While investors may be tired of hearing how virus-complacent they are, as stocks keep busting records, our call of the day from Goldman Sachs is saying exactly that.

“In the nearer term…we believe the greater risk is that the impact of the coronavirus on earnings may well be underestimated in current stock prices, suggesting that the risks of a correction are high,” chief global equity strategist Peter Oppenheimer told clients.

The virus history books — SARS in 2003 — reveal that setbacks for markets are often temporary. But China’s economy is “six times bigger now than it was then,” with Chinese tourism a 0.4% chunk of global GDP and missed work days in China equal to an two-month unplanned break for the entire U.S., he notes.

Oppenheimer points to Apple’s AAPL, -1.03% latest warning that Wall Street largely shrugged off, noting that the company has been driving better-than-expected fourth-quarter earnings results.

“During the fourth quarter, the five largest stocks in the S&P 500 (Facebook FB, -1.34%, Amazon AMZN, -0.79%, Apple AAPL, -1.03%, Microsoft MSFT, -1.53%, Google owner Alphabet GOOGL, -0.52% ) posted an average earnings surprise of +20%, compared with just 4% for the average S&P 500 company. Any weakness to these and other companies would likely push earnings estimates lower,” cautions Oppenheimer.

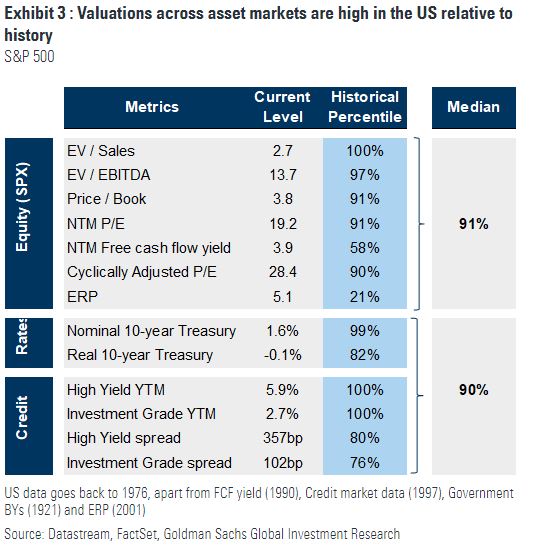

Don’t look to stretched valuations in bond markets versus stocks to immunize against an equity pullback, he said. Not a sustained bear market, but don’t hit the snooze button is the message.

Last word goes to JPMorgan’s top quantitative strategist Marko Kolanovic, who notes investors have been piling into technology, low-volatility stocks and bonds, driven by coronavirus fears and as passive-funds pile into stock winners. As a fan of value stocks, Kolanovic expects a rotation back to that asset class once the virus subsides.

“We caution investors that this bubble will likely collapse, i.e. this time is not ‘different,’ with valuations reverting closer to 2010-2020 average,” he warns in a note.

The chart

Palladium prices PAH20, +0.74% have been going parabolic, and the commodity is a fine Tesla TSLA, -1.96% contender as a “green hedge” for investors, says The Market Ear blog.

The Market Ear/Thompson Reuters

The Market Ear/Thompson Reuters “Palladium is a key component in pollution-control devices for cars and trucks. About 85% of palladium ends up in the exhaust system in cars, where it helps turn toxic pollutants into less-harmful carbon dioxide and water vapor,” says the blogger.

Random reads

Nine dead in Germany after gunman attacks hookah bars.

What the Taliban want — deputy leader’s New York Times opinion piece.

Silicon Valley inventor behind “cut-copy-paste” has died.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>