The doom-and-gloom crew has been drawing lines between the dot-com bubble and the current market climate for a while now. With stocks banging out record highs on a regular basis, those forecasting a collapse can’t catch a break.

But hey, it’s almost Halloween — maybe it’s their time to shine.

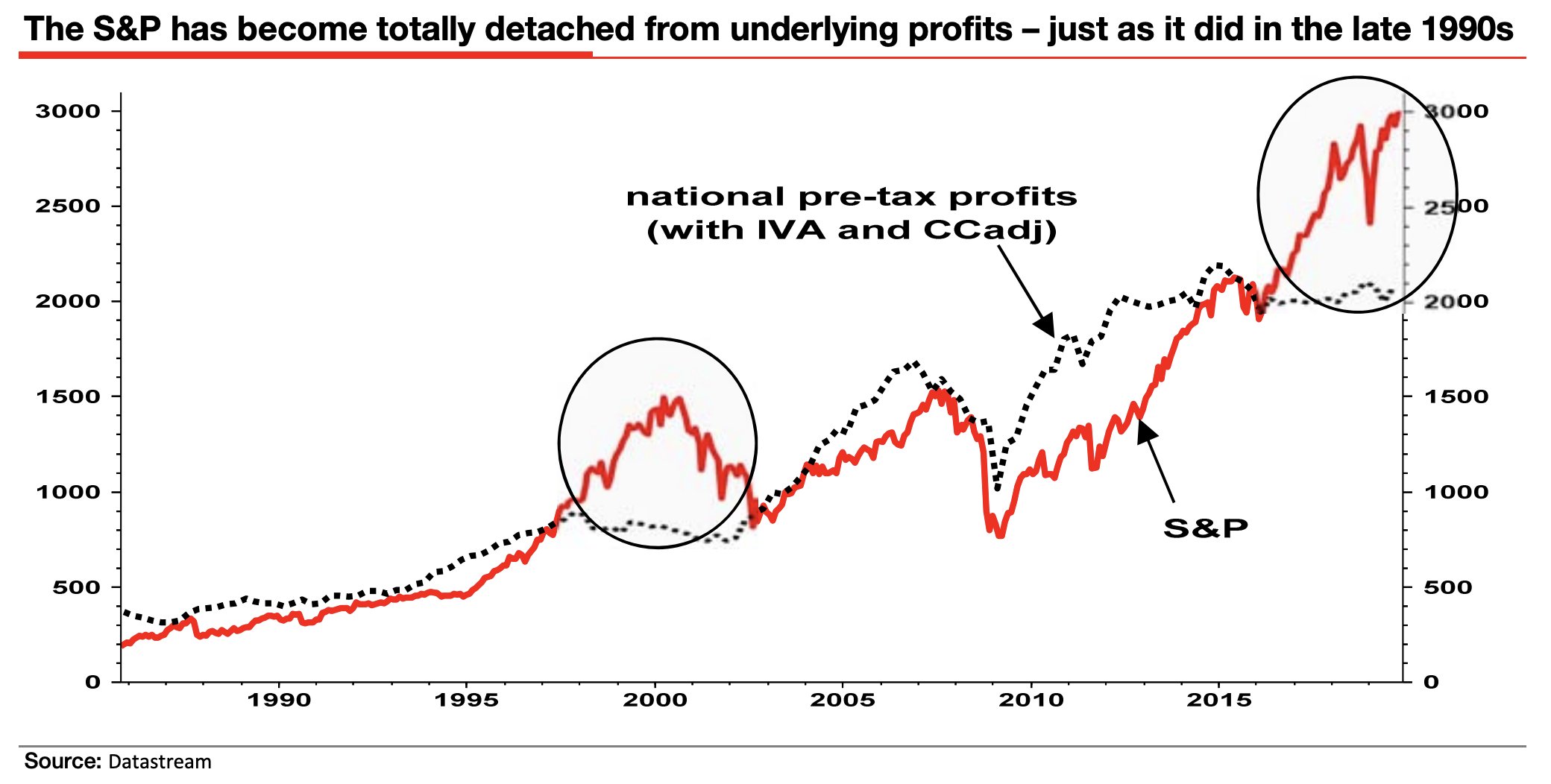

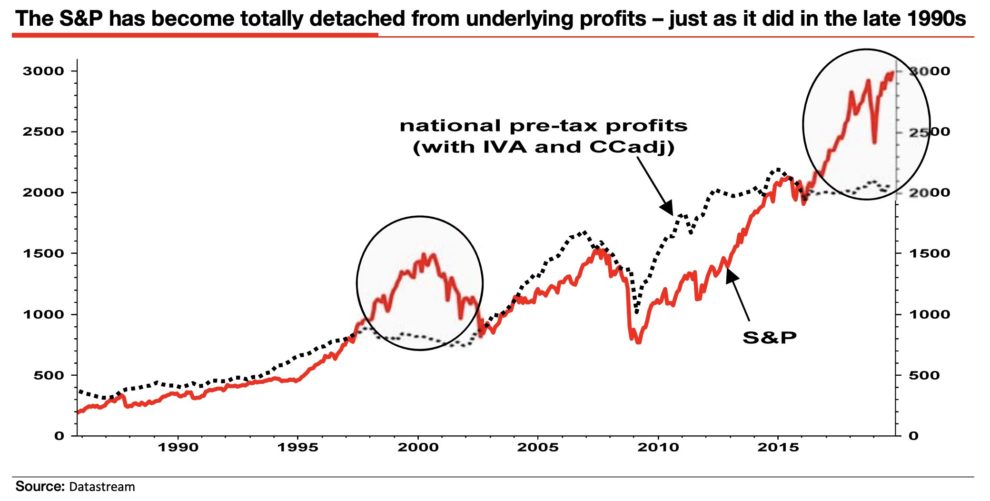

In that spirit, noted bear Albert Edwards, global strategist at Société Générale, earns our chart of the day with this graph showing how earnings have diverged from the S&P 500 SPX, +0.41% to a degree not seen since, yes, 2000.

What does this mean? “Carnage awaits,” Edwards wrote in a note to clients over the weekend. He warned that surging tech stocks have disconnected from the reality of earnings at a problematic time.

“The unfolding profits recession will expose the ‘growth’ impostors and they will collapse, as they are on the wrong ‘growth’ [price-to-earnings] valuations with the wrong [earnings per share] projections,” he said. “Just like in 2001, investors will not wait to distinguish true ‘growth’ stocks from the impostors. Investors will slam the whole sector and work it out later.”

There is no “carnage” yet, as investors appear to be in the buying mood.

The market

