Your short Easter trading week is about to get busy.

Aside from a few key earnings reports on Wall Street, investors will get a whiff of how the global economy is doing with a data dump from China due after U.S. markets close Tuesday. (Different parts of Europe are shut for trading between Thursday and Monday.)

Read: Which markets are closed on Good Friday

Investors will be looking for more evidence that Chinese government stimulus efforts are paying off as they pick through first-quarter gross domestic product, industrial output and retail sales. The country is seen by some as the key to holding up increasingly wobbly global growth, especially if the U.S. starts to falter as some fear it will.

Read: BlackRock strategist says China holds keys to global growth

That brings us to our call of the day from a team of UBS strategists led by Daniel Waldman, who say investors have been too negative when it comes to global growth expectations—good news for equities.

“The rally has been underpinned by dovish central banks and a sharp decline in global real rates, and we have shown that markets are priced for growth stabilization, but not for acceleration,” said Waldman and the team in a note.

He says that “leaves room for stocks to run higher,” though a confirmation of that growth turn is required. On that note, they are seeing some positive signs, such as Chinese credit growth, which bounced back last week. And clearly, Tuesday’s China data could also have some bearing on whether investors start to shake off the gloom over growth.

As for how to trade this view, Waldman and the team say a growth upturn would be good for firms selling nonessential items likes cars and clothes that consumers don’t exactly need – these are known as consumer discretionary companies. In tough economic times, that kind of spending gets pared back. They’d also advise getting a little more bearish on utilities, stocks that perform better when growth concerns crop up.

And if China’s domestic growth picture picks up, that would be a boost for stocks in the region, says UBS. But, unlike what was seen in 2016, the analyst doesn’t think the rest of emerging market stocks and currencies will benefit from China’s good news. Not everyone agrees here:

The market

A buyer’s mood is setting in for Tuesday, with Dow US:YMH9 , S&P 500 US:ESH9 and Nasdaq US:NQH9 futures all in the black, after Monday’s session that was slightly negative for the major indexes. See more coverage in Market Snapshot.

The dollar DXY, -0.01% is steady, while gold US:GCU8 is slipping and U.S. crude US:CLU8 is up.

Europe stocks SXXP, +0.29% are a mixed bag, while in Asia, the Shanghai Composite SHCOMP, +2.39% shot up over 2%, partly fueled by fresh stimulus from China’s central bank.

The chart

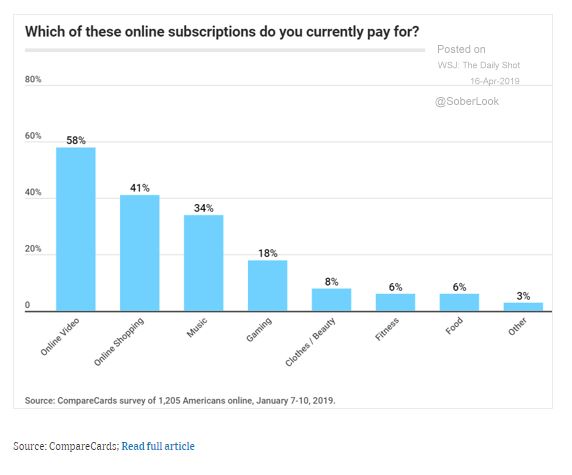

How many subscriptions do consumers really need? In the wake of Disney DIS, +1.52% announcing its own $6.99-a-month streaming entertainment service, many may be asking themselves that question. Our chart of the day, from CompareCards (h/t The Daily Shot) finds that online video accounts for 58% of online spending by Americans they surveyed:

The buzz

Bank of America BAC, -1.09% shares are slipping after first-quarter revenue fell short of expectations. Health insurer UnitedHealth UNH, +3.13% is rallying after beating profit and revenue expectations, while drug and consumer product group Johnson & Johnson JNJ, +0.40% also exceeded expectations on its numbers. BlackRock BLK, -0.55% is still to come ahead of the market open, with Netflix NFLX, -0.65% after the bell.

Earnings preview: The Netflix number to watch and seven Dow components ahead this week

Mastercard MA, +0.13% purchase of Vyze has the credit-card company wading into the buy-now, pay-later consumer movement.

The return of “Game of Thrones” drew a record 17.4 million viewers on Sunday for AT&T owned cable service HBO.

Opinion: Salesforce.com buys Salesforce.org, and that’s the only straightforward part

The economy

Industrial production and capacity utilization data, along with a home builders index are all on tap for Tuesday.

The quote

“We will rebuild it. Together. It’s part of our French destiny.“—That was French President Emmanuel Macron on Twitter, vowing to rebuild the Notre Dame cathedral with the help of a national fundraiser after Monday’s devastating fire. François-Henri Pinault, CEO of French-based luxury group Kering KER, +0.21% has said he would pitch in over $110 million.

Random reads

U.S. deports man whose spouse died in Afghanistan, then reverses course

Rep. Alexandria Ocasio-Cortez says social media is bad for your health and is giving up Facebook

A China propaganda app is drawing droves

Another college student dies trying to snap a perfect photo

Parents sue over New York’s mandatory measles vaccination order

When did you realize you’d raised a monster? Reddit parents commiserate

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.

Add Comment