Havens in, tech stocks out may be the theme for Friday.

Investors seem eager to insure themselves against geopolitical tensions that have flared up in the Middle East and Hong Kong this week, with gold vaulting on Friday. Meanwhile, U.S. technology stocks might not win any popularity contests as a red flag cropped up over how the trade war is biting that industry.

Tech conglomerate Broadcom is sliding in premarket activity after slashing its revenue guidance, citing a hit from an export ban on big Chinese customer Huawei. So if stocks don’t get any support from retail sales data this morning, it could be the Nasdaq COMP, +0.57% that leads the market south as traders head into the weekend.

Trade tensions are also one reason DoubleLine Capital Chief Executive Officer Jeffrey Gundlach now sees a bigger chance of a recession hitting U.S. shores in the not-too-distant future.

Providing our call of the day, Gundlach predicted a 40% to 50% chance of a U.S. recession within the next six months and a 65% chance of that happening in the next 12 months, in a webcast to clients late Thursday, according to a roundup of his comments from Reuters and other media outlets. He said signs of a slowdown on the global economic front are also a worry.

Read: China’s economy cools further in May

The so-called bond king and closely watched market forecaster isn’t the only one starting to fret. JPMorgan’s chief quant strategist Marko Kolanovic said in a note this week that President Donald Trump’s trade battles have cost U.S. companies trillions, and could trigger a downturn that would end up being known as the “Trump recession.”

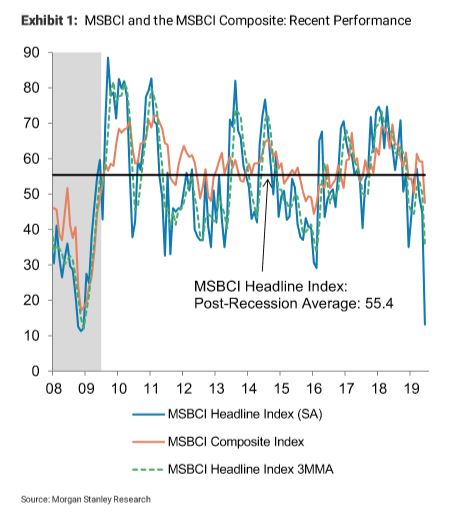

Meanwhile, Morgan Stanley reported Thursday that its closely watched Business Conditions Index fell by the most on record in June to a level of 13, nearing levels not seen since the downturn of 2008, though economist Ellen Zentner said their analysts weren’t really blaming that on trade.

No doubt, the calls for the Federal Reserve to head off a downturn are growing louder by the day. Gundlach is not expecting an interest-rate cut when the Fed meets next week. Instead, he notes the bond market is tipping two or three cuts by the end of the year.

As for where Gundlach is putting his money, he said he is “certainly long gold,” given expectations the dollar, which stands to take a hit if the Fed lowers interest rates, will close the year weaker.

The market

Nasdaq-100 NQM19, -0.68% futures are notably lower, with Dow YMM19, -0.14% S&P ESM19, -0.24% futures also in the red.

Geopolitical jitters have driven gold GCQ19, +1.15% above a big technical level, and the yen USDJPY, -0.02% is also up against the dollar. Oil CLN19, -0.21% is pulling back after Thursday’s big gains sparked by the Strait of Hormuz tanker attacks.

Read: Escalation in Mideast oil attacks could add $7 per barrel to prices

Stocks are lower across Europe SXXP, -0.63% weighed by weak China production data. Asia had a mostly down day, led by the Hong Kong’s Hang Seng HSI, -0.65% ahead of potential further unrest this weekend.

The economy

Important retail sales data is on tap, followed by industrial production and capacity utilization, then the University of Michigan’s consumer sentiment index and business inventories. See our preview here.

The chart

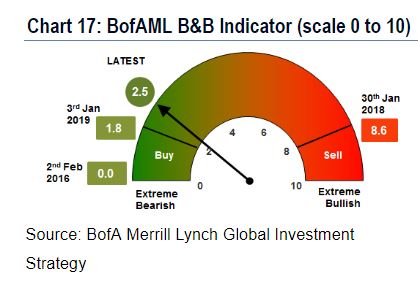

The Bank of America Merrill Lynch’s Bull & Bear Indicator is leaving us in suspense. Last week their key contrarian indicator made an exciting leap toward an area that indicated investors are so bearish it’s time to buy stocks.

Alas, in the latest week, as our chart of the day shows, the indicator has not budged, stuck at 2.5. The indicator’s main purpose is to chart whether investor buying or selling of stocks has moved too far on a zero to 10 scale. The indicator tumbled last week to that 2.5 level, from 3.6 the prior move.

The buzz

The U.S. military on Friday released a video that it says shows Iranian patrol boat removing an unexploded mine from one of the tankers that was attacked near the Strait of Hormuz Thursday. Iran has denied any involvement.

Broadcom AVGO, +0.67% is sliding on a sales guidance cut, as hopes for a rebound in the semiconductor industry may now be toast.

Pet goods seller Chewy CHWY, +0.00% will make its Wall Street debut on Friday, with shares set to start trading at $22 each, valuing the company at an initial $9 billion.

Read: How the Chinese tariff fight could snuff out a key American summer tradition

A group of American companies including Walmart Inc. WMT, -0.16% and Target Corp. TGT, +0.05% have sent a letter to Trump urging him make a trade deal and end the tariff war.

Read: Volkswagen sets IPO price range for Traton unit, valuing it at $1.9 billion

The tweet

Here’s Amazon AMZN, +0.81% firing back at former vice president and 2020 Democratic presidential candidate Joe Biden, who chided the e-commerce giant for not paying enough in taxes:

Random reads

Australian man pleads not guilty to Christchurch mosque shooting charges

Rethink the Cheerios sitting on the breakfast table

Here’s why your teen can’t just hop into an Uber

Toronto celebrates after the Raptors grab their first NBA championship

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.