There’s a lot of worries to go around, from trade tensions with China to Britain’s possible abrupt exit from the European Union and now, political turmoil in debt-laden Italy. More on that in a bit.

But closer to home, Congress very quietly negotiated more stimulus in what has been mostly overlooked, or at least little discussed, in markets.

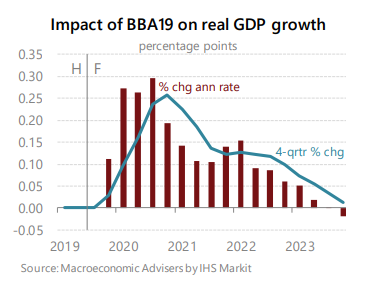

The call of the day comes from Macroeconomic Advisers, which points out that the Bipartisan Budget Act of 2019 will add to growth over 2020 and 2021. It took its GDP forecast for 2020 to 2.4%—an upgrade of 0.6 percentage points—in large part due to the legislation.

With that forecast in mind, the Macroeconomic Advisers team forecasts a 20% gain in the S&P 500 SPX, -0.66% this year—it’s 17% as of Thursday—and bond yields TMUBMUSD10Y, +0.00% to “trend slowly higher” but not breach 3% until the middle of 2021 at the earliest.

The forecast does come with an asterisk—if the planned 10% tariffs on $300 billion of Chinese goods, and Chinese retaliation, aren’t reversed quickly, the outlook could change.

The market

After a 371-point gain for the Dow Jones Industrial Average DJIA, -0.34% on Thursday, U.S. stock futures ES00, +0.14% YM00, +0.11% NQ00, +0.12% were pointing lower.

Gold GC00, -0.03% and oil futures CL.1, -0.42% rose.

Europe SXXP, -0.84% stocks dropped while Asia ADOW, +0.20% stocks advanced.

The buzz

There was a lot of international news for markets to digest. Chinese producer prices declined while consumer prices accelerated, putting Chinese authorities in a bind. Italian stocks tumbled after the call for a snap election. The U.K. economy shrank for the first time in seven years, not exactly a great backdrop for the British government to negotiate with the EU, while the Japanese economy was stronger than expected.

In the U.S., producer price data for July showed a 0.2% rise, and Uber Technologies UBER, -6.80% will be in focus after losing more than $5 billion in a quarter.

The chart

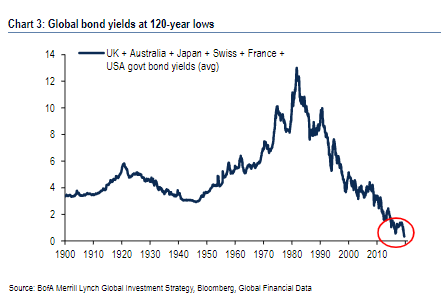

Just how low are bond yields? Bank of America Merrill Lynch says by their definition—using U.K, Australian, Japanese, Swiss, French and U.S. data—global bond yields are at a 120-year low.

Interestingly, while money is flowing out of stocks — $24.9 billion, including $12.4 billion on Monday alone—the flows of $3.6 billion into bonds was the least since Jan. 2016, according to the BAML data.

Random reads

A preseason touchdown is usually no big deal, but Damon Sheehy-Guiseppi’s improbable story—including sleeping in a gym and convincing an executive that he was meant to be at a workout he wasn’t invited to—caused the entire Cleveland Browns team to celebrate.

Huawei unveiled an operating system that it could potentially use on its phones if it can no longer use Google’s GOOGL, -1.43% Android.

In Maine, 45 ducklings successfully crossed a five-lane road.

This teenager was making $4,000 a month reposting memes on Instagram—until he got purged.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.