Sounds like it’ll be raining jobs, growth and profit across the U.S. for the foreseeable future, if White House trade adviser Peter Navarro has it right.

“I can tell you with certainty… we’re going to have a strong economy through 2020 and beyond with a bull market,” he told ABC News in an interview on Sunday morning. “The Fed will be lowering rates. The ECB will be engaging in monetary stimulus. China will be engaging in fiscal stimulus.”

Yes, cheap money at home and abroad. Easy, right?

‘Without intervention, without stimulus, without artificial help markets fall apart. If the Fed doesn’t cut rates in September markets plunge.’

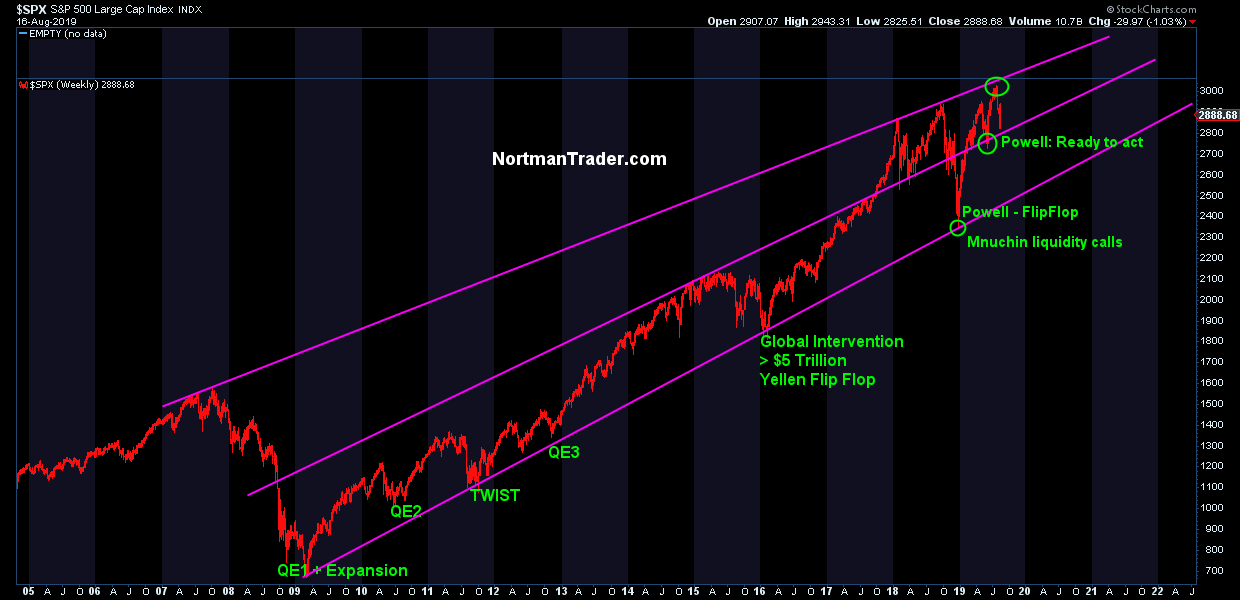

Don’t be fooled, people, it’s all “a giant con game,” according to the Northman Trader blog’s Sven Henrich. In our call of the day, he warns that, without the steady injections from central banks, a global recession would already be here, with a U.S. recession not far behind.

“Confidence must be maintained under all circumstances. This has been the game for 10 years and hence any market drops that would add pressure to confidence must be averted,” he wrote in a post over the weekend.

Navarro’s rosy outlook exists only with the understanding that rates will be dropping, but, in reality, there’s a shelf-life here.

“If the Fed doesn’t cut rates in September, markets plunge,” Henrich wrote.

This isn’t unique to the U.S., either, he pointed out. If the European Central Bank doesn’t cut rates — ouch. If China and Switzerland don’t — ouch.

It’s ultimately a losing game: short-term gain/long-term pain. And it’s the short term that’s driving policies in the face of a teetering market.

