Could the worst U.S. growth reading since World War II trigger stock gains on Thursday?

After an unsurprisingly gloomy economic assessment from Federal Reserve Chairman Jerome Powell on Wednesday, some are pondering whether markets would take cheer from data that may secure more stimulus down the road. So far, there is not much optimism and equity futures are down on what is also a big day for earnings.

But that segues straight into our call of the day from Andrew Garthwaite, Credit Suisse’s global equity strategy analyst, who believes the S&P 500 could “easily hit 3,500 on our models” by the end of next year. “The key to me is do you get a big correction? Do you get a fall of more than 10%? I don’t think so and the key is whether you want to buy into dips or sell into rallies and we want to buy into dips,” he tells MarketWatch.

Reason number one to keep buying? “We’re going to get a combination of easy money, easy fiscal, with yield curve control — i.e. fiscal QE [quantitative easing] — until unemployment returns to politically acceptable levels,” he says. Note, the Fed hasn’t committed to instituting yield curve control, though officials have said they are considering it.

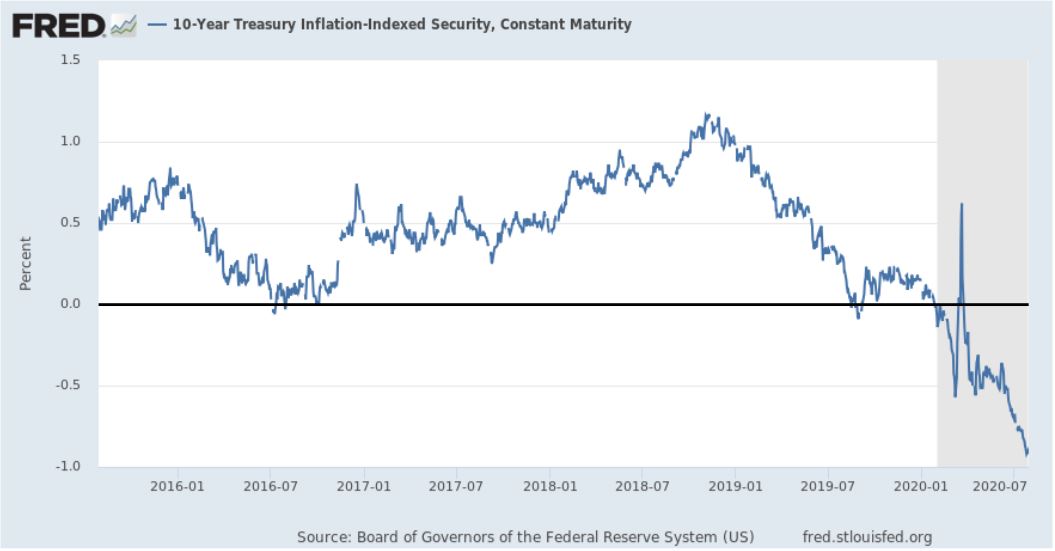

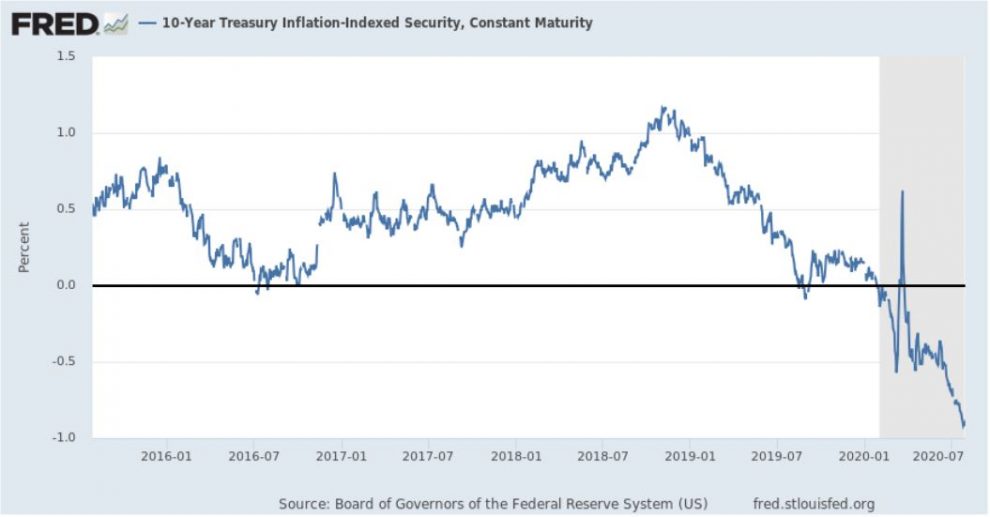

And Garthwaite believes real bond yields — 10-year Treasury inflation-protected securities that have been tumbling on COVID-19 worries — are headed to minus 2%. “Why do you own a bond if it’s a non-diversifying return-less risk? As a result of that, we’ve seen flows into equities hold up abnormally well,” he says.

Investors have missed a couple of things, he says, firstly that policy is key, and that worries about a stock market that looks expensive — based on forward price earnings ratios for 2021 — matters less than the additional return they will get relative to falling bonds.

That said, he worries a bit about the disconnect between earnings revisions and equities, and overly optimistic credit spreads that imply a too-low default rate for companies, which could be problematic for stocks. Also on his mind are manufacturing new orders that may have peaked and overall heavy newsflow.

Garthwaite has a last bit of insight, and that is about the big technology stocks, which report earnings on Thursday and have been in the driver’s seat of market gains this year. Question: Will momentum fade if we get a vaccine or the virus recedes?

“I think the way you’re going to get a major rotation would be if there were in response to a strong economic recovery, a sharp rise in bond yields or a major change in policy from the Fed on interest rates, and I don’t see that,” says the strategist.

The market

Dow YM00, -0.94%, S&P ES00, -1.00% and Nasdaq NQ00, -1.06% futures are down, alongside European stocks SXXP, -1.36% deluged by earnings. Asia markets finished mixed. Gold GCQ20, -0.29% is down.

The chart

German stocks DAX, -2.50% are slumping after the biggest gross domestic product drop since 1970.

The economy

Data are expected to show a near-35% drop in second-quarter GDP, and 1.5 million filed for unemployment benefits.

The buzz

After the market close, Google parent Alphabet GOOGL, +1.32%, e-commerce group Amazon AMZN, +1.10%, iPhone maker Apple AAPL, +1.91% and social media megalith Facebook FB, +1.37% will report. That is after a grilling for those tech bosses in D.C. on Wednesday.

Parcel shipper UPS UPS, +3.39% is soaring on a profit beat, with consumer goods group Procter & Gamble PG, +0.33% and food giants KraftHeinz KHC, +0.90% and Kellogg K, +0.04% reporting early.

A bullish forecast is sending shares of chip group Qualcomm QCOM, +1.72% to a record high.

Conglomerate Johnson & Johnson JNJ, -0.19% will start trials of its COVID-19 vaccine in humans after promising tests on primates, while the Food and Drug Administration is reportedly nearing emergency approval to treat COVID-19 patients with blood plasma from the recovered.

Random reads

NASA will launch a third and final mission to Mars on Thursday.

A big Stonehenge mystery has been solved.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Add Comment