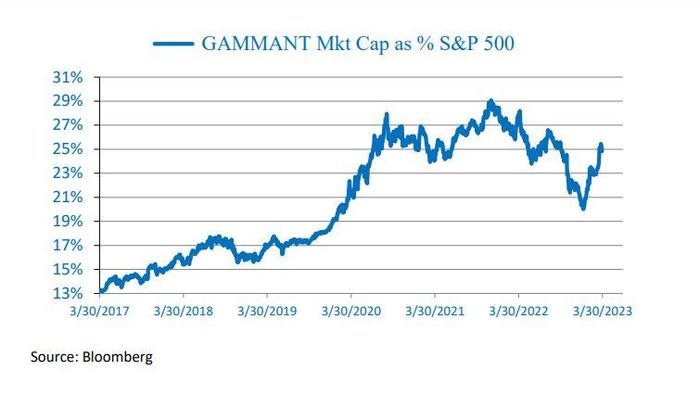

The above chart from JonesTrading’s chief market strategist Michael O’Rourke shows how seven of the biggest S&P 500 companies have recouped half of their move from the November 2021 peak to the January 2023 low thanks to a strong first quarter. That includes an 81% jump for Nvidia NVDA, +2.17%, Meta Platforms META, +2.33% up 67%, Tesla TSLA, +2.48% up 53%, Apple AAPL, +1.98% up 21%, Amazon.com AMZN, +3.10% up 15% and Microsoft MSFT, +1.92% and Alphabet GOOGL, +0.36% up 14% each. “Although the tape has withstood persistent inflation, rate hikes and now a banking panic, such narrow, unstable speculative gains are likely to prove fragile. If this group rolls over as its setup is primed for, it will make for a long 2023,” says O’Rourke.

Random reads

Amsterdam will do almost anything to keep out young British men.

Metal detector unearths $250,000 gold nugget.

Worth it? $90,000 a year for an Ivy League education.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.