“Trump can’t afford a recession in 2020 nor deteriorating economic sentiment,” Henrich said. “How will the Chinese take advantage of this? This remains to be seen, but the longer there is no resolution the higher the risk of a global recession.”

He says that while bears wait for the inevitable destruction of markets, a massive relief rally could be unleashed as Trump burnishes his resume for 2020.

“See massive rate cuts and stimulus announcements and asset prices can once again race to the upside at least in the short term. That is the bull case. Intervention,” Henrich wrote.

The market

The Dow DJIA, -2.37% , S&P SPX, -2.59% and Nasdaq COMP, -3.00% are catching a nice lift, while gold GC.1, +0.04% and silver SI00, -0.10% are both lower. Oil CL.1, -0.37% is up and the dollar DXY, -0.92% is flat.

Europe stocks SXXP, -0.78% are joining in all the fun, as well, while Asia markets ADOW, +0.64% closed with gains.

The chart

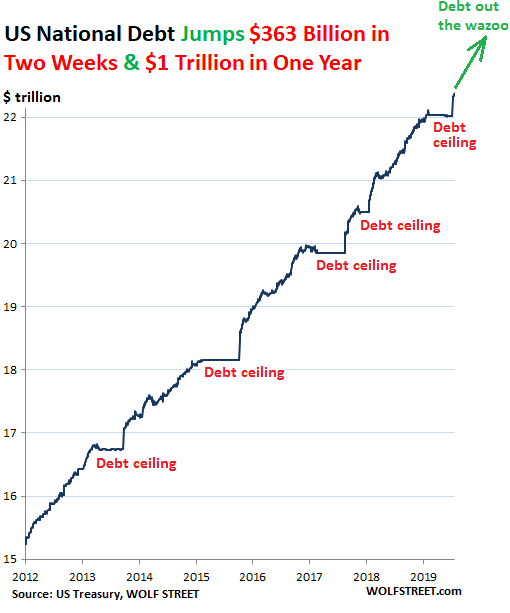

Does this look like the chart of a country getting a handle on its debt?

Of course not. Wolf Richter of the Wolf Street blog points out that the U.S. gross national debt jumped by $363 billion in the two weeks since Trump signed the law suspending the debt ceiling. As you can see, we’re looking at $22.39 trillion, up by $1.01 trillion from 12 months ago. “Watch this debt balloon during an economic downturn! Whoopee!” Richter wrote.

The buzz

Greenland, really? It’s true. White House economic adviser Larry Kudlow confirmed that President Trump “wants to take a look at” buying Greenland, although the semi-autonomous Denmark territory has said it’s not for sale.

Apple AAPL, -4.62% CEO Tim Cook warned Trump Friday that tariffs could hurt his company, arguing that U.S. tariffs on Chinese goods would give rival Samsung an advantage, since it wouldn’t be subject to the same restrictions. “I thought he made a very compelling argument, so I’m thinking about it,” Trump said.

The stat

43% — That’s how many people approve of Trump — the lowest level of the year — according to the Wall Street Journal/NBC poll. A big drop in his rating on the economy is a big factor as is his response to the mass shootings.

The quote

Associated Press

Associated Press

Sarah Fairhurst, a partner at an economic consulting firm in Hong Kong, on why she transferred about $25,500 worth of Hong Kong dollars into British pounds.

The economy

Notable numbers include housing data this week. We’ll also hear from Fed Chair Jerome Powell on Friday when he speaks in Jackson Hole, but here’s why investors might be disappointed in what comes out of the central bank’s retreat.

Read: U.S. to enter recession in two years, say a third of business economists

The tweet

Random reads

Iceland lost its first glacier to global warming, and there was a funeral.

Study shows people with kids are happier than people without kids… when the kids finally move out

Former star NFL player dies in motorcycle accident.

How family separations brought down a migrant mogul.

Behold, the $8.9-million Bugatti:

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.