Futures on the Dow YM00, +0.27%, S&P ES00, +0.21% and Nasdaq NQ00, +0.26% are all higher. European stocks SXXP, -0.08% are struggling while Asian stocks ADOW, +0.29% were boosted by comments on Friday that the U.S. and China were close to reaching a “phase one” trade deal.

Bitcoin BTCUSD, -1.65% exploded over the weekend, breaking through the 10,000 level before pulling back. At last check, the digital currency was hovering at $9,420.

The buzz

Watch shares of Tiffany TIF, +0.90% after Paris-based luxury goods company LVMH MC, +0.33% said it’s in talks over a potential takeover for the luxury jeweler.

President Donald Trump said on Sunday that a U.S. military raid in Syria led to the death of Abu Bakr al-Baghdadi, the shadowy leader of the Islamic State group.

There’s a state of emergency in California after officials on Sunday ordered nearly 200,000 people to evacuate due to multiple wildfires. Power company PG&E PCG, -30.56% cut electricity to millions of residents to prevent more areas from igniting.

The call

French economist Gabriel Zucman says US senator Elizabeth Warren’s wealth tax, which would impose a tax of at least 2% on households worth more than $50 million, would solve economic inequality. “The snowball gets bigger and bigger,” Zucman told Yahoo Finance. “The solution is lowering taxes for the working class, but much higher taxes for the very, very rich.”

The stat

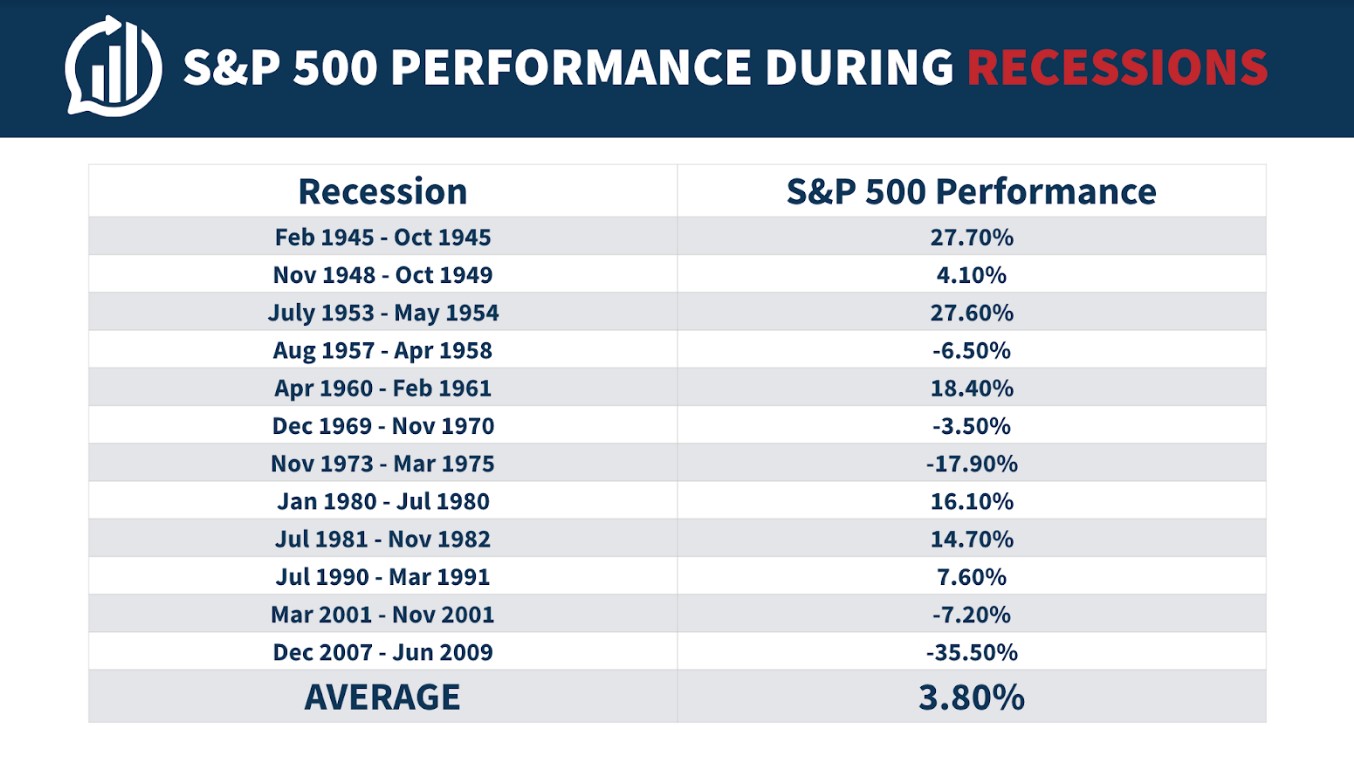

3.8%: That’s how the S&P has performed on average during recessions going back to 1945, according to National Bureau of Economic Research data cited by Ritholtz Wealth Management’s Ben Carlson. Look at this chart and relax:

The quote

“Investors should always regard the stock market as sailors regard the sea — a means to an end, usually benign, but potentially lethal. Catastrophic losses are rare, but their risk never goes away” — The Wall Street Journal’s Jason Zweig, in a piece about “putting the buy-and-hold gospel to the ultimate test”.

The economy

October jobs for Friday is the big one to watch, with the ISM manufacturing index and Case-Shiller house prices before that. The Federal Open Market Committee is also expected to cut rates this week. As for Monday, the Chicago Fed National Activity index hits at 8:30 a.m. Eastern time, followed by the Dallas Fed manufacturing survey two hours later.

Random reads

The World Series waded into politics on Sunday night

Should gas guzzlers be outlawed in America?

Melting ice? For some, there’s a silver lining

These are the 100 best songs of the past decade — surely we all agree

Space tourism… yes, it’s inevitable and maybe even luxurious

21 things Trump unexpectedly thinks are beautiful

